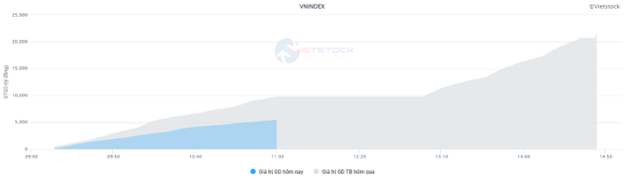

Market liquidity decreased compared to the previous trading session, with the matching trading volume of VN-Index reaching more than 568 million shares, equivalent to a value of more than 12.6 trillion VND; HNX-Index reached more than 52.1 million shares, equivalent to a value of more than 1,110 billion VND.

At the opening of the afternoon session, buying demand reappeared but selling pressure still dominated, causing the VN-Index to reverse and continue losing points until the end of the session. In terms of impact, VNM, CTG, GVR, and MBB were the most negative stocks, taking away more than 2.8 points from the index. On the other hand, GAS, PLX, HAG, and LPB were the most positive stocks, but their impact on the index was not significant.

| Top 10 stocks with the strongest impact on VN-Index on October 4, 2024 |

Similarly, the HNX-Index also witnessed a lackluster performance, with negative impacts from stocks such as IDC (-1.75%), MBS (-1.26%), VIF (-2.86%), and NVB (-2.15%).

|

Source: VietstockFinance

|

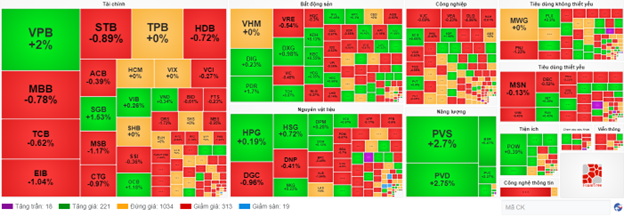

The financial sector witnessed the sharpest decline in the market, falling by -0.8%, mainly due to TCB (-1.23%), STB (-1.93%), MBB (-1.57%), and TPB (-1.43%). This was followed by the real estate and materials sectors, which decreased by 0.62% and 0.6%, respectively. On the contrary, the energy sector witnessed the strongest recovery in the market, gaining 0.27% with green signals from PVS (+1.72%), PVD (+1.65%), PVB (+2.7%), and CST (+1.2%).

In terms of foreign trading, they returned to net sell more than 399 billion VND on the HOSE exchange, focusing on VRE (62.01 billion), HDB (50.07 billion), VNM (47.01 billion), and PLX (46.12 billion). On the HNX exchange, foreigners net sold more than 34 million VND, focusing on IDC (42.05 billion), TNG (10.69 billion), SHS (7.31 billion), and CEO (4.89 billion).

| Foreign Trading Buy – Sell Net |

Morning Session: Dismal market, foreigners net sell again

The market traded gloomily after a sharp decline in the previous session. Liquidity trickled as investors remained cautious amid the VN-Index’s continuous failed attempts to break through the peak, and foreigners resumed net selling in the morning session. By midday break, the VN-Index lost 2.85 points, equivalent to 0.22%, to 1,275.25 points; the HNX-Index also fell by 0.22% to 232.83 points. Sellers temporarily dominated with 373 declining stocks versus 221 advancing stocks.

The matching trading volume of the VN-Index in the morning session reached over 251 million units, equivalent to a value of nearly 5.5 trillion VND. The HNX-Index recorded a matching volume of nearly 25 million units, with a value of nearly 588 billion VND.

Source: VietstockFinance

|

In terms of impact, CTG, BID, and GVR exerted the most negative pressure on the index, taking away more than 1 point from the VN-Index. Conversely, the most positive pillars were VPB, PLX, and GAS, contributing more than 1 point.

Red dominated most industry groups, with the telecommunications group ranking at the bottom with a decline of 0.91%. This was mainly influenced by stocks such as VGI (-1.09%), FOX (-0.91%), and ELC (-1%).

The real estate group, after a sharp decline in the previous session, continued to face selling pressure. However, some stocks showed positive signals, including PDR (+1.94%), KDH (+0.27%), NVL (+0.4%), DXG (+0.65%), DIG (+0.46%), HDG (+0.55%), and SZC (+0.42%). Meanwhile, many large-cap stocks such as VHM, VIC, VRE, BCM, IDC, etc., remained in the red. The banking group also saw only a few bright spots, with VPB, SGB, and BAB rising by more than 1%, while the majority followed the overall downward trend.

On the other hand, the energy group recorded the most remarkable increase in the market during the morning session. Green signals appeared in many large-cap stocks in the industry, including PVD (+2.2%), PVS (+1.96%), BSR (+0.41%), PVC (+1.52%), and PVB (+4.05%). Additionally, the utilities and non-essential consumer goods groups also edged slightly higher, thanks to stocks like GAS (+0.69%), POW (+0.39%), VSH (+0.99%); PLX (+2.25%), OIL (+0.78%), GEE (+0.92%), MSH (+0.66%), and PET (+0.58%).

