Saigon-Hanoi Securities Corporation (SHS) has submitted a report to the Hanoi Stock Exchange (HNX) detailing the utilization of funds raised from its recent issuance.

On October 2, 2025, SHS successfully offered 5 million shares under its 2025 Employee Stock Ownership Plan (ESOP). The shares were priced at VND 10,000 each, generating a total of VND 50 billion. These funds were allocated to enhance the company’s margin lending operations, with the disbursement completed on October 9, 2025.

Illustrative image

According to the ESOP issuance report, Mr. Nguyen Chi Thanh, CEO, acquired the largest number of shares at 624,720. Following him were Mr. Do Quang Vinh, Chairman of the Board, with 200,000 shares, and Mr. Le Dang Khoa, Board Member, with 95,000 shares.

The ESOP shares are subject to a one-year transfer restriction from the end of the issuance period. With this issuance, SHS has increased its chartered capital to nearly VND 8,995 billion.

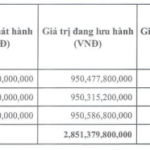

In other developments, SHS recently announced the results of its private bond offering to the Hanoi Stock Exchange (HNX).

On October 9, SHS issued 3,600 bonds under the code SHS12502, with a face value of VND 100 million each, raising VND 360 billion. The bonds have a one-year term and a fixed interest rate of 8% per annum.

Just days prior, SHS announced a resolution to issue its second private bond series in 2025, with a maximum face value of VND 1,800 billion.

These bonds are non-convertible, unsecured, and unaccompanied by warrants. The issuance is planned for up to 5 tranches within Q4/2025, with each tranche expected to range from 300 to 500 bonds.

The bonds have a one-year term, a maximum fixed interest rate of 8% per annum, and semi-annual interest payments. The purpose of the issuance is to restructure the issuer’s debt.

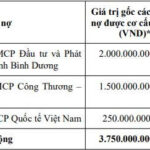

Becamex Group Plans to Issue VND 2 Trillion in Corporate Bonds

Becamex Group plans to issue VND 2,000 billion in bonds to restructure its debt and fund various investment programs and projects throughout 2025.

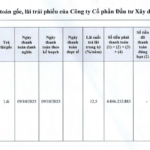

Marina Tower Developer Delays Bond Interest Payments

Marina Tower’s developer has missed the scheduled interest payment for the DPJ12202 bond tranche and has communicated a revised payment timeline to investors.