The information is contained in a report that the Board of Directors is preparing to send to shareholders for written feedback. The focus of the report is how the company plans to mobilize resources to address the VND 2,880 billion repayment obligation as per the ruling related to the Bắc Phước Kiển residential project (Nhà Bè) and the case of Trương Mỹ Lan.

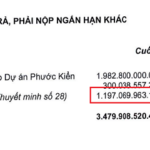

Amid tight cash flow, stalled projects, and market challenges, QCG has managed to secure approximately VND 1,100 billion through asset sales and personal loans. While this amount provides temporary relief, it falls significantly short of the total obligation.

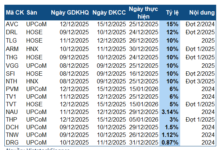

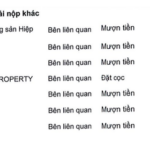

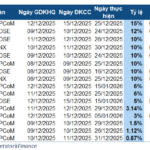

To repay the raised funds and secure the remaining amount, QCG is compelled to divest from its subsidiaries and affiliates, with plans to execute in 2025.

The Board of Directors stated that the capital divestment will be open to all financially capable partners, including related parties, on a voluntary basis and ensuring the company’s interests. The proceeds are expected to be used for further legal obligation payments and to repay the previously secured funds.

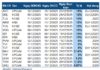

Location of the nearly 100-hectare land for the Bắc Phước Kiển project – Image: Googlemaps

|

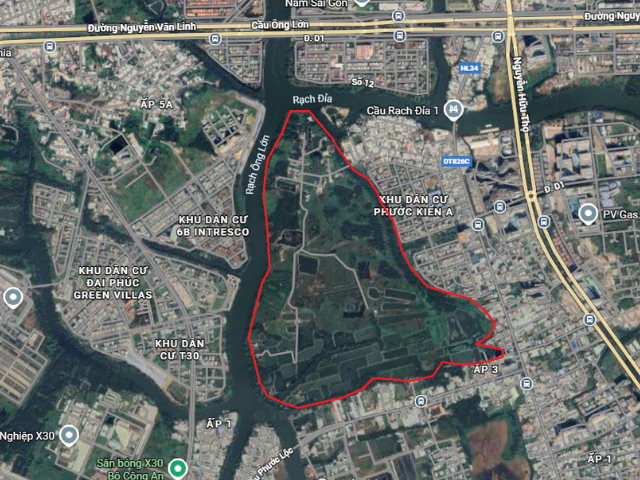

Aerial view of the land – Image: Googlemaps

|

Among the potential divestments, Đà Nẵng Marina Joint Stock Company, the developer of Marina Đà Nẵng, holds the largest investment from QCG at VND 486 billion. Additionally, Ayun Trung Hydropower Construction Joint Stock Company, owner of the 13MW Ayun Trung plant, is valued at VND 126 billion.

If the divestment proceeds, QCG will retain only the Ia Grai 2 plant under the parent company. Previously, the company attempted to sell Ayun Trung for VND 380 billion and Ia Grai 2 for VND 235 billion in 2024, but both attempts were unsuccessful. These assets were once stable revenue sources, helping the company navigate challenging periods.

QCG also holds investments in Giai Việt Joint Stock Company, Phạm Gia Construction and Housing Business Joint Stock Company (Đa Phước residential project), and Hiệp Phúc Real Estate (Sông Đà Riverside project), all of which were expected to generate revenue in the coming years.

At previous general meetings, CEO Nguyễn Quốc Cường mentioned that the recovery of the Bắc Phước Kiển project would be phased and could extend until 2027, marking a decade since the transaction with Sunny Island encountered issues. However, the company is considering various scenarios, including the possibility of early repayment if conditions allow.

For 2025, QCG targets VND 2,000 billion in revenue and VND 300 billion in pre-tax profit, a significant growth compared to previous periods. Mr. Cường noted that achieving this plan requires divesting from the hydropower sector to fund legal obligations.

As of Q3, QCG recorded VND 354 billion in revenue and VND 46 billion in pre-tax profit. The results indicate that meeting the targets heavily relies on capital divestment in the final quarter.

Did QCG borrow over VND 1,000 billion from acquaintances to reclaim the Bắc Phước Kiển project?

– 13:57 07/12/2025

Quốc Cường Gia Lai Sells Subsidiary to Settle Debts with Trương Mỹ Lan

To address the financial obligations arising from the purchase agreement for the Bac Phuoc Kien Residential Area project with Sunny Island Investment Corporation, Quoc Cuong Gia Lai Corporation proposes that shareholders approve the transfer of capital contributions in its subsidiaries and affiliated companies within this year.

Unveiling the Lender Behind Cuong ‘Do La’s Company’s Billion-Dollar Loan

Quoc Cuong Gia Lai JSC has secured significant financial support through loans from key individuals closely associated with the company. Specifically, the company borrowed 507 billion VND from Ms. Lai Thi Hoang Yen, the daughter of QCG’s Chairman, Mr. Lai The Ha. Additionally, Mr. Lau Duc Duy, the brother-in-law of Mr. Nguyen Quoc Cuong (known as Cuong ‘do la’) and the CEO of QCG, provided a loan exceeding 527 billion VND.

QCG Borrows Over $43 Million from Acquaintances to Redeem Bắc Phước Kiển Project?

Quoc Cuong Gia Lai JSC (HOSE: QCG) has allocated an additional VND 1 trillion to the Ho Chi Minh City Civil Judgment Execution Agency to fulfill obligations related to the Bac Phuoc Kien residential project. Concurrently, personal loans from relatives of the company’s leadership have seen a significant surge.

The Weight on CEO Cuong’s Shoulders Remains Unrelenting

Once envisioned as a catalyst for the transformative growth of Quoc Cuong Gia Lai, the Phuoc Kien project has now morphed into a burdensome billion-dollar albatross around the company’s neck.