Market liquidity decreased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 1.1 billion shares, equivalent to a value of more than 35.4 trillion VND; the HNX-Index reached over 89.1 million shares, equivalent to a value of more than 2.2 trillion VND.

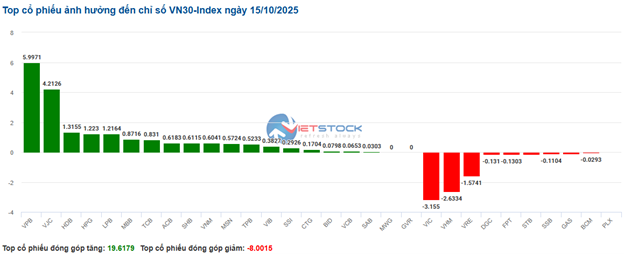

The VN-Index opened the afternoon session on a relatively positive note as buying pressure returned, helping the index quickly recover to its reference level. However, selling pressure re-emerged towards the end of the session, causing the index to reverse and close in the red. In terms of impact, VHM, VIC, VCB, and VPL were the most negatively influential stocks on the VN-Index, contributing to a decline of over 7.1 points. Conversely, VPB, VJC, GEE, and GEX maintained their green status, adding more than 5.6 points to the overall index.

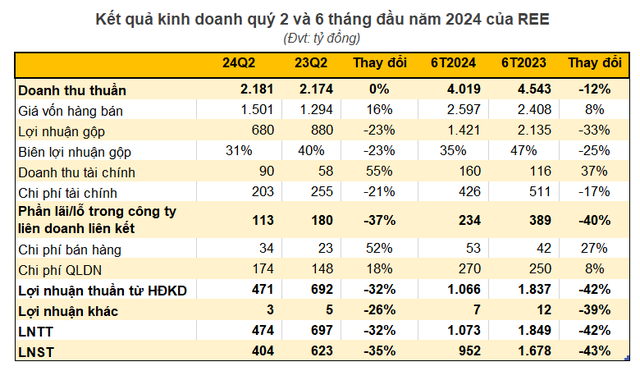

| Top 10 stocks with the strongest impact on the VN-Index on October 15, 2025 (calculated in points) |

In contrast, the HNX-Index showed a more optimistic trend, with positive contributions from stocks such as CEO (+4.28%), HUT (+2.41%), NVB (+1.37%), and PGS (+9.26%).

| Top 10 stocks with the strongest impact on the HNX-Index on October 15, 2025 (calculated in points) |

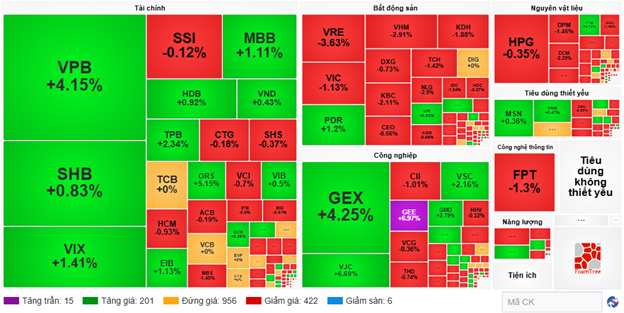

At the close, the market declined by 0.31%, with red dominating most industry groups. The information technology sector saw the most significant decline, at 2.85%, primarily due to FPT (-3.03%), CMG (-1.55%), ELC (-0.47%), and DLG (-2.97%). The communication services and materials sectors followed with declines of 2.23% and 1.29%, respectively. Conversely, the industrial sector was among the few groups to maintain a green status, with the strongest market increase of 0.93%, primarily driven by VJC (+6.95%), GEE (+6.97%), GEX (+6.97%), and GMD (+1.32%). Additionally, the financial sector recorded a notable increase of 0.32%, with buying pressure concentrated in VPB (+3.69%), SHB (+1.11%), SSI (+1.1%), and HDB (+1.38%).

