Latest Savings Interest Rates at GPBank

According to the latest online deposit interest rate schedule, GPBank has increased rates by 0.1%/year for terms from 6 to 36 months, while keeping rates unchanged for terms under 6 months.

Currently, GPBank’s online interest rates are listed at 5.35%/year for 6–8 month terms and 5.45%/year for 9-month terms. The bank also offers a rate of 5.65%/year for terms ranging from 12 to 36 months, which is the highest rate in their current schedule.

For over-the-counter deposits, the bank has also adjusted rates upward by 0.1%/year for terms of 4–36 months. The interest rate for 12–36 month terms now stands at 5.2%/year, positioning GPBank among banks with stable medium to long-term savings rates.

Latest Savings Interest Rates at Vikki Bank

Digital bank Vikki Bank has also adjusted its savings interest rates, effective from October 6. Short-term rates of 1–3 months have increased by 0.1%/year, 6-month terms by 0.2%/year, and 12–13 month terms by 0.1%/year.

After the adjustment, Vikki Bank’s online interest rate for 1-month terms is 4.35%/year, and 4.45%/year for 3-month terms. Notably, the bank is offering 6%/year for 6-month terms and 6.2%/year for 12–13 month terms, the highest rates currently available in the deposit market.

Latest Savings Interest Rates at NCB

NCB Bank has uniformly increased interest rates by 0.1%/year across all savings products, including An Phú Savings, Traditional Savings, Accumulation, and Flexible Principal Withdrawal.

Under the An Phú schedule, 6–7 month terms are at 5.45%/year, while 12–36 month terms reach 5.7%/year – the highest at NCB currently. For Traditional Savings, the longest term of 36 months remains at 5.6%/year, with other online savings products peaking at 5.5–5.6%/year.

Latest Savings Interest Rates at HDBank

HDBank has recently adjusted its online interest rates for short terms of 1 to 5 months, marking the second increase this year. Specifically, 1–2 month terms have risen to 4.05%/year, and 3–5 month terms to 4.15%/year.

Terms of 6 months and longer remain unchanged, with 6–11 month terms at 5.3%/year, 12 months at 5.6%/year, and 13 months at 5.8%/year. Notably, HDBank is among the few banks maintaining a 6%/year rate for 15-month terms and 6.1%/year for 18-month terms.

Latest Savings Interest Rates at VCBNeo

VCBNeo has announced new interest rates for individual customers, increasing by 0.25–0.3 percentage points across various terms, effective from October 10.

The 6-month term rate has risen to 5.6%/year, a 0.3 percentage point increase from last month; the 12-month term also stands at 5.6%/year. For online deposits, rates are 4.35%/year for 1 month, 4.55%/year for 3 months, 5.9%/year for 6 months, 5.45%/year for 9 months, and 5.8%/year for 12 months.

For terms of 13 months and longer, VCBNeo applies a rate of 5.8%/year, maintaining its position among banks with high online interest rates.

Latest Savings Interest Rates at Bac A Bank

Following a rate increase on October 9 of 0.05–0.25%/year for short terms, Bac A Bank has further adjusted savings interest rates from October 12.

Specifically, 6–11 month terms have increased by 0.2%/year, and 12–36 month terms by 0.3%/year. Notably, for deposits under 1 billion VND, the 12-month term rate has reached 5.8%/year, 13–15 month terms at 5.9%/year, and 18–36 month terms at 6.1%/year.

For deposits of 1 billion VND and above, Bac A Bank offers 6%/year for 12-month terms, 6.1%/year for 13–15 month terms, and 6.3%/year for 18–36 month terms, the highest rates currently available, surpassing Vikki Bank’s 6.2%/year.

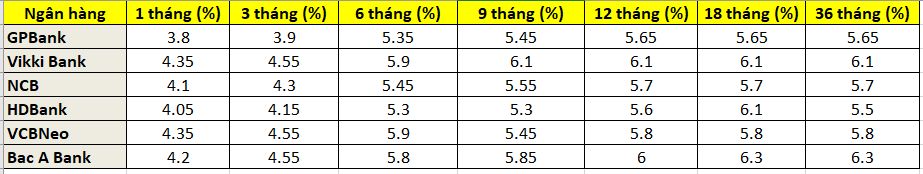

Online savings interest rates of select banks as of October 22, 2025. (Compiled by Nguyễn Minh)

Vietnamese Billionaire Nguyễn Thị Phương Thảo Sets Unprecedented Record for Women in Vietnam

Nguyễn Thị Phương Thảo has made history as the first Vietnamese woman to achieve this remarkable feat. Her groundbreaking accomplishment sets a new standard, inspiring generations to come.

NCB Honored as a Top “Favorite Enterprise of 2025”

National Citizen Commercial Joint Stock Bank (NCB) has been honored with four prestigious awards at the “Enterprise of Choice 2025” program, solidifying its reputation as a leading and trusted brand with an attractive work environment in Vietnam’s financial and banking sector.