The Ministry of Finance has recently released a consolidated feedback report on the draft amendment to Decree 126/2020/NĐ-CP, which governs tax administration.

Under the current regulations (Decree 126/2020/NĐ-CP), organizations are required to file and pay taxes on behalf of individuals in cases such as receiving stock dividends, existing shareholders receiving stock bonuses, individuals recognized for capital increases due to recorded profits, and individuals contributing capital through real estate, capital contributions, or securities.

The filing and payment of taxes on behalf of individuals are to be executed when the individual transfers the same type of securities, transfers capital, or withdraws capital.

According to the proposed amendment, in cases where organizations issue stock dividends or stock bonuses to existing shareholders, the paying entity will withhold personal income tax (PIT) at the time of dividend or bonus distribution, as indicated in the notification of dividend or bonus issuance to individual shareholders.

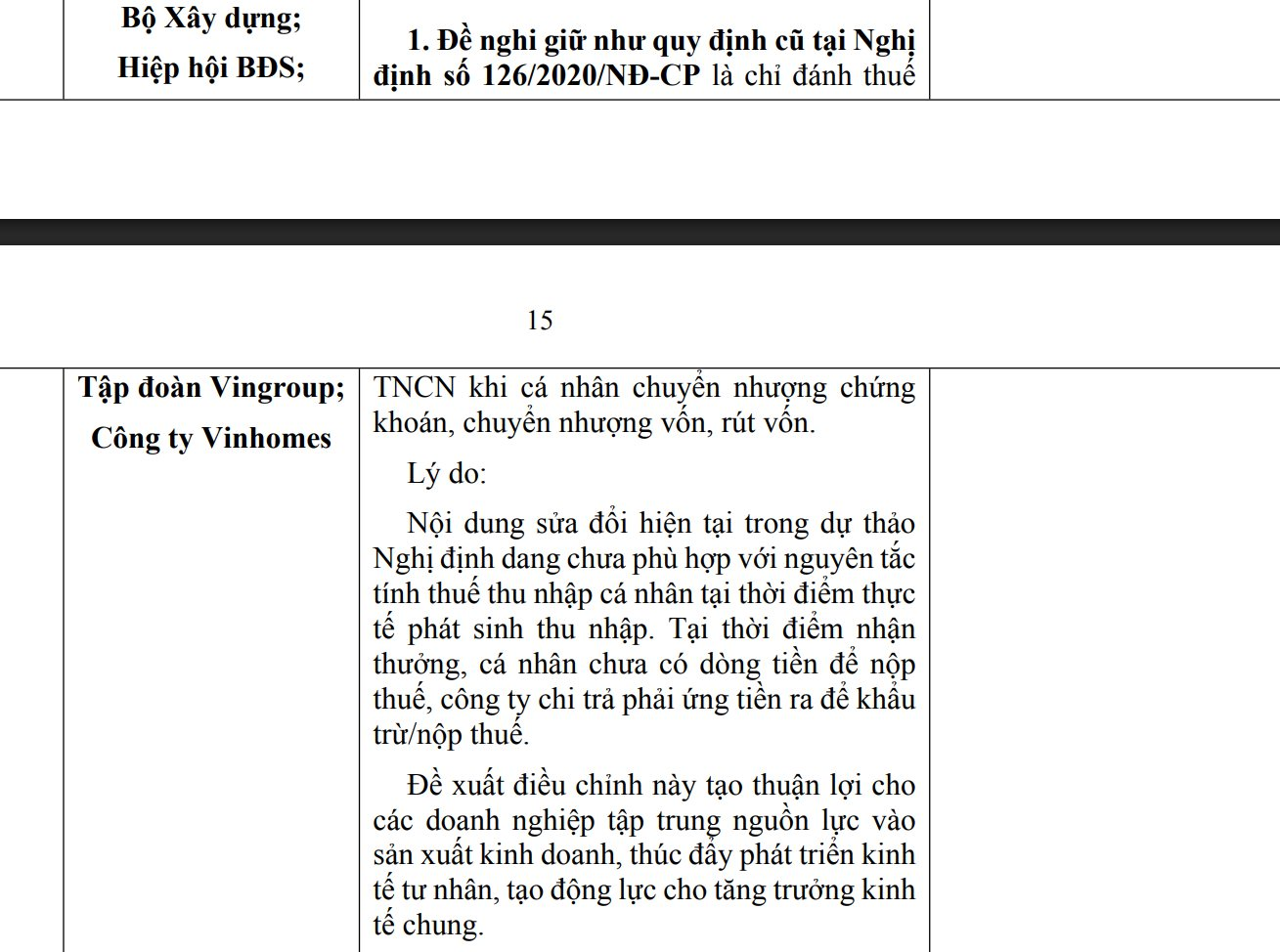

The Ministry of Construction, Vingroup (HoSE: VIC), Vinhomes (HoSE: VHM), Techcombank (HoSE: TCB), and Masan (HoSE: MSN) share a common stance on this change, advocating to retain the existing regulation (taxation upon transfer of securities, capital withdrawal, or capital transfer).

The Ministry of Construction, Vingroup, and Vinhomes argue that at the time of receiving bonuses, individuals do not have the cash flow to pay taxes, forcing the paying company to advance funds for tax deduction and payment.

Masan asserts that, from a financial perspective, shareholders do not gain any additional value as the company’s overall value remains unchanged. While the number of shares increases, the value per share decreases proportionally with the additional shares issued.

Additionally, shareholders have not received any actual income in cash and face the risk that the distributed shares or capital contributions may lack liquidity in the market.

Techcombank observes that shareholders receiving stock dividends or bonuses must pay taxes immediately upon distribution, despite not having actual cash flow. This requires shareholders to advance significant funds, which is particularly burdensome for long-term investors who do not intend to convert shares into cash.

In response to these concerns, the Ministry of Finance maintains that taxing personal income at the time of withholding is appropriate when distributing stock dividends to investors.

However, the nation is currently focusing resources on private economic development under Resolution No. 68-NQ/TW and preparing to upgrade the stock market. Implementing tax deduction and declaration requirements at the time of stock dividend or bonus distribution would pose challenges for both individuals and businesses.

For individuals, receiving stock dividends without transferring them means they have not realized actual income (only receiving securities) and lack the cash flow to pay taxes. For businesses, withholding and paying taxes on behalf of individuals would strain their finances, impacting capital mobilization and operational activities.

Therefore, the drafting agency recommends that the personal income tax provisions remain unchanged for the time being.

Business Tax Management from 2026: Ending Presumptive Tax, Fully Transitioning to Declaration Method

As of January 1, 2026, the lump-sum tax method will be discontinued, and the Ministry of Finance will introduce a new management model. Under this model, businesses will be categorized into three groups based on their revenue scale, with corresponding tax regulations and declaration requirements applied accordingly.

Finance Ministry Withdraws Proposal for Immediate Taxation on Stock Dividends

The Ministry of Finance has opted to maintain the existing tax payment method for dividends and bonuses in the form of securities, requiring payment at the time of transfer rather than upon receipt, as previously suggested. Immediate taxation upon stock distribution is deemed impractical, as investors lack the actual cash flow to pay taxes, while businesses, if required to withhold taxes, would face additional financial strain, potentially impacting their production and business operations.

Withdraw Tax Filing Proposals Upon Receipt of Stock Dividends

The Ministry of Finance has maintained its stance on dividend and bonus taxation, requiring payment upon transfer rather than at the time of receipt, as previously suggested months ago.