Domestic Enterprises Thrive

According to the Ministry of Industry and Trade, Vietnam’s import and export activities have been recovering positively and have been a bright spot in the economy, thanks to proactive and synchronous measures to remove difficulties, support domestic production, promote trade, and expand export markets.

Statistics released by the Ministry on December 12, 2024, show that the country’s export turnover reached a preliminary figure of US$369.93 billion in the first 11 months of 2024, up 14.4% compared to the same period last year. Notably, this growth rate is higher than that of many countries in the ASEAN and Asian regions. For example, from January to October 2024, China’s exports increased by 12.7%, South Korea’s by 9.6%, Thailand’s by 4.9%, and Indonesia’s by only 1.33%.

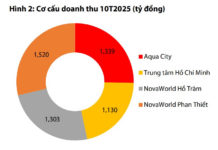

Mr. Tran Thanh Hai, Deputy Director of the Import-Export Department (Ministry of Industry and Trade), shared that we have witnessed a strong effort and breakthrough development of domestic enterprises this year. For many consecutive months, the export turnover of this sector has reached double digits and is much higher than that of foreign-invested enterprises (FDI), which usually dominate market share and growth.

“Export turnover of the domestic economic sector reached nearly US$104 billion, up 20%, accounting for more than 28% of total export turnover. In contrast, the foreign-invested sector increased by only 12.4%, reaching over US$266 billion,” Mr. Hai analyzed.

Furthermore, according to the leader of the Import-Export Department, the proportion of export turnover of the domestic economic sector in the country’s total export turnover (over 28%) has reached a higher level than in the same period in 2023 (only 26.8%). This indicates that domestic enterprises are making progress and climbing higher on Vietnam’s export map.

In the first 11 months of 2024, 36 items had an export turnover of over US$1 billion (compared to 33 in the same period last year), accounting for 94.1% of the total export turnover (including seven items with an export turnover of over US$10 billion, accounting for 66.5%).

Positive Changes in Export Commodity Structure

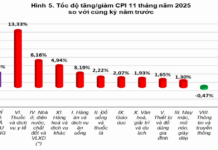

According to the Import-Export Department, in the past 11 months, the export turnover of most key items has achieved positive growth compared to the same period last year due to the recovery in demand.

Notably, the export turnover of the group of agricultural, forestry, and aquatic products is estimated at US$35.5 billion, up 20.6% over the same period in 2023, accounting for 9.6% of the country’s total export turnover. Within this group, some items with high export turnover increased by over 20% compared to the same period last year due to higher prices.

Some of the top-performing items include pepper, up 46.2%; coffee, up 35.4%; rice, up 22.3%; tea, up 26.9%; fruit and vegetables, up 27.4%; rubber, up 17.8%; and cashew nuts, up 20.6%.

As a key export industry, the group of processed industrial products also recovered strongly in the first 11 months, with a growth rate of 14.3% over the same period and a preliminary export turnover of US$313.6 billion, accounting for nearly 85% of the country’s total export turnover.

Many key items in this group achieved double-digit growth, such as computers, electronic products, and components, reaching US$65.2 billion, up 26.3%; telephones and components, reaching US$50.2 billion, up 3.2%; machinery, equipment, tools, and other components, reaching US$47.8 billion, up 21.6%; textiles, reaching US$33.65 billion, up 10.6%; and footwear of all kinds, reaching US$20.76 billion…

Domestic exporters are striving to improve

Regarding export markets, the Ministry of Industry and Trade’s statistics show that exports to almost all major markets and trade partners have recovered positively and achieved high growth.

The United States is Vietnam’s largest export market, with an estimated turnover of US$98.4 billion, accounting for 29.3% of the country’s total export turnover and an increase of 24.2% over the same period last year (down 13% in the same period in 2023). This is followed by China, with an estimated turnover of US$55.1 billion, down 0.9% over the same period last year (up 6% in the same period last year); the EU market, with an estimated turnover of US$47.3 billion, up 18.1% over the same period last year (down 8% in the same period in 2023); South Korea, with an estimated turnover of US$23.3 billion, up 8.7% (down 4% in the same period in 2023); and Japan, with an estimated turnover of US$22.3 billion, up 4.8% (down 4.3% in the same period in 2023).

Focusing on Implementing New FTAs to Expand Export Markets

According to Mr. Hai, besides continuing to remove institutional obstacles and unblock bottlenecks for import and export activities, the Ministry of Industry and Trade is promoting the implementation of new agreements to expand and diversify export markets, items, and supply chains. “The Ministry of Industry and Trade is trying to complete the procedures for implementing the Vietnam – UAE Comprehensive Economic Partnership Agreement to help businesses expand their export markets and target new potential areas,” he emphasized.

At the same time, the industry and trade sector will strengthen support for businesses to effectively exploit the advantages of Free Trade Agreements (FTAs) that have come into effect and been signed; focus on exploiting potential neighboring markets; promote official exports associated with brand building; and promote sustainable exports.

In the future, the Ministry of Industry and Trade will focus on innovating and improving the efficiency of trade promotion activities, promoting the completion of the legal system to consolidate the trade defense regime towards protecting the domestic economy, businesses, and markets in line with international commitments; continue to improve the effective use of trade defense tools to protect domestic production industries and support Vietnam’s export industries to effectively cope with foreign trade defense cases. At the same time, closely monitor and promptly and fully assess the impacts of changes in US policies, especially after President Trump takes office in late January 2025, to respond timely and appropriately./.