In September 2025, Vietnam’s automobile market witnessed a significant decline in traditional sedan sales. The A, C, and D segments—once the backbone of the market—saw no model surpass the 300-unit mark. Total sales for each segment remained below 500 units, clearly indicating a consumer shift towards SUVs and Crossovers.

A-Class Vehicles

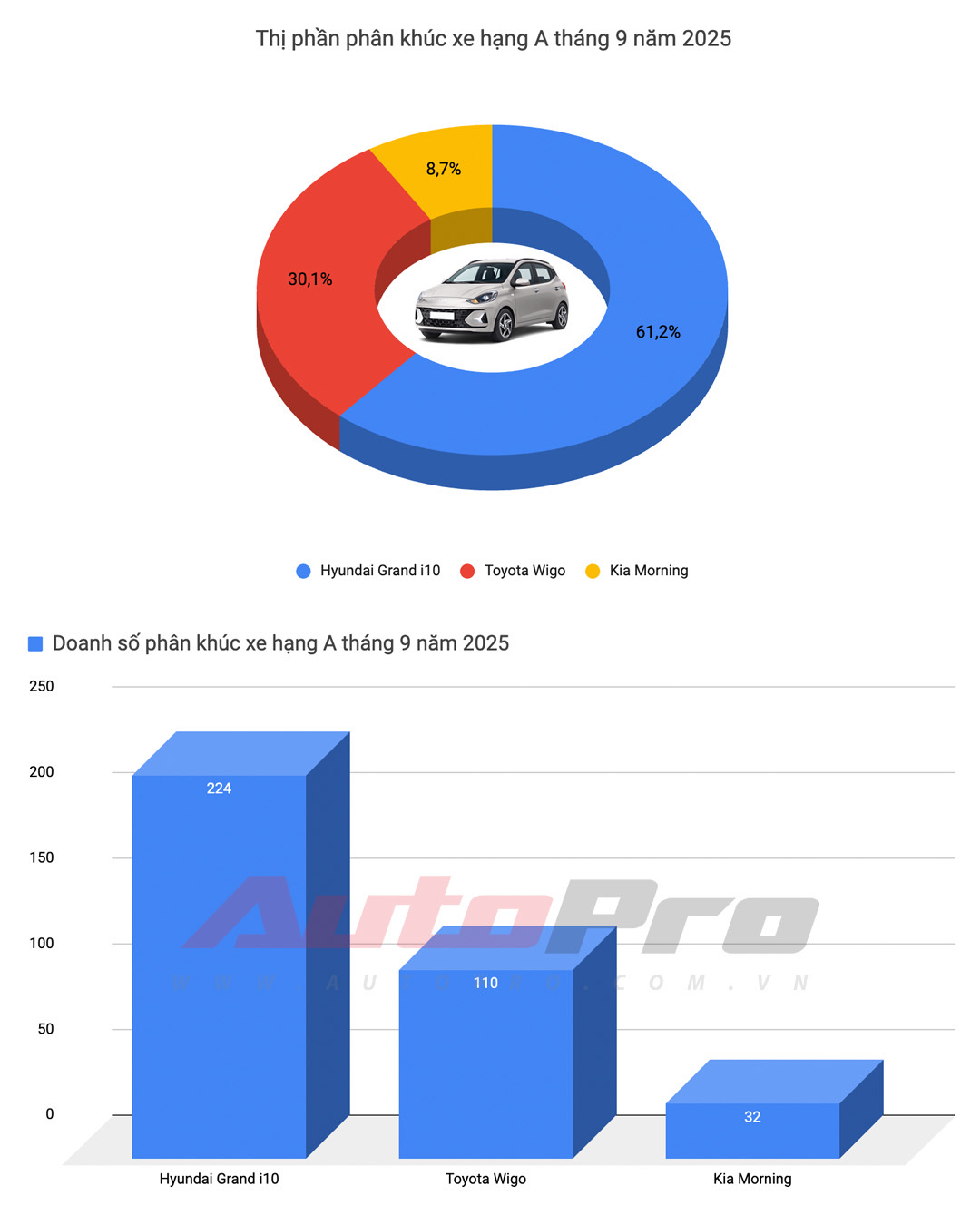

The A-class segment, typically targeting first-time car buyers, also experienced a notable downturn. The Hyundai Grand i10 maintained its lead with 224 units sold, capturing 61.2% of the market share. The Toyota Wigo followed with 110 units, while the Kia Morning managed only 32 units.

A-class segment sales plummeted. Source: VAMA, Hyundai

Despite leading the segment, the Hyundai Grand i10 couldn’t escape the overall decline. Collectively, A-class vehicles sold only 366 units in the month, reflecting a consumer shift towards compact SUVs with comparable pricing.

