Handico6 Approves 10% Dividend Payout for 2023

Handico6 has announced a 10% dividend payout for 2023, amounting to over VND 15 billion. The payment will be made starting December 20, 2024.

According to the resolutions of the 2024 Annual General Meeting of Shareholders held on June 20, the company planned to distribute a total dividend of 15% for 2023 (including 5% in cash and 10% in stocks). However, Handico6 has decided to forgo the stock dividend and instead pay a 10% cash dividend.

This decision was approved by the shareholders through a written vote from November 11 to 15. The company attributed the change to the impact of Super Typhoon Yagi and market considerations.

Prior to this, Handico6 had not issued any stock dividends. From 2019 to 2022, the company consistently paid cash dividends ranging from 10% to 12%.

Handico6 is a subsidiary of the Hanoi Housing Development and Investment Corporation (Hadico) and operates in three main fields: housing investment and development, construction and production, and building materials trading. Its chartered capital currently stands at VND 151.2 billion, with major shareholders being Chairman Le Quoc Binh, holding 20.25%, and Handico, holding 16.27%.

Handico6 is known for its real estate projects in Hanoi, most notably the Diamond Flower Tower at 48 Le Van Luong, Thanh Xuan. The company also achieved success with the Green Diamond Ha Long project.

Diamond Flower Tower, 48 Le Van Luong, Thanh Xuan, Hanoi

|

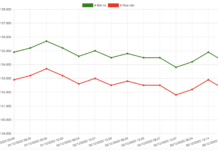

In terms of business performance, Handico6’s third-quarter revenue for 2024 doubled from the previous year to VND 121 billion, mainly from real estate and construction activities. However, net profit remained flat at VND 2.8 billion due to increased selling and management expenses.

| Handico6’s Quarterly Financial Results for 2021-2024 |

For the first nine months of 2024, revenue reached nearly VND 312 billion, more than double the figure for the same period in 2023, and accounted for over 74% of the annual plan. However, profit before tax decreased by 27% year-on-year to nearly VND 11 billion, or 24% of the annual profit target. Net profit was nearly VND 8 billion.

In the stock market, HD6’s share price surged by 4.44% on November 28 compared to the previous trading day, reaching VND 14,100 per share. However, the price has lost nearly two-thirds of its value since the beginning of the year. The average trading volume was over 56,000 shares per day.

| HD6 Share Price Movement in 2024 |

Te Manh

The SunValue and UEH-CELG Collaboration: A Turning Point for Vietnam’s Valuation Industry

The collaboration between the School of Economics, Law, and Public Administration (UEH – CELG), the Institute of Economics and Technology, and the SunValue Valuation Group presents a significant opportunity for advancement in research, growth, and development within the real estate and valuation industry, both in Vietnam and internationally.

“Funded by Bill Gates’ Foundation, Omachi and Chin-su Manufacturer Soars: Triples in Value This Year, Enters Top 10 Biggest Companies in the Stock Market”

With impressive business results and an exciting IPO and uplisting journey, MCH’s stock has soared over the past year.

The Ultimate Guide to Flipping Properties: Navigating the Real Estate Landscape Like a Pro

Southern localities are calling for an investigation into the causes of fluctuating real estate prices. They aim to understand and address the factors contributing to price volatility in the region’s diverse property markets. This includes scrutinizing the practice of quick resales, particularly in project areas and apartment complexes, where unusual price hikes have been observed.

The Penultimate Partnership: Regal Group Seals the Deal with Nation-Wide Agencies and Leading Banks

The partnership signing event with 25 reputable distributors across the country and leading financial partners marked a significant milestone in the development and prosperity of Regal Group in the 2024 – 2027 period.