Hai Tap Doan Co Khi Tien Giang Va Hau Giang

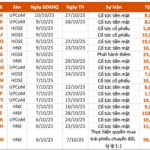

Hai Duong Pump Manufacturing JSC (Hapuma, stock code: CTB) has announced a shareholder list closure for a bonus share issuance. The ex-dividend date is set for November 4, 2025.

The issuance ratio is 50%, meaning shareholders holding 2 shares will receive 1 additional share. The total number of shares to be issued is over 6.84 million.

The capital for this issuance will be sourced from the share premium and undistributed after-tax profits, as per the audited financial report of 2024. Upon completion, Hapuma’s chartered capital will increase to 205.2 billion VND.

This marks Hapuma’s first bonus share issuance in six years, with the last one occurring in 2019 at a 20% ratio.

During the interim period, the company maintained a consistent high cash dividend policy. It paid out 20% in both 2023 and 2024, 15% from 2020 to 2022, and 25% in 2018.

In late May 2025, Hai Duong Pump Manufacturing completed a 27.4 billion VND cash dividend payment for 2024 (20% ratio).

Hai Duong Pump Manufacturing JSC

Established in 1960 in Hanoi, Hai Duong Pump Manufacturing JSC originated from the merger of Tien Giang and Hau Giang mechanical corporations, initially named Dong Da Mechanical Factory. The company officially transitioned to a joint-stock structure in April 2004.

According to its website, Hai Duong Pump Manufacturing JSC is Vietnam’s largest and a leading regional enterprise in researching, designing, manufacturing, and supplying pumps, valves, turbines, and integrated electromechanical systems for pumping stations.

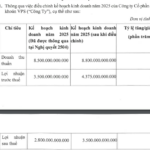

VPS Securities Raises Full-Year Profit Target Above 4,300 Billion VND

VPS Securities has revised its full-year profit targets upward, setting pre-tax and post-tax profit goals at VND 4,375 billion and VND 3,500 billion, respectively. Both figures represent a 25% increase compared to the plan approved at the Annual General Meeting of Shareholders.