Global gold prices continued their strong recovery trend as risk aversion demand increased amid escalating armed conflict between Russia and Ukraine. This upward momentum in gold prices remained robust even as the US dollar strengthened.

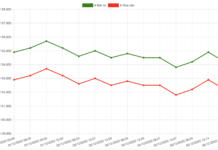

As of Wednesday’s (Nov 20) close in New York, spot gold prices rose by $18.8/oz compared to the previous session’s close, equivalent to a gain of over 0.7%, reaching $2650.6/oz, according to data from Kitco Exchange.

As of early Thursday morning Vietnam time, spot gold prices were up by $3.7/oz compared to the US close, equivalent to a gain of 0.14%, trading at $2654.3/oz. Converted at Vietcombank’s selling exchange rate, this price is equivalent to VND 81.6 million/tael, an increase of VND 600,000/tael from yesterday’s morning session.

This week, global gold prices, when converted, have increased by VND 2.5 million/tael, recovering from a loss of over VND 5 million/tael in the previous two weeks.

Vietcombank, at the beginning of the morning session, quoted the US dollar at VND 25,170 (buying) and VND 25,504 (selling).

Spot gold prices are currently at their highest level in a week, supported by investors’ risk aversion.

On Wednesday, Ukraine fired a barrage of British Storm Shadow cruise missiles into Russia. This was the latest Western weapon Ukraine was permitted to use against Russian targets, following the use of US-made ATACMS long-range missiles the day before. On Monday, Russian President Vladimir Putin declared a lower threshold for the use of nuclear weapons in response to external attacks on Russian territory.

“Clearly, the escalating conflict is driving safe-haven demand… But a strong US dollar will still be a headwind for gold,” said Peter Grant, strategist at Zaner Metals, in a Reuters interview.

The US dollar strengthened during Wednesday’s session, with the Dollar Index settling at 106.68, up from 106.28 in the previous session. The index had briefly surpassed 107 last week, its highest level in a year.

There are two main drivers behind the US dollar’s upward trend. Firstly, the greenback is serving as a risk aversion asset similar to gold, and secondly, investors anticipate that policies implemented by re-elected President Donald Trump over the next four years will lead to higher inflation and interest rates in the US.

Since gold is priced in US dollars in international markets, the dollar’s strength has exerted significant downward pressure on gold prices. Last week, gold prices experienced their biggest weekly decline in over three years as the US dollar strengthened to its highest level since November 2021.

The Dollar Index has risen over 2% since Trump’s re-election on November 5th.

“There is no reason to sell the dollar right now,” especially as investors consider the possibility of the Fed refraining from cutting interest rates at their December meeting, said Matt Simpson, senior analyst at City Index.

According to data from the FedWatch Tool of the CME Exchange, the probability of a 0.25 percentage point rate cut at the upcoming Fed meeting has decreased to 52%, while the probability of no rate cut has increased to 48%. Just a week ago, the likelihood of a rate reduction at this meeting stood at over 80%.

Statements made by Fed Governors Michelle Bowman and Lisa Cook on Wednesday did not provide clear signals about the future path of interest rates. One governor referenced concerns about persistent inflation, while the other expressed confidence that price pressures would continue to ease.

“If the Fed pauses its rate cuts in the December meeting, it will put downward pressure on gold prices. However, the Fed’s accommodative monetary policy cycle, macroeconomic and geopolitical uncertainties, and robust physical gold demand will continue to underpin market sentiment,” said a report by ANZ Bank.

The Art of Strategic Trading: Navigating the Freeze on Liquidity for Derivatives Maturity

The trading market was sluggish this morning as investors awaited the derivatives expiration in the afternoon. The total matched order value on HoSE and HNX fell by 58% compared to yesterday’s morning session, reaching just over VND 3,368 billion, the lowest since April 2023. Despite this, the breadth showed a balanced differentiation.

The Evolution of Trade Figures Between Vietnam and Russia

Vietnam’s trade with the Russian Federation has reached 3.52 billion USD in the first three quarters of this year, a significant 41% increase compared to the same period last year. This has sparked a growing interest from Vietnamese enterprises, with many delegations traveling to Russia to explore market opportunities.