While the broader market experienced a rapid decline followed by a strong rebound, shares of Saigon General Service Corporation (Savico, stock code: SVC) maintained their momentum, closing at the upper limit for the fourth consecutive session on October 21, 2025. The stock price surged to 26,100 VND per share.

Notably, SVC has seen its price nearly double over the past five months, reaching its highest level in over two years (since August 2023). Its market capitalization has subsequently risen to over 2,400 billion VND.

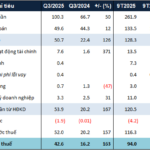

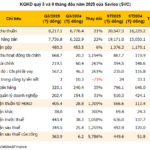

This remarkable rally followed Savico’s release of its Q3/2025 consolidated financial report, which revealed a post-tax profit of 364 billion VND, a staggering 5,800% increase from the same period last year (6 billion VND). This marks the highest quarterly profit in the company’s history, surpassing the 2022 record of 333 billion VND and nearly quadrupling the full-year 2024 profit of 100 billion VND.

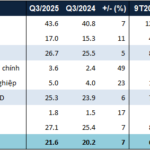

According to Savico, the significant growth in consolidated revenue for Q3/2025 was driven by the recovery of the automotive market and the expansion of its subsidiary network. The increase in the number of affiliated units substantially boosted sales revenue.

However, the primary driver of the profit surge was the financial segment, with financial revenue reaching 669 billion VND in the quarter, a 33-fold increase compared to the 20 billion VND recorded in Q3/2024. Of this, over 537 billion VND was generated from the sale of investments.

In the first nine months of 2025, Savico reported revenue of over 20,547 billion VND, a 27% increase year-on-year, with post-tax profit reaching nearly 450 billion VND, a 767% surge and 4.5 times the full-year 2024 profit. With these results, the company has exceeded its annual profit target by 120%, despite achieving only 69% of its revenue goal.

Savico is a subsidiary of Tasco Auto, a wholly-owned company of Tasco. Formerly known as SVC Holdings JSC, Tasco Auto specializes in real estate and automotive retail and distribution.

Tasco Auto is the controlling shareholder of Savico and one of the largest automotive distributors in Vietnam, selling over 40,500 vehicles in 2024, capturing a 13.7% market share. The company is also the official importer of international brands such as Volvo, Lynk & Co, Zeekr, and Geely, with a distribution network of 126 showrooms nationwide.