In recent times, we’ve been hearing about the remarkable price surges across various asset classes. From stocks here, gold there, to Bitcoin elsewhere, all have hit record highs.

Nothing influences investor psychology more than price movements. Rapid asset price increases trigger the fear of missing out (FOMO), compelling many to jump into the game. They can’t bear to let their money sit idle, nor can they settle for the meager 4-5% annual interest rates offered by savings accounts.

However, when the worst-case scenario for investors is not meeting profit expectations rather than losing money, it’s time to be on high alert.

Significant losses often emerge during major bull markets, as investors become willing to pay higher prices for lower-quality stocks. A recent example is the period from late 2021 to early 2022, when the market enthusiastically drove up the prices of stocks from companies with poor business fundamentals.

The age-old question: Is the bull market driven by intrinsic value growth or fueled by speculative capital?

|

This year, the VN-Index has ranked among the world’s top-performing indices, surging nearly 31.3% as of October 21. This excitement comes amid robust national GDP growth, supported by expansionary fiscal and monetary policies, a major administrative reform, and the long-awaited upgrade of the stock market to Secondary Emerging Market status by FTSE Russell. In early October, analysts from JP Morgan even predicted the VN-Index could reach 2,000-2,200 points within a year.

Yet, in a bull market, it’s crucial not only to see the positives but also to identify underlying risks. Upon closer inspection, the stock market’s rally shows signs of unsustainability.

Foreign capital has been consistently flowing out, offset by domestic inflows in a low-interest-rate environment and a weakening local currency. Domestic players are driving up the prices of a select few stocks, turning them into index heavyweights. Meanwhile, stocks are increasingly being used as collateral for loans, possibly to boost purchasing power or for purposes outside the stock market.

An unbalanced rally

In the first nine months of this year, foreign investors sold a net of 84.5 trillion VND on the HOSE via order-matching transactions, nearly matching the full-year 2024 outflow. In October (up to October 21), this figure reached 14.6 trillion VND, even after FTSE Russell’s upgrade announcement. Notably, the outflow isn’t just from short-term players but also long-term strategic investors like South Korea’s SK Group and Singapore’s Keppel Land.

The retreat of foreign investors is making Vietnam’s stock market increasingly reliant on individual investors, including those who turned to stocks this year due to lower deposit rates.

A less diversified investor base, skewed toward short-term profit-seeking, heightens the market’s vulnerability to volatility. For instance, on October 20, the VN-Index plunged nearly 95 points. Stocks across various sectors hit their lower limits despite no significant negative news.

Such intense volatility is even riskier as margin debt continues to balloon.

By the end of Q3/2025, securities companies’ lending reached a record 384 trillion VND, up 54% in just six months and nearly double the peak during the last bull cycle in Q1/2022. In the near future, leverage is expected to rise further as securities firms raise tens of trillions of VND in new capital for expanded lending.

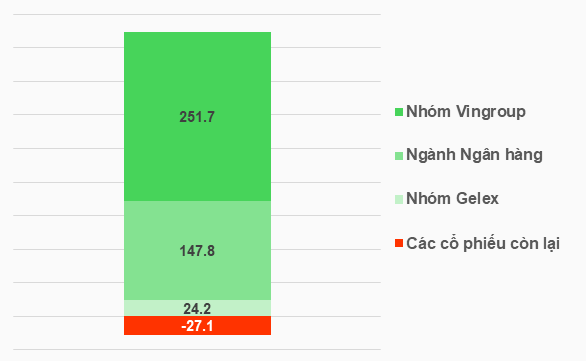

Additionally, the market’s imbalance is evident in a small group of stocks anchoring the index, including the Vingroup ecosystem, Gelex, and the banking sector. Excluding these groups’ contributions, the VN-Index’s 31.1% year-to-date gain would turn into a 2.1% decline as of October 21.

|

Concentrated gains in VN-Index

Contribution breakdown of the 396.6-point increase in VN-Index from January 1 to October 21, 2025, categorized by four stock groups: – Vingroup Group: VIC, VHM, VRE, VPL Unit: Points (contribution to VN-Index)

Source: VietstockFinance

|

– 13:19 23/10/2025

Market Pulse 23/10: Vingroup Once Again “Rescues” the Market

The afternoon session on October 23rd saw the VN-Index continue its volatile trend. At one point, it seemed poised to reclaim the 1,700-point mark, but mounting pressures forced the index to retreat, closing at 1,687 points. Despite the gains, the rally was largely driven by the influence of the Vingroup conglomerate.

How Do Investors Fare After a Memorable Stock Market Session?

Today (October 22nd), shares purchased at the market bottom during the VN-Index’s record 94-point plunge on October 20th have been credited to investor accounts and are now eligible for trading. However, hopes of quick profits through short-term trading have largely been unfulfilled for the majority.

Do Investors Profit or Lose When ‘Bottom Fishing’ in a Stock Market Plunge?

Today (October 22nd), shares purchased at the market bottom during the VN-Index’s record 94-point plunge on October 20th have been credited to investor accounts and are now eligible for trading. However, hopes of quick profits through short-term trading have largely been unfulfilled for the majority.