Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (HOSE: CII) announces that its Board of Directors has approved an adjustment to the dividend payment schedule.

The company states that the change is due to several significant developments planned for the fourth quarter of 2024.

Specifically, one of CII’s subsidiary companies is expected to receive approval for a real estate project with a total investment of nearly VND 5,000 billion. The project includes 2,160 apartments and shophouses, 81 detached houses, and various amenities such as kindergartens, elementary schools, ecological gardens, healthcare facilities, BBQ areas, children’s playgrounds, swimming pools, and gyms.

Additionally, on October 21, 2024, CII’s bonds with the code CIIB2124002 will mature, with a face value of VND 500 billion. The company emphasizes the importance of ensuring timely repayment of the principal and interest on these bonds.

The CIIB2124002 bonds have a total issued face value of VND 500 billion and were issued on October 21, 2021, with a maturity date of October 21, 2024. They have a three-year term, pay interest every three months at a rate of 9.5% per annum, and are non-convertible, non-warrant-attached, and unsecured bonds. The proceeds from the bond issuance will be used to expand the operating capital of the company.

To focus resources on the real estate project and bond repayment, Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company will defer the dividend payment scheduled for the beginning of the fourth quarter of 2024 to subsequent quarters. The company also plans to increase the dividend payout ratio in the following periods to compensate for the delayed payment.

Recently, CII also approved a plan to offer public bonds with the code CIIB2426001 to raise VND 300 billion. These bonds have a two-year term, a 10% annual interest rate, and the subscription period will run from September 24 to 11:15 am on October 14, 2024. The CIIB2426001 bonds are non-convertible, non-warrant-attached, unsecured, and the proceeds will be used to partially or fully repay the principal of the CIIB2124002 bonds.

Additionally, CII announced a tender offer to purchase 5 million NBB shares at a price of VND 25,488 per share. The company will use its own capital, loans from other organizations, and other legal sources to fund this acquisition, amounting to VND 127.44 billion for the purchase of these shares.

The tender offer period will run from August 19, 2024, to October 1, 2024.

For the first half of 2024, CII reported total assets of VND 35,673 billion and equity of VND 9,430 billion. Audited post-tax profit reached VND 443.5 billion, a 1.9% decrease compared to the figures published in the previous financial statements.

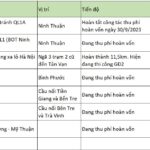

According to CII, compared to the same period last year, the audited post-tax profit for the first half of 2024 increased by VND 325.6 billion (post-tax profit for the first half of 2023 was VND 117.9 billion). This improvement was mainly due to increased net profit from the BOT Trung Luong – My Thuan project (BOT Trung Luong – My Thuan Joint Stock Company has been a subsidiary of CII since the fourth quarter of 2023) and higher financial revenue from cumulative financial benefits related to the Ca Na Toll Station project – Km 1584 +100, National Highway 1-Ninh Thuan, operated by Ninh Thuan BOT One-Member Limited Liability Company.

On September 25, CII’s stock price closed at VND 15,500 per share, up VND 400 from the previous day’s closing price.

Profiting Over $250,000 Daily from Toll Booths, CII Waives Fees for Vehicles Transporting Relief Goods to Flood-Affected Areas

As per the reviewed semi-annual financial statements for 2024, CII recorded net revenue of VND 1,651 billion, which remained unchanged from the same period in 2023.