Source: VietstockFinance

|

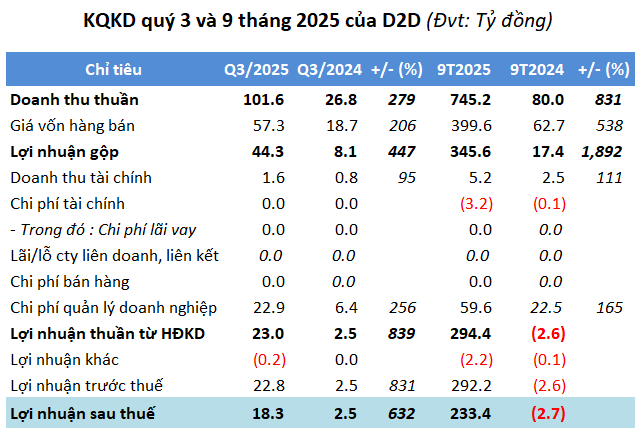

In Q3, D2D reported a net revenue of nearly VND 102 billion, a 3.8-fold increase year-on-year. Net profit reached over VND 18 billion, up 7.3 times. The company attributed this surge primarily to the transfer of land in Chau Duc Industrial Park (IP), which significantly boosted profitability.

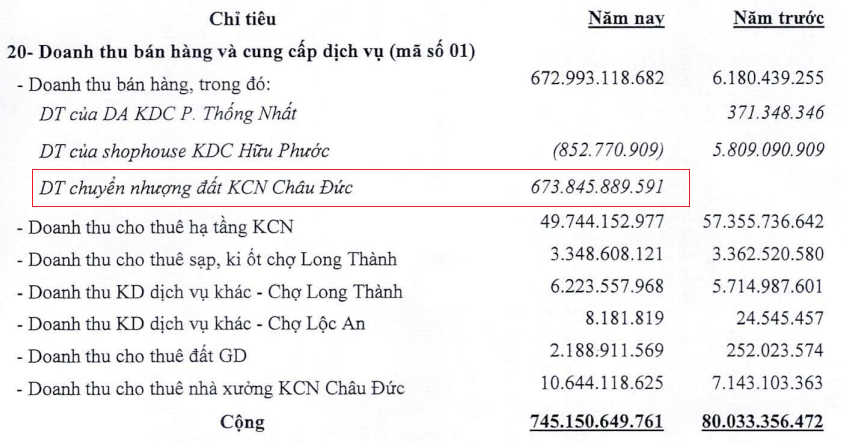

For the first nine months, D2D achieved a record-breaking revenue of over VND 745 billion, a 9.3-fold increase compared to the same period last year. Notably, the transfer of land in Chau Duc IP alone contributed nearly VND 674 billion.

|

Revenue Structure of D2D in 9M/2025

Source: D2D

|

After-tax profit exceeded VND 233 billion, a stark contrast to the nearly VND 3 billion loss in the same period last year. This performance enabled the company to surpass 13% of its annual revenue target and 33% of its profit goal ahead of schedule.

| 9-Month Business Results of D2D from 2019 – 2025 |

By the end of Q3, D2D‘s total assets stood at nearly VND 1,400 billion, an 8% decrease from the beginning of the year. Cash on hand was approximately VND 38 billion, down 41%; short-term receivables increased by 54% to over VND 98 billion, including over VND 6 billion from tenants in Chau Duc IP. Inventory decreased by 26% to nearly VND 139 billion, primarily in Huu Phuoc and Loc An residential areas.

Total liabilities amounted to nearly VND 682 billion, an 11% decrease, with the majority being advance payments from buyers and unearned revenue, accounting for 92% of total liabilities, or approximately VND 630 billion. D2D reported no financial debt.

Sonadezi, D2D, and 168 Individuals Establish a Company to Develop Ninh Diem 3 IP in Khanh Hoa

– 15:16 24/10/2025

Techcombank Leads Private Banks in Profit for Q1-Q3 2025, Maintains Industry-Top CASA Ratio

Techcombank (TCB) has unveiled its Q3 2025 financial report, showcasing remarkable business performance.

Q3 2025 Financial Report Update (October 20th): First Textile Firm Announces 35% Profit Surge, Real Estate Company Reports 65% Profit Decline

Seoul Metal reported a Q3 pre-tax profit of VND 24 billion, a 120% increase, while its 9-month figure reached VND 60 billion, up 74% year-on-year. In contrast, Sasco (SAS) posted a Q3 pre-tax profit of VND 133 billion, reflecting a 38% decline compared to the same period last year.