In terms of foreign trading, foreign investors continued to net sell over 844 billion VND on the HOSE, focusing on stocks such as FPT (419.67 billion), KDH (262.43 billion), HDB (169.89 billion), and VIC (79.96 billion). On the HNX, foreign investors net sold over 68 billion VND, primarily in IDC (43.95 billion), SHS (21.86 billion), PVS (15.38 billion), and MBS (13.16 billion).

| Foreign net buying and selling trends |

Morning Session: Vingroup Stocks Reverse, Market Turns Red

Adjustment pressure from Vingroup stocks, coupled with increased selling pressure from foreign investors, challenged the market. By the midday break, the VN-Index had slipped below its reference level, declining nearly 4 points (-0.23%) to 1,757.08 points. The HNX-Index also decreased by 0.34%, reaching 274.4 points. Market breadth favored sellers, with 428 declining stocks and 216 advancing stocks.

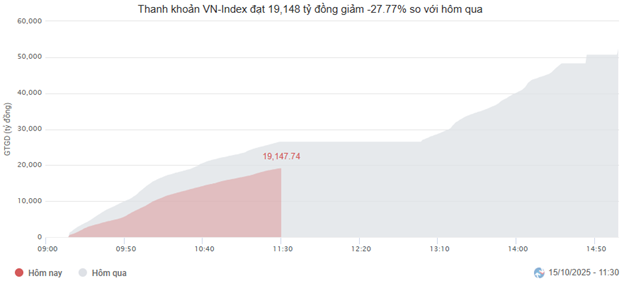

Investor sentiment remained cautious, with the HOSE trading volume reaching only over 613 million units in the morning, equivalent to a value of more than 19 trillion VND, a 27.77% decrease from the previous session. The HNX recorded a volume of over 41 million units, equivalent to 1 trillion VND.

Source: VietstockFinance

|

In terms of impact on the VN-Index, VHM was the most negatively influential stock, reducing the index by 3.38 points. VIC, VPL, and VRE followed, collectively pulling the index down by an additional 3.9 points. Conversely, VPB and VJC were the bright spots, contributing 2.56 points and 1.48 points, respectively, to the overall index.

| Top 10 stocks with the strongest impact on the VN-Index in the morning session of October 15, 2025 |

Divergence continued to dominate, with the communication services sector temporarily at the bottom, adjusting by 1.73%. This was due to negative performances from VGI (-1.79%), FOX (-1.75%), VNZ (-1.34%), CTR (-1.21%), YEG (-2.99%), SGT (-1.49%), and VNB (-1.04%).

The real estate, non-essential consumer goods, and information technology sectors also weighed heavily on the overall index, all declining by over 1%. Leading stocks in these sectors were deeply in the red, including VIC (-1.13%), VHM (-2.91%), VRE (-3.63%), BCM (-1.54%), KBC (-2.11%); VPL (-2.89%), MWG (-0.71%), FRT (-1.62%); FPT (-1.3%), and CMG (-0.52%).

Conversely, the industrial and financial sectors emerged as bright spots, with buying pressure concentrated in stocks such as GEE (ceiling price), GEX (+4.25%), VJC (+6.69%), VSC (+2.16%), GMD (+2.79%), HAH (+2%); VPB (+4.15%), VIX (+1.41%), MBB (+1.11%), TPB (+2.34%), EIB (+1.13%), and ORS (+5.15%). However, several stocks recorded notable adjustments, including ACV (-1.11%), VEF (-1.64%), VGC (-1.68%), CII (-1.01%), PHP (-2.1%); BID (-0.51%), BVH (-2.31%), MBS (-1.45%), and SSB (-1.03%).

Source: VietstockFinance

|

Foreign investors continued to net sell, with a value of 709.51 billion VND across all three exchanges. Selling pressure was concentrated in KDH and FPT, with values of 158.85 billion and 133.69 billion, respectively. Meanwhile, SHB led the net buying list with a value of 160.88 billion VND.

| Top 10 stocks with the strongest foreign net buying and selling in the morning session of October 15, 2025 |

10:30 AM: Hesitant Sentiment Emerges, Financial Sector Continues to Support VN-Index

Investors showed hesitation, preventing major indices from making significant breakthroughs. As of 10:30 AM, the VN-Index increased slightly by 7.41 points, trading around 1,768 points. The HNX-Index rose by over 1 point, trading around 276 points.