High prices make the A-class segment less appealing. Photo: AP Team

One factor contributing to the A-class segment’s diminished appeal is its pricing. According to expert Đinh Văn Nam: “However, since this segment is no longer as vibrant, manufacturers invest less and maintain higher prices. While mid-size SUVs are seeing significant price reductions, from 800 million to 700 million (a 10% drop), the A-class segment remains stagnant. If the i10 or Morning were to drop by 10%, their starting price would be around 400 million, which would undoubtedly revive the segment. This would create a sufficient gap between A-class hatchbacks and B-class sedans, giving buyers a clear reason to choose.”

C-Class Sedans

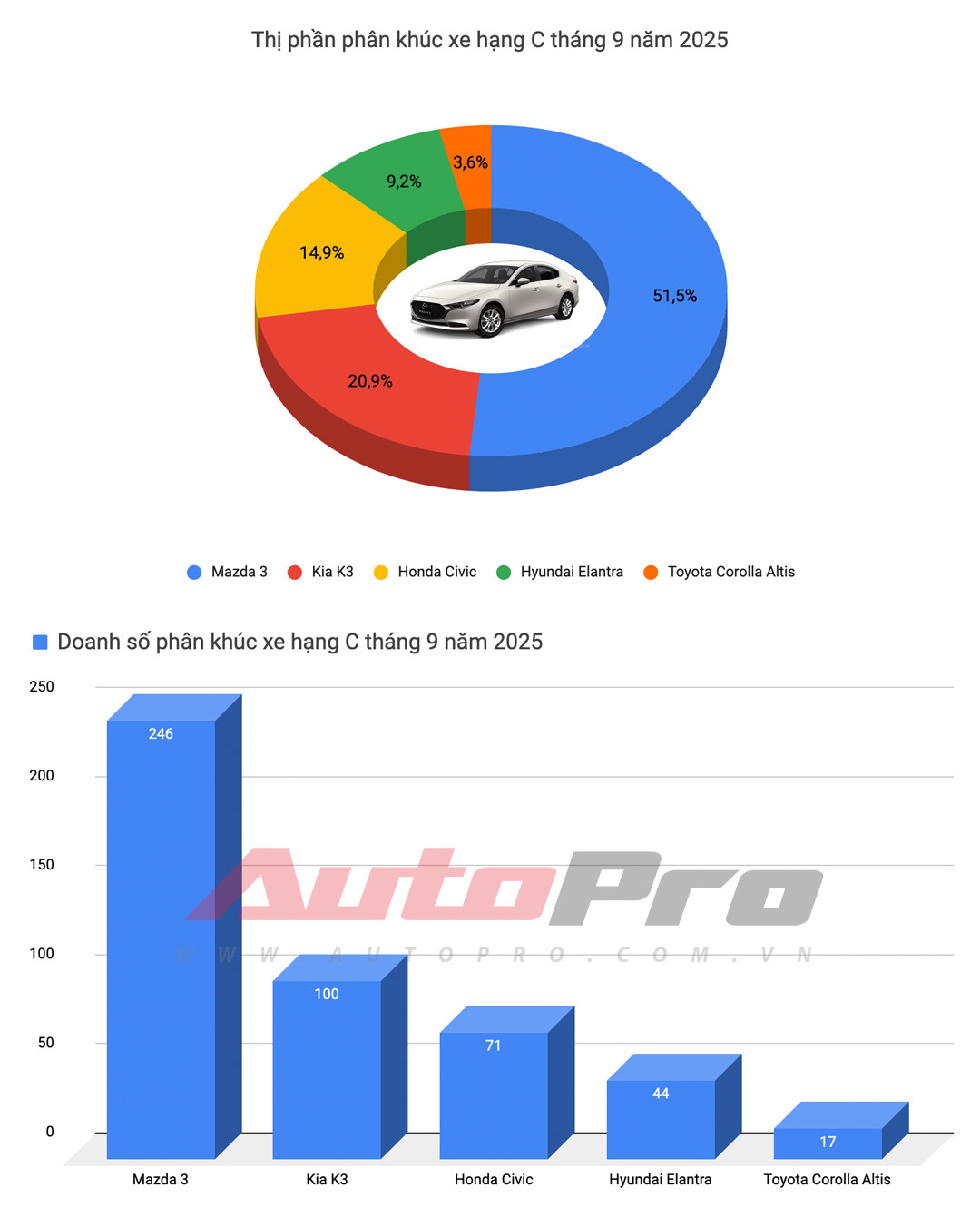

In the C-class segment, the Mazda3 remained the top choice with 246 units sold, capturing 51.5% of the market share. However, this figure pales in comparison to its past performance, when it consistently achieved much higher sales.

Mazda3 remains the leader in the C-class sedan segment. Source: VAMA, Hyundai

Competitors such as the Kia K3 (100 units), Honda Civic (71 units), Hyundai Elantra (44 units), and Toyota Corolla Altis (17 units) maintained low sales figures. The segment’s total sales reached only 478 units, lower than the sales of a single mid-size SUV model currently on the market.

