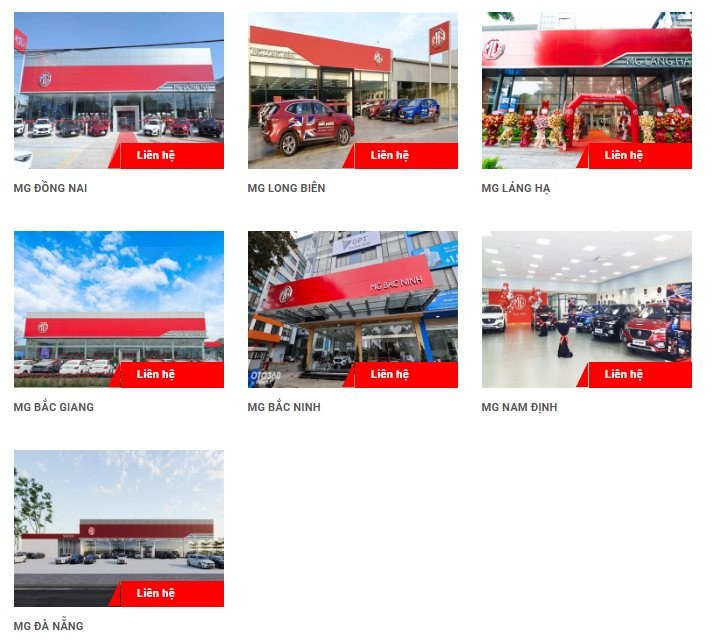

On November 13, the Board of Directors of Haxaco, a leading automotive services company in Vietnam, approved the plan to list the shares of its subsidiary, PTM, on the Ho Chi Minh Stock Exchange (HoSE). PTM, with a charter capital of VND 320 billion, is engaged in the distribution of MG vehicles for Haxaco through its nationwide network of seven dealerships.

As per the announcement, the process will commence from November 2024 onwards. Haxaco’s Board of Directors will entrust the company’s Executive Board to establish a dedicated team to support and coordinate with PTM in fulfilling the necessary procedures for public company registration and listing on HoSE, in compliance with regulations.

Additionally, the Haxaco Board has directed the PTM Board of Directors and Executive Board to collaborate with partners to establish a Project Management Board. This initiative aims to effectively develop and expand PTM’s production and business operations for the year 2025.

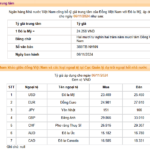

Prior to this development, PTM successfully concluded a rights offering with a 1:1 ratio, increasing its charter capital to VND 320 billion. Haxaco also approved an additional investment of nearly VND 82.6 billion to exercise the share purchase rights of existing shareholders in PTM’s additional issuance. As a result, Haxaco currently holds 51.62% of PTM’s charter capital.

For the first nine months of 2024, Haxaco reported impressive financial results, with net revenue reaching VND 3,696 billion, reflecting a 27% increase compared to the same period last year. The company’s profit after tax stood at VND 144 billion, marking an extraordinary growth of 888% year-on-year.

Looking ahead to 2024, Haxaco has set an ambitious target of achieving VND 200 billion in pre-tax profit. With the conclusion of the third quarter, the company has already accomplished 91% of its full-year profit plan.

Who is the Woman Behind the 6-Month-Old Enterprise That Just Invested 300 Billion VND in VIB?

Quang Kim Investment and Development JSC, established on May 23, 2024, purchased 17.2 million VIB shares during the November 11 trading session. This substantial acquisition elevated the company’s holdings, along with those of its affiliated shareholder group, to a notable 9.836% stake in the bank’s capital. The legal representative of Quang Kim Investment and Development JSC is Ms. Do Xuan Ha, the sister of Mr. Do Xuan Hoang, who serves as a member of the board of directors of VIB Bank.

The Greenback’s Freefall: A Sudden Surge

The US dollar surges on the black market, with a notable spike. While the selling rate in banks witnesses an increase, the buying rate takes a contrasting dip.