Recently, PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo, stock code: DCM, HoSE) announced adjustments to several key performance indicators for its 2025 business operations.

Specifically, PVFCCo plans to increase its urea production target for 2025 by 32,000 tons, from the initial 910,000 tons to 942,000 tons. Conversely, the company reduced its functional fertilizer production target from 120,000 tons to 105,000 tons.

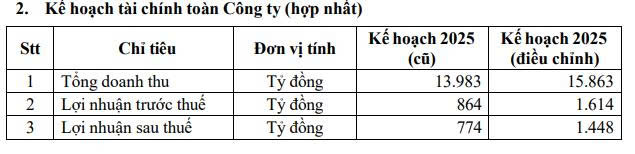

Additionally, PVFCCo revised its financial plan, projecting consolidated revenue to reach VND 15,863 billion, a 13.4% increase from the original plan. After-tax profit is expected to hit VND 1,448 billion, an 87% surge.

Source: DCM

Regarding investment plans, the company reduced its total capital investment needs from VND 771 billion to VND 498 billion. Of this, VND 250 billion will come from equity, and the remaining VND 248 billion will be sourced from loans and other means.

These adjustments come after PVFCCo achieved positive business results in the first nine months of 2025.

For the nine-month period, the company reported net revenue of over VND 12,432.3 billion, a 34.5% increase compared to the same period in 2024. After-tax profit reached VND 1,527.8 billion, up 44.7%.

As a result, the company has achieved 78.4% of its revenue target and 105.5% of its after-tax profit target, as per the recently adjusted plan.

As of September 30, 2025, PVFCCo’s total assets increased by 4.9% from the beginning of the year to over VND 16,505.6 billion. Held-to-maturity investments accounted for VND 4,952 billion, or 30% of total assets, while inventory stood at VND 4,596.6 billion, or 27.8%.

On the liabilities side, total payables reached VND 5,951.3 billion, a 7.2% increase year-to-date. This includes VND 1,993.8 billion in loans and finance leases (33.5% of total liabilities), VND 1,166.9 billion in short-term payables to suppliers, and VND 806.4 billion in the science and technology development fund.

Cà Mau Fertilizer Adjusts Plan After Surpassing 200% Profit Target in 9 Months

As a routine, following nine months of achieving over 200% of its profit targets, Petrovietnam Fertilizer and Chemicals Corporation (Cà Mau Fertilizer or Cà Mau Urea, HOSE: DCM) has announced an adjustment to its 2025 business plan, along with the release of key performance indicators for 2026.

Textile Firm Reports Record-Breaking Q3 Profits, Stock Surges to All-Time High

As of September 30, 2025, cash, cash equivalents, and deposits surged to nearly 2.0 trillion VND, marking a remarkable 29% increase compared to the beginning of the year.