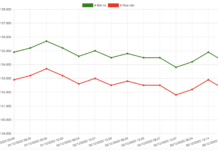

The market is witnessing significant volatility around the 1200-point mark for the VNI, indicating that this area is likely a key supply and demand contest zone. Today’s bottom-fishing capital was more effective than the session on November 18th.

The VNI had another dip to test the 1200-point level and even went slightly lower before rebounding. It would be preferable if the time spent below 1200 points is extended, as testing supply and demand becomes clearer over a more extended period. When the market breaks through a critical support level, emotions can run high, especially after witnessing the aggressive price suppression yesterday.

Buyers today acted relatively early and maintained proactive pressure. Inflows were strong, although they slowed towards the end, erasing yesterday’s loss. The VNI’s three-session candle combination indicates a positive tug-of-war, preserving the price channel extending from the April 2024 low to the present.

The momentum of the afternoon’s inertia rise and fall indicates a temporary balance of high-buying motivation. Buyers are not looking to push prices higher but are returning to a wait-and-see mode. This caused the afternoon’s slowdown in liquidity, which is more positive than negative, as sellers did not offload more as they did yesterday.

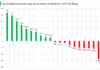

The supply and demand testing process is entering a very active phase, thanks to the increased volatility. Every day, there are extreme psychological states, and anyone who wants to sell will be pressured by the overall market decline. In contrast, those who want to buy will have a better price. Liquidity improved this session, and bottom-fishers did not have enough amplitude to surf T+. Maintaining liquidity around 15k billion (today above 16k billion, excluding agreements) is stable.

The market may need more sessions to consolidate confidence in the market’s ability to create a bottom around the 1200-point mark: either through repeated strong volatility without the VNI finding a new bottom or by being pulled up sharply to create a clear bottom reference. However, the signal for bottom-fishing capital around the current threshold is quite clear. The remaining question is how much more the stockholders want to exit at this level.

The current news flow remains unchanged, and negative factors persist. Still, the market is showing increasingly favorable reactions, which is understandable. When fear and discouragement are high, negative news seems to be everywhere. Everyone was happy when the bottom-fishing demand pulled up the market on Monday, but when it was dumped down yesterday, complaints resurfaced. Today, as the buying pressure maintains the price foundation, there will likely be cautious and skeptical analyses. If emotions dominate, the basis of analysis will fluctuate as unpredictably as the weather.

The perspective remains that the market is excellent for accumulating purchases for the new uptrend and can increase the stock proportion to a high level. There will come a time when sentiment becomes “immune” to negative news. The current adjustment phase is entirely normal and even milder than the previous two.

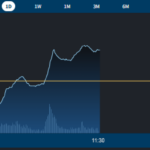

Today, the derivatives market fluctuated strongly with the underlying market, and liquidity was substantial. What was somewhat surprising was that even when the VNI broke through 1200, the F1 basis remained positive, and liquidity was high. This could be a short-covering activity. VN30 has two narrow fluctuation zones from 1260.xx to 1255.xx and 1249.xx. The best entry point for Long is to wait for VN30 to break through 1260.xx, as it will then enter the zone of expanding the upward amplitude. Today’s pull was stronger than expected, with VN30 not only breaking through the narrow zone of 1268.xx to 1272.xx but also approaching 1279.xx, with F1 even surpassing 1279.

Strong fluctuations around a support area are typical signals during bottom formation, as conflicting perspectives intensify their battle. With F1 approaching maturity and F2 showing a wide spread, the strategy remains to buy stocks and flexibly Long/Short F1.

VN30 closed today at 1271.73, right at a milestone. The next resistance levels for tomorrow are 1279, 1290, 1294, 1302, and 1315. Supports are at 1260, 1255, 1249, and 1242.

“Stock Market Blog” reflects the personal perspective of the investor and does not represent the views of VnEconomy. The opinions and assessments are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for issues related to the investment assessments and opinions presented in this blog.

The Market’s “Rebound Rally”: Foreign Selling “Accepted”, Bottom Fishers “Strike” from 1200-Point Region, Liquidity Nearly Doubles

Yesterday’s pessimistic performance led to a negative opening for the market this morning, with the VN-Index dipping as low as 1,197.99 points and the number of declining stocks outpacing advancers fivefold. However, an unexpected turnaround occurred as strong buying power once again demonstrated its strength, driving a series of upward reversals. Turnover on the two exchanges is up nearly 90% from yesterday’s morning session, even as foreign investors continue to offload significant net sell positions.

The Stock Market: Riding the Unexpected Wave

The market seems to be steered by a “abandonment” script, with a sharp and decisive surge in margin. Two consecutive bullish sessions and the retention of bottom-fishing stocks have contributed to a perceived “shortage”.