Six Priorities for the Next Five Years

Speaking of the roadmap to becoming a billion-dollar company, the Chairman of CTD believes that this milestone is the result of a long and persistent journey, reflecting the company’s daily efforts.

Revenue, profit, and market capitalization are ambitious goals that can only be achieved by the Coteccons team.

Coteccons’ revenue is derived from a selective approach to clients, choosing only those that meet their internal standards, rather than pursuing revenue at all costs. The company boasts an impressive client portfolio, a dedicated team, and a diverse revenue stream. CTD’s aspiration is to achieve a minimum growth rate of 20% annually.

Mr. Bolat is confident that CTD possesses all the necessary elements to become a billion-dollar company. With their current pace and untapped potential, the goal of a billion-dollar market capitalization is well within reach.

Instead of making promises about specific timelines, Mr. Bolat wishes to share the company’s key initiatives and strategies with shareholders. These priorities are practical and actionable, and their successful implementation will lead to the desired market capitalization.

“A billion-dollar market cap cannot be associated with a specific timeframe,” says Chairman Bolat. “It merely represents the scale and stature of the company we aspire to become.”

The leader of Coteccons outlines six key priorities for the next 3-5 years. The first priority is to maintain existing growth in civil construction while simultaneously strengthening their presence in industrial construction. This will create a solid foundation for their infrastructure projects and contribute to their revenue stream, mainly from the domestic market.

The second priority involves strategies to penetrate international markets, introducing new business segments and international projects that will significantly impact both revenue and profits.

As the third priority, CTD aims to improve profit margins through various initiatives, including investing in newer, more efficient technology and equipment, such as AI applications in the field.

The fourth priority is to continue organizational restructuring and enhance operational capabilities by ensuring the right people are in the right roles.

Becoming an industry leader in construction is the fifth priority. This entails further developing their brand in Vietnam and on a global scale.

Lastly, the sixth priority is to remain actively engaged in social initiatives and environmental protection in Vietnam, implementing solutions to minimize their environmental impact.

Mr. Bolat Duisenov, Chairman of the Board of Directors of CTD, at the dialogue session.

|

Stock Price Doesn’t Reflect the Company’s True Value

In addition to the six priorities mentioned above, the Chairman also includes a seventh priority, which is to develop effective investor relations strategies to enhance the value of CTD’s stock in the market.

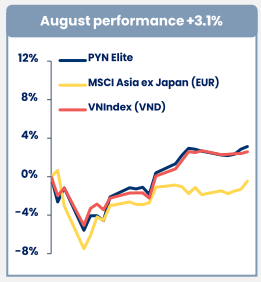

Over the past few years, stock price fluctuations have been a key focus for the management team. The company has worked on enhancing its internal capabilities to restructure, reshape, and stabilize its operations. They will allocate a significant percentage of their strategies to analyzing market cycles and the value of CTD stock.

Regarding the stock price, Mr. Bolat expresses his confusion as to why it doesn’t accurately reflect Coteccons’ performance. “The current stock price does not reflect the true condition and capabilities of Coteccons,” he explains. “In recent months, CTD stock has unintentionally been grouped with real estate stocks, and the real estate market has been rather dull for the past year, which has impacted our stock price.”

The Chairman of Coteccons suggests that direct influence on the stock price is not possible, but they can impact the company’s revenue and profits. He also advises against focusing on short-term stock price movements and instead encourages shareholders to have faith in the team.

“Instead of monitoring the stock price, shareholders should look at our construction sites and assess if they are environmentally friendly, safe, and growing. These are the factors that matter to investors who want to accompany Coteccons on its long-term journey. If investors are buying CTD stock with the intention of selling it shortly after, they are investing based on emotions, which is not a sustainable approach. As a shareholder, the most important thing is to trust the management team. If you trust them, you hold on to your investment; if you don’t, then you sell,” says the Chairman.

Mr. Bolat emphasizes that shareholders have invested in a transparent and open company, and their trust is the foundation of Coteccons’ success. He invites shareholders to join the company on its journey to becoming an industry leader.

Additionally, Chairman Bolat offers an investment formula, suggesting that 80% of the decision should be based on faith in the company’s talented and dedicated team, while the remaining 20% relies on the investor’s risk management skills and experience.

CTD’s stock price has declined by 11% since the beginning of the year until the session on September 19th

On the topic of share buybacks, a CTD representative explains that the company only considers buying back shares when aiming to reduce its charter capital. However, Coteccons is currently focused on increasing its capital.

Regarding the ongoing disputes with former leaders, Mr. Bolat states, “We have our hands full,” indicating that they don’t have time to dwell on the past. “We are here to pursue our dreams, and that’s what gets us out of bed every morning, driving us to contribute to Coteccons. We know what we’re doing, what needs to be done, and how to do it,” he adds.

Mr. Bolat promises to continuously push the company forward, embracing challenges and attracting new talent and capabilities. He emphasizes the importance of being proactive and not resting on past successes.

The Gourmet Chairman Pledges $4 Million to Buy HNF Shares

Mr. Trinh Trung Quyet, Chairman of the Board of Directors of Huu Nghi Food JSC, has announced his intention to purchase an additional 3.5 million HNF shares, increasing his ownership stake to 39.09%. This move underscores Mr. Quyet’s confidence in the company’s prospects and his commitment to its long-term growth. With a strong track record in the food industry, Huu Nghi Food JSC is well-positioned for success, and Mr. Quyet’s increased investment highlights the company’s potential for expansion and profitability.