This service is designed for corporate customers who have been granted a credit limit by Sacombank and have completed the necessary loan procedures. With a simple registration process, businesses will have full control over requesting disbursements without having to visit a Sacombank transaction point. There is no limit to the number of requests within the credit limit set by the bank. Additionally, Sacombank has integrated a “Buy Foreign Currency” feature into this service, catering to those who need to make overseas payments from the disbursed funds.

To register and use the service, follow these steps:

(1) Register for the “Online Disbursement” service at any Sacombank transaction point.

(2) Create a disbursement request via Internet Banking.

(3) Attach the necessary documents.

(4) Complete the request through the digital signature transaction establishment method.

(5) Sacombank will receive and process the disbursement request.

Sacombank’s electronic banking is a modern and convenient digital banking solution for individuals and businesses, constantly improved and updated with new features to enhance the customer experience. Nearly 150,000 businesses trust this service due to its high security and privacy standards and its ability to meet various financial needs, such as account opening, domestic payments, international money transfers, and letter of credit issuance. It also offers a range of authentication methods and approval models, from single to multi-level, suitable for businesses of all sizes, from micro-enterprises to small and medium-sized enterprises (SMEs). All transaction invoices and documents at Sacombank’s electronic channels are digitally signed by the bank using public key infrastructure (PKI) technology, and the electronic invoices are provided in [.xml] format for easy data transmission to tax authorities.

As part of its digital banking strategy, Sacombank has employed eKYC technology to enable online business account opening on its website, www.sacombank.com.vn, since 2022. Businesses only need to provide a valid business registration certificate and the authorized representative’s ID, and they can immediately start transacting without visiting a Sacombank transaction point to submit additional paperwork. In 2024, the bank added an extra step of verifying the authorized representative’s ID and biometric data to align with society’s digitization and enhance account security and privacy.

For more information, please contact any Sacombank transaction point nationwide, hotline 1800 5858 88, Email: [email protected], or visit the website www.sacombank.com.vn.

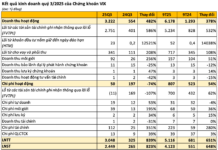

VietinBank: Leading the Pack in Operational Income

As per the Q3 2024 financial statements, VietinBank has emerged as a leader in Vietnam’s banking industry, boasting top-tier figures in terms of operating income and pre-provision profit from business operations. This remarkable performance underscores the bank’s adeptness in leveraging its earning assets to generate robust revenue and profits.

26 Commercial Banks Join Vietnam Card Day 2024

The Vietnam Card Day 2024 will feature six key activities, including a thematic workshop and a career orientation seminar for students at the beginning of October. The highlight of the event is the Song Festival, which will take place on October 5-6 at the Bach Khoa Stadium. This festival will be a hub of payment experiences for customers across various devices.

The Bank Slashes $17 Million Debt of a Real Estate Firm, Backed by 40 Million Pledged Shares

Sacombank has announced the auction of a non-performing loan of nearly VND 600 billion, originating from Van Phat Real Estate Investment Joint Stock Company. With a starting price of just VND 189 billion, this auction presents a unique opportunity for investors to acquire a substantial loan at a discounted rate.