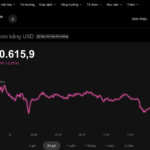

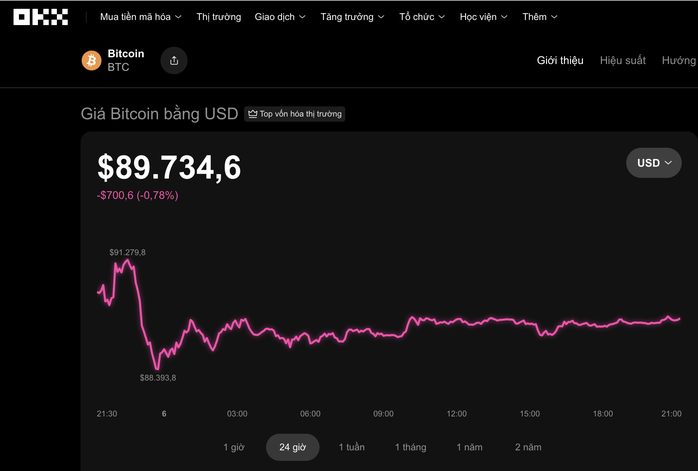

On the evening of December 6th, the cryptocurrency market experienced a slight downturn. Data from the OKX exchange reveals that Bitcoin’s price dipped by nearly 1% over the past 24 hours, trading around $89,730.

Several other major cryptocurrencies also saw declines. Ethereum fell by approximately 2% to $3,050, while Solana dropped similarly to $133. XRP decreased by 1% to $2. In contrast, BNB saw a modest 0.2% increase, reaching $890.

According to Cointelegraph, Bitcoin’s short-term price movements are significantly influenced by fluctuations on the Binance exchange.

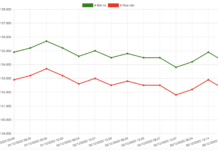

Multiple indicators suggest rising selling pressure, unusual capital shifts, and a market entering a highly volatile phase.

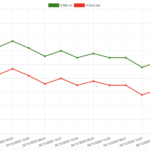

A metric tracking large investor activity shows a notable increase in Bitcoin deposits on exchanges.

On Binance, this metric has reached its highest level since April. Such consistent transfers of assets to exchanges by large investors often signal an impending distribution phase, especially as Bitcoin struggles to maintain the $93,000 threshold.

Bitcoin is currently trading at $89,730. Source: OKX

This highlights stronger resistance levels and the risk of prices retreating to test support zones before any potential upward movement.

Money flow data also indicates a sharp rise in Bitcoin inflows to Binance over the past 30 days, nearing the year’s highest levels.

Historically, such patterns have often preceded significant market corrections.

Meanwhile, Binance continues to dominate the market in USDT deposit volumes, significantly outpacing other major exchanges.

This influx of capital suggests investors are preparing for swift trading maneuvers—from buying the dip to adjusting positions during volatile periods.

However, amid heightened selling pressure, this is seen as a precursor to increased volatility rather than a long-term accumulation phase.

If Bitcoin falls below $90,000, the substantial funds on exchanges could accelerate and deepen the decline.

Conversely, if this support level holds, the market may witness a short-term reactive recovery.

Today’s Crypto Market, December 3: Bitcoin’s Volatility Mirrors Google’s Stock Swings

Bitcoin may be gearing up for one final surge to new highs before entering a corrective cycle, according to expert analysis.

Today’s Crypto Market, December 1st: Investors Fear Bitcoin Could Drop to $40,000

Many traders are sounding the alarm, cautioning that if Bitcoin fails to reclaim the $88,000–$89,000 range soon, its price could plummet back to November’s lows, potentially even dropping as far as $50,000.