In the international market, the DXY index fell by 0.37 points over the week, reaching 100.74 – the lowest level for the index in over a year.

USD extended its decline in the international market after the Fed initiated a robust easing cycle on September 18 with a 0.5% rate cut, diminishing the allure of the greenback.

Fed Chair Jerome Powell assessed that the Fed’s monetary tightening campaign had “yielded results” in curbing inflation. However, he also noted a “noticeable slowdown” in jobs growth, indicating that the labor market is “cooling off.” This may have been a contributing factor in the Fed’s decisive action during the first easing policy in four years.

Nevertheless, Powell emphasized that the Fed is not rushing and will continue to make decisions “meeting by meeting” based on data and risks. He also cautioned against viewing the 50-basis-point cut as the “new normal” for Fed rate reductions.

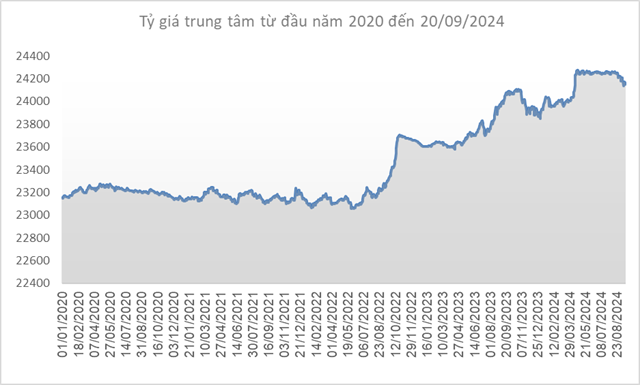

Source: SBV

|

Domestically, the central exchange rate of the Vietnamese Dong to USD decreased by 24 VND/USD compared to the previous week (September 13), reaching 24,148 VND/USD on September 20, 2024.

The State Bank of Vietnam (SBV) maintained the immediate buying rate unchanged at 23,400 VND/USD. Notably, after nearly five months of fixing the immediate selling rate at 25,450 VND/USD, the regulator started adjusting the immediate selling rate according to the central rate movement from August 30. On September 20, the immediate selling rate stood at 25,305 VND/USD, a decrease of 25 VND/USD compared to the previous week.

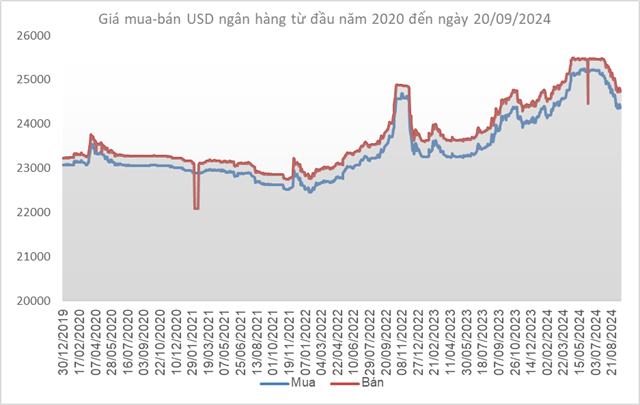

Source: VCB

|

In contrast, Vietcombank’s exchange rate was quoted at 24,370-24,740 VND/USD (buying-selling), a 10 VND/USD increase in both directions, breaking the seven-week streak of declining bank USD/VND rates.

Source: VietstockFinance

|

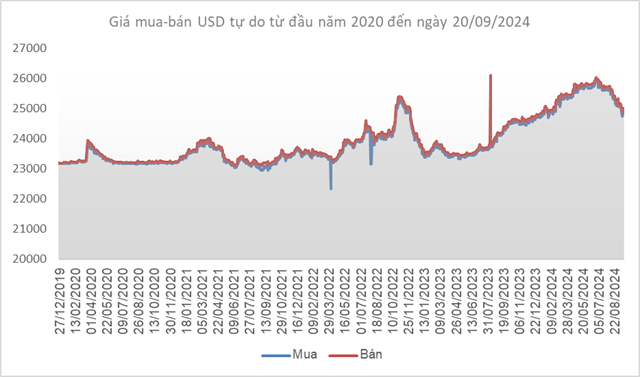

Meanwhile, the USD/VND exchange rate in the free market remained unchanged from the previous week, holding at 24,900-25,000 VND/USD (buying-selling).

The Golden Loop: A Record-Breaking Price Surge

This morning (September 19th), domestic gold ring prices soared to a record high of 79.2 million VND per tael, an unprecedented level. The selling price of SJC gold reached an astounding 82 million VND per tael.

Sure, I can assist with that.

## Empowering Borrowers and Unraveling the Complexities of Collateral: A Lender’s Perspective

“In a proposal to the government, the Chairman of TPBank emphasized the need for enhanced public awareness and borrower accountability regarding loan debts. The bank seeks to address the challenging situation where lenders find themselves ‘standing when granting loans but kneeling when collecting debts.’ This metaphor highlights the urgent requirement for a cultural shift in borrowing behavior and a more responsible attitude toward financial obligations.”