Illustrative image

The global silver market is experiencing its most severe shock in 45 years, as a widespread physical shortage spreads from India to London, the world’s silver pricing hub.

In India, surging demand for silver during the Diwali festival season has left major refiners and dealers depleted within days. Vipin Raina, head of trading at MMTC-Pamp India Pvt., the country’s largest precious metals refiner, stated that his company has run out of silver for the first time in its history. “The market has never been this frenzied in my 27-year career,” he remarked.

India’s silver frenzy stems from the belief that silver will be the “next metal” to surge after gold. Individual investors and hedge funds have poured money into the metal, while jewelry manufacturers have ramped up purchases in preparation for the festival honoring the goddess of wealth, Lakshmi. Premiums for silver in India—typically just a few cents per ounce—have soared past $1 as supplies vanish.

Just as Indian demand peaked, China, a key silver supplier, entered an extended holiday shutdown, forcing traders to seek supplies from London. However, London’s vaults are nearly empty, with most silver held by ETFs, which have amassed over 100 million ounces since early 2025.

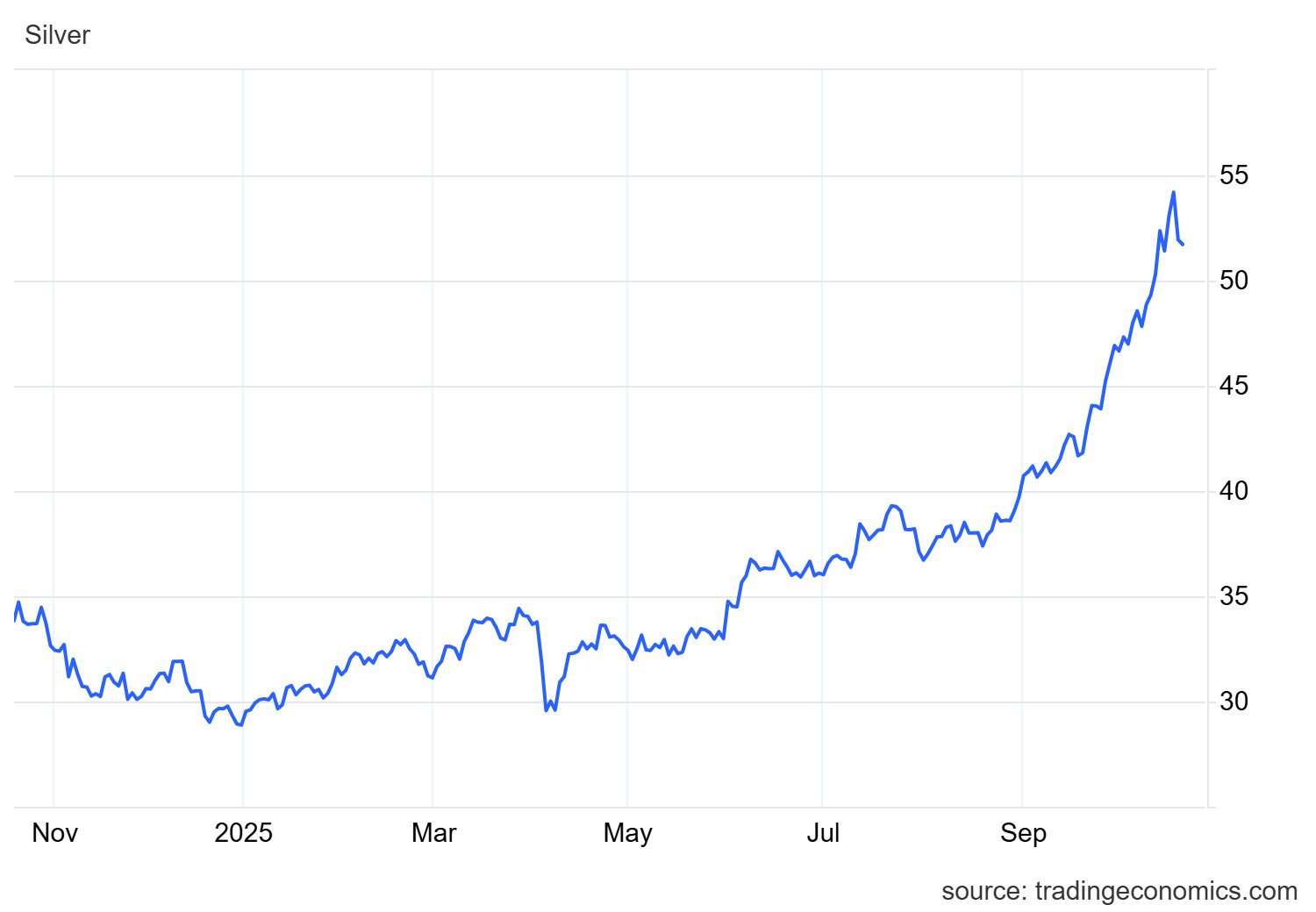

Silver prices over the past year.

With demand far outstripping supply, London’s market—trading over 250 million ounces daily—has frozen. Major banks halted quotes, overnight lending rates for silver spiked to 200% annually, and bid-ask spreads widened to unprecedented levels. “The market is virtually paralyzed. No one dares lend silver anymore,” said Robin Kolvenbach, co-CEO of Swiss refiner Argor-Heraeus.

Experts attribute the crisis to a “perfect storm”: soaring solar energy demand has tightened silver supplies, as it’s a key component in photovoltaic cells; traders rushed shipments to the U.S. to avoid potential tariffs; and investors flooded silver as a hedge against USD weakness.

Since 2021, global silver demand has exceeded supply by 678 million ounces, according to the Silver Institute. Meanwhile, London’s “free-floating” reserves have plummeted below 150 million ounces, a multi-year low.

Tensions escalated when JPMorgan Chase & Co., India’s largest precious metals supplier, announced it couldn’t deliver silver in October, forcing funds like Kotak Asset Management and UTI Asset Management to suspend new investments.

Silver prices hit a record $54 per ounce last week before plunging 6.7% in the next session, reflecting extreme volatility. While some hope supplies from New York and China will ease tensions, analysts warn that supply pressures and speculation could prolong volatility for weeks.

“This year’s silver market is a stark reminder of the fragility of the global commodities system,” said Daniel Ghali, analyst at TD Securities. “We’re witnessing not just a physical shortage, but an unprecedented speculative wave fueled by global FOMO.”

Source: ET

Silver Prices Hit All-Time High: What Signals a Correction Ahead?

The silver market may experience technical corrections following its recent surge, particularly as supply flows return to London.