D-Class Sedans

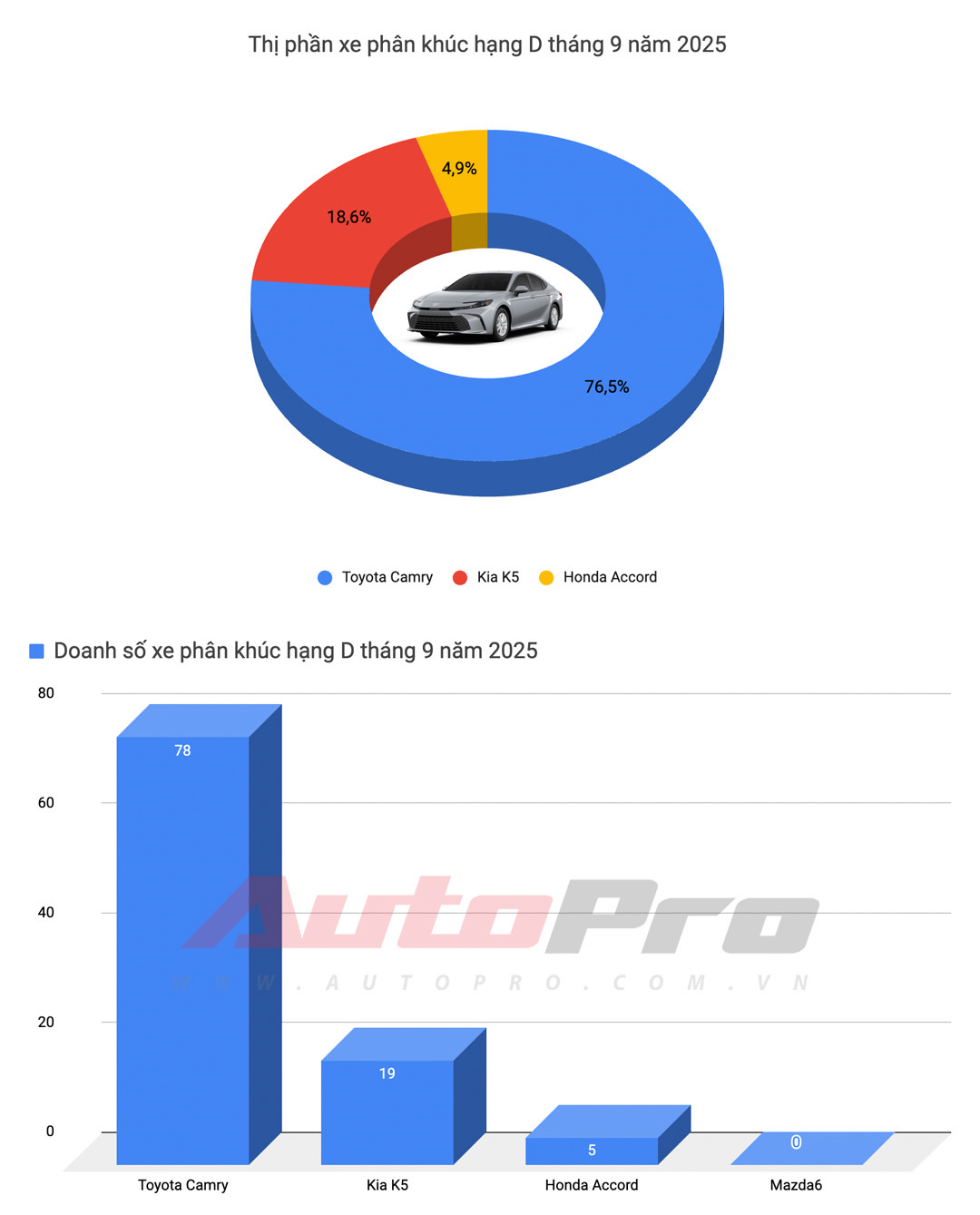

The situation in the D-class sedan segment is even more dire. The Toyota Camry dominated with 78 units sold, capturing 76.5% of the market share. The Kia K5 sold 19 units, the Honda Accord 5 units, and the Mazda6 recorded no sales for the month.

No model sold more than 100 units. Source: VAMA, Hyundai

The segment’s total sales reached a mere 102 units, a rare low in recent years, highlighting the D-class sedan’s diminishing position against 5+2-seat SUVs in the same price range.

The D-class sedan segment is becoming increasingly sparse. Photo: ST

Previously, the Mazda6, once a strong competitor to the Toyota Camry, ceased sales in the Vietnamese market. “I believe the D-class sedan segment in Vietnam, already limited, is shrinking further. The departure of the Mazda6 only makes it slightly easier for the remaining models,” shared expert Đinh Văn Nam.

September 2025 sales results reinforce a clear trend: sedans are no longer the preferred choice for Vietnamese consumers. The rise of SUVs, coupled with the demand for flexible and high-clearance vehicles, is making it increasingly difficult for traditional sedans to compete.

If the situation doesn’t improve, many sedan models may exit the market, leaving the field to high-clearance vehicles that currently dominate.

Is the Era of D-Class Sedans Over? A Look at Declining Sales

Year-to-date sales of D-segment sedans have reached a mere 1,768 units—a stark contrast to the heyday of this once-dominant vehicle class.