According to the latest online deposit interest rate schedule, GPBank has increased rates by 0.1% per annum for terms ranging from 6 to 36 months, while keeping rates unchanged for terms under 6 months.

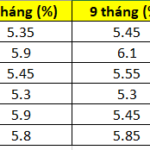

Currently, GPBank’s online interest rates are listed at 5.35% per annum for 6-8 month terms and 5.45% per annum for 9-month terms. The bank also offers a rate of 5.65% per annum for terms from 12 to 36 months, which is the highest rate in its current schedule.

For over-the-counter deposits, the bank has also adjusted rates upward by 0.1% per annum for terms of 4-36 months. The interest rate for 12-36 month terms now stands at 5.2% per annum.

Bac A Bank has recently increased rates by 0.2% per annum for deposits with terms from 6 to 11 months and by 0.3% per annum for terms from 12 to 36 months.

Following these adjustments, the interest rates for savings accounts under 1 billion VND are as follows: 5.6% per annum for 6-8 month terms, 5.65% per annum for 9-11 month terms, 5.8% per annum for 12-month terms, 5.9% per annum for 13-15 month terms, and 6.1% per annum for 18-36 month terms.

Deposit interest rates have risen but remain at low levels.

For deposits of 1 billion VND or more, the rates are: 5.8% per annum for 6-8 month terms, 5.85% per annum for 9-11 month terms, 6% per annum for 12-month terms, 6.1% per annum for 13-15 month terms, and 6.3% per annum for 18-36 month terms. These are the highest publicly listed deposit rates among banks.

Since the beginning of October, six banks have increased their deposit rates, including GPBank, NCB, Vikki Bank, Bac A Bank, VCBNeo, and HDBank. Notably, Bac A Bank has raised rates twice this month.

Several banks are now offering rates above 6% per annum for long-term deposits without minimum deposit requirements.

Vikki Bank offers a 6% per annum rate for 6-month terms and 6.2% for 12-13 month terms. Cake by VPBank provides a 6% per annum rate for 12-18 month and 24-36 month terms. HDBank offers 6% per annum for 15-month terms and 6.1% for 18-month terms. BVBank pays 6.1% per annum for 60-month terms and 6.0% for 48-month terms. Viet A Bank maintains a 6.0% per annum rate exclusively for 36-month terms, while Bac A Bank offers 6.1% for 18-36 month terms.

According to MBS analysts, deposit interest rates are expected to face upward pressure by year-end due to high credit growth, particularly following the State Bank’s announcement of additional credit growth quotas for credit institutions to meet the economy’s capital demands.

Data from the State Bank shows that as of September 29, the banking system’s outstanding credit had increased by 13.37% compared to the end of 2024 and by 19.6% year-on-year. The State Bank estimates that credit growth this year could reach 20%, the highest level in several years.

The State Bank continues to urge credit institutions to implement synchronized measures to stabilize and strive to reduce deposit interest rates, contributing to monetary market stability and creating room for lower lending rates.

Also, according to State Bank data, by the end of July this year, resident deposits reached over 7.7 million billion VND, up nearly 10% since the beginning of the year and marking a five-year high.

In July alone, residents deposited an additional 54 trillion VND into banks, despite 12-month term rates generally remaining below 6% per annum. This trend highlights a preference for savings due to its stability and lower risk compared to stocks or real estate. Additionally, the increase in deposits despite low rates reflects a well-functioning money circulation.

Experts predict that deposit interest rates will remain stable through year-end and possibly into 2026, fluctuating between 5.2% and 5.3% per annum.

Historic Liquidity Injection: SBV Executes Record-Breaking Forward Purchase Operation

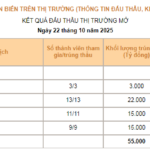

On October 22nd, the State Bank of Vietnam (SBV) injected a record-breaking VND 55 trillion into the financial system through open market operations, utilizing a fixed interest rate of 4% per annum. This marks the largest single-day injection ever conducted by the central bank via this channel.

Techcombank Sets Record Q3 Profit, Sustaining Strong Growth Momentum

Techcombank (HOSE: TCB) has unveiled its Q3 2025 and 9-month financial results, showcasing record-breaking performance and underscoring the success of its comprehensive transformation strategy. The bank reported pre-tax profits of VND 23.4 trillion for the first nine months, with Q3 alone contributing VND 8.3 trillion—a 14.4% year-on-year increase and the highest quarterly profit in its history.

Unveiling the First Banks to Report Skyrocketing Profits

Several leading banks have reported substantial profits for Q3, while select brokerage firms have already achieved their full-year earnings targets.