The VN30-Index breadth favored the green side, with VPB contributing 5.99 points, VJC contributing 4.21 points, HDB contributing 1.31 points, and HPG contributing 1.22 points. Conversely, VIC, VHM, VRE, and DGC collectively reduced the index by over 7.4 points.

Source: VietstockFinance

|

Most industry groups were dominated by red, with the real estate sector showing divergence. On the selling side, VHM decreased by 1.89%, VIC by 1.23%, VRE by 2.34%, and BCM by 0.77%. Conversely, some stocks like KSF, PDR, TCH, NVL, and DIG maintained green status, but with insignificant increases.

Conversely, the banking sector led the overall market increase, with green recorded across most stocks. Notably, VPB increased by 5.38%, LPB by 1.36%, MBB by 1.29%, and HDB by 2.14%.

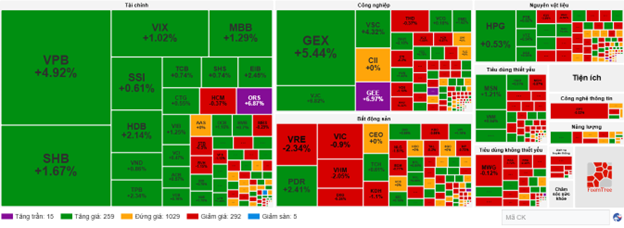

Compared to the opening, buyers maintained a slight advantage, despite ongoing divergence, with over 1,000 stocks standing still. There were 259 advancing stocks (15 ceiling stocks) and 292 declining stocks (5 floor stocks).

Source: VietstockFinance

|

Market Opening: Green Dominates Early Session

The market began the October 15 trading session positively, with green dominating. As of 9:30 AM, the VN-Index increased by nearly 10 points, trading around 1,770 points, while the HNX-Index surpassed 276 points.

VPB was the most significant contributor to the VN-Index, with a notable 4% increase. Additionally, the duo GEX and GEE attracted impressive buying interest from the opening, both increasing by over 3% and contributing nearly 1 point to the overall index.

In terms of industry groups, the industrial sector temporarily led the market with a 0.6% increase. Besides GEX and GEE, transportation stocks in this group also had a notable start, including HVN (+1.28%), VJC (+3.02%), GMD (+3.08%), VSC (+2.34%), HAH (+2%), and VTP (+1.44%).

The banking sector also showed widespread improvement, significantly contributing to the overall index with notable stocks such as CTG increasing by 1.29%, MBB by 0.92%, TPB by 1.3%, and EIB by 2.26%.

Conversely, the real estate sector temporarily lagged due to adjustments in the Vingroup trio, with a 3% decrease. Other stocks in the sector were mostly narrowly divergent, with only CRV standing out after its fourth consecutive ceiling session post-listing.

– 15:25 15/10/2025

Vietstock Daily October 17, 2025: Will Market Volatility Persist?

The VN-Index gained ground following a highly volatile session and is currently undergoing short-term consolidation after breaking into new highs. The Stochastic Oscillator continues to weaken after signaling a sell-off in overbought territory, suggesting further volatility in upcoming sessions.

Vietstock Daily 16/10/2025: Clear Market Polarization?

The VN-Index remains volatile, with declining liquidity reflecting investors’ cautious sentiment. Currently, the Stochastic Oscillator has issued a sell signal in the overbought territory, indicating heightened short-term correction risks. Should selling pressure persist, the index is likely to retest the 1,700–1,711 point range, aligning with the September 2025 peak.

Technical Analysis Afternoon Session 16/10: Intense Tug-of-War

The VN-Index experienced a tug-of-war session, while the Stochastic Oscillator continued its downward trajectory, reaffirming a sell signal. Meanwhile, the HNX-Index formed a pattern resembling a Long Upper Shadow, indicating persistent selling pressure.