Foreigners further pressured the overall market, resuming net selling of more than 150 billion VND on the HOSE exchange in the morning session. The net selling value was not concentrated in a single stock but was spread across several stocks, with VRE, MWG, HDB, and DGC being the most net-sold stocks, with values exceeding 20 billion VND. Conversely, TPB attracted buying demand from foreigners, with a net buying value of nearly 33 billion VND. On the HNX exchange, foreigners net sold nearly 21 billion VND by the end of the morning session, with the selling pressure concentrated mainly on the IDC stock.

10:30 am: Investors remain cautious

Investor caution persisted after the previous session’s decline, causing the main indices to fluctuate within a narrow range around the reference level. As of 10:30 am, the VN-Index fell by 2.05 points, trading around 1,276 points. The HNX-Index decreased by 0.18 points, trading around 233 points.

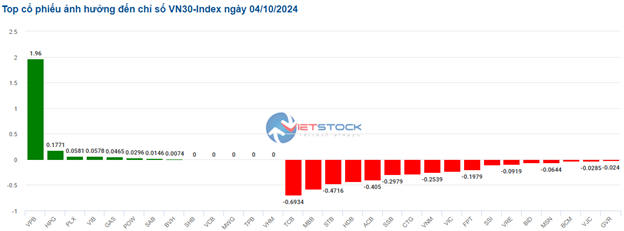

Most of the stocks in the VN30 basket continued to face selling pressure. Notably, the banking group witnessed a decline, with TCB falling by 0.69 points, MBB by 0.58 points, STB by 0.47 points, and HDB by 0.43 points. Conversely, only a few stocks, including VPB, HPG, VHM, and PLX, managed to stay in the green, contributing more than 2.2 points to the index.

Source: VietstockFinance

|

Telecommunications stocks continued their weak performance, recording the sharpest decline in the market of 0.52%. Specifically, VGI fell by 0.47%, ELC by 1.41%, TTN by 1.42%, and FOX by 0.91%. Only FOC and SED managed to stay in positive territory, rising by 0.96% and 0.48%, respectively.

Next was the financial sector, which declined by 0.23% and had a relatively strong negative impact on the overall index. This decline was mainly driven by banking stocks, with MBB falling by 0.59%, TCB by 0.21%, and STB by 0.59%. On the upside, green signals persisted in VPB (+2%), TPB (+0.29%), SGB (+1.53%), and OCB (+0.78%).

On the contrary, the energy sector maintained a relatively optimistic performance, with notable gains in several oil and gas stocks, including PVS (+3.19%), PVD (+2.94%), PVB (+4.39%), and PVC (+1.52%)…

Compared to the opening, the market continued to witness mixed performances, with over 1,000 stocks trading around the reference level. Sellers maintained their dominance, with 313 declining stocks versus 221 advancing stocks.

Source: VietstockFinance

|

Opening: Caution prevails at the start of the session

At the beginning of the October 4 session, as of 9:40 am, the VN-Index fluctuated around the reference level and lost nearly 1 point, falling to 1,277.16 points. In contrast, the HNX-Index edged slightly higher, reaching 233.5 points.

U.S. stocks declined on Thursday (October 3) as concerns about tensions in the Middle East made investors cautious ahead of the September jobs report.

At the close of the trading session on October 3, the Dow Jones index fell by 184.93 points (equivalent to 0.44%) to 42,011.59 points. The S&P 500 index decreased by 0.17% to 5,699.94 points. The Nasdaq Composite index slipped by 0.04% to 17,918.48 points, as the more than 3% gain in Nvidia’s shares curbed the downward pressure.

Red dominated the VN30 basket, with 9 declining stocks, 12 advancing stocks, and 9 stocks trading around the reference level. Notably, SSB, CTG, and VIC were the most negative stocks, while POW, TPB, and MSN were the top gainers.

The industrial group was one of the most prominent sectors in the market, with positive performances from stocks such as ACV, ASM, PVT, LCG, ASM, LHC, SCS, and SCG.

What Will Fuel the VN-Index’s Growth in the Coming Period?

“A robust economy is the fundamental driver of a thriving stock market, and that’s precisely what we’re seeing. With impressive economic growth rates, Vietnam is poised for success. The government forecasts a remarkable 7% growth rate for this year, while VinaCapital predicts a still-healthy 6.5%. This bodes well for the stock market and investors alike.”

Technical Analysis for the Session Ending 07/10: Indecision Plaguing the Markets

The VN-Index and HNX-Index rose in tandem, while trading volume plummeted in the morning session, indicating a cautious sentiment among investors.