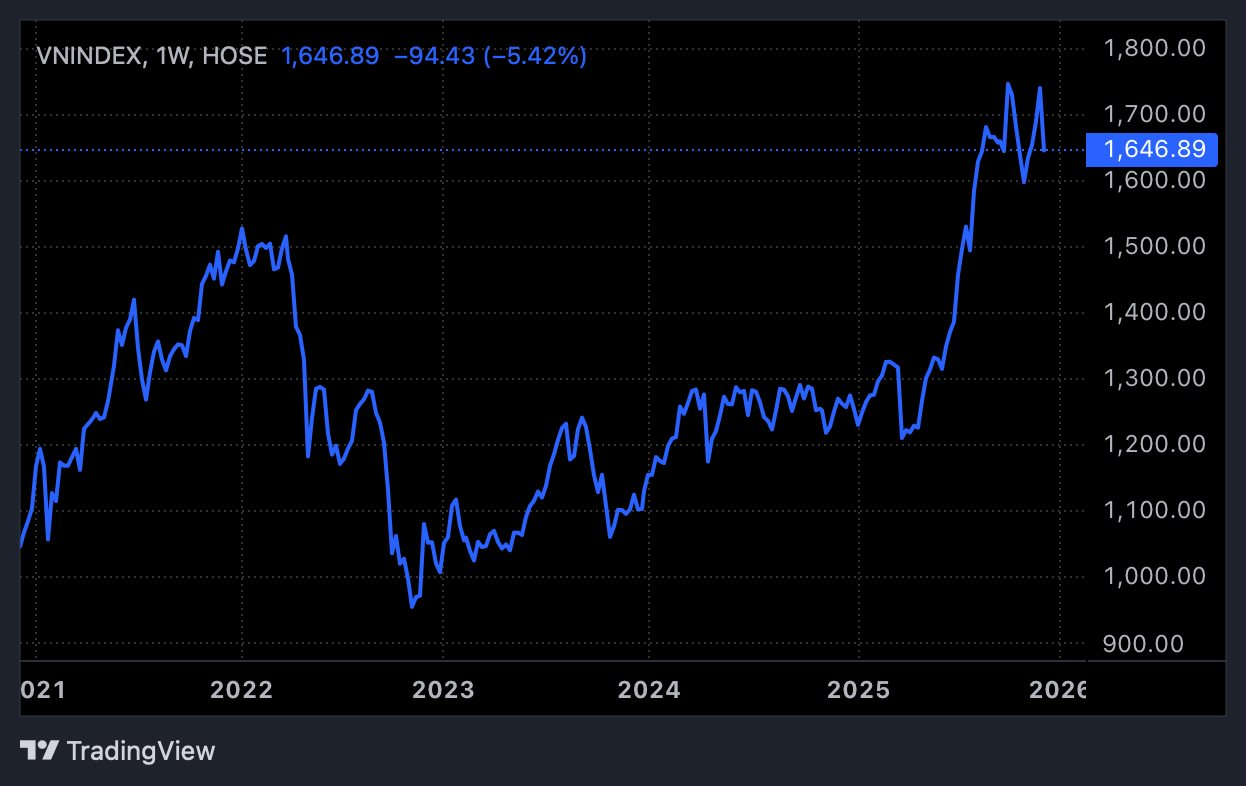

The VN-Index experienced a shocking decline last week, losing over 94 points, marking its steepest adjustment since April. This contrasts sharply with the global stock market’s positive trend, as both the Dow Jones and S&P 500 reached new historical highs.

Notably, liquidity did not surge during the decline, indicating insufficient buying power to absorb selling pressure. Investors remain cautious, opting to observe rather than open new positions.

For the upcoming week, most experts predict the market has entered an attractive price zone after the deep correction. However, investors should remain vigilant, only deploying capital once the index establishes a new equilibrium.

Many Stocks Enter “Oversold” Territory

Nguyễn Thái Học – Securities Analyst at Pinetree attributes the domestic market’s sharp decline primarily to the weakness in Vingroup-related stocks. While VIC saw a slight weekly gain, its floor drop on December 10th, coupled with steep falls in VHM, VPL, and VRE, exerted significant pressure on the index. These three stocks alone cost the VN-Index nearly 25 points.

Market sentiment turned increasingly negative as the Banking sector, a key driver, also entered a strong correction. Large-cap stocks like VPB, TCB, and STB broke their four-month accumulation bases, triggering widespread sell-offs. Consequently, numerous stocks across sectors, particularly Real Estate and Securities, plunged, with many hitting floor prices in the final two sessions.

A notable signal emerged as liquidity surged in Friday’s closing session, likely reflecting retail investors’ stop-loss activities. This suggests the market may be entering the “shakeout” phase of the current correction, especially as many stocks, particularly in the Securities and Real Estate sectors, have entered oversold territory.

In this context, experts anticipate a technical rebound starting next week, potentially lasting until month-end. Many stocks could recover 10–15%, especially mid-caps that were heavily sold off and deeply discounted recently. These mid-caps are best positioned to rebound if short-term capital returns.

Equilibrium Zone Within Reach

Nghiêm Bảo Nam – Market Strategist at VFS believes last week’s sharp decline wasn’t triggered by specific negative macro news or a “black swan” event. Instead, it stemmed from retail investors’ fragile sentiment after a prolonged sideways market, coupled with prolonged negative account performance eroding patience. With low liquidity, a normal correction quickly escalated into widespread panic selling.

The “straw that broke the camel’s back” was the collapse of pillar stocks, particularly Vingroup-related ones like VIC, VHM, VPL, and the Banking sector. As these large-caps lost their supportive role (excluding Vingroup, the VN-Index hovered around 1,500 points), fears of breaching technical support levels triggered a wave of market sell orders (MP) in the closing session.

Despite the deep decline, average liquidity of VND 22 trillion on HoSE highlights systemic liquidity shortages and rising interest rate pressures. The OMO rate hike from 4% to 4.5% increased banks’ funding costs, while overnight rates reached 7.5%, a multi-year high. In this environment, large capital remains sidelined, unwilling to deploy decisively at current prices.

However, this caution doesn’t imply a risk of an endless freefall. With the market already discounting heavily – losing nearly 100 points in four sessions – and 2026 projected P/E ratios falling to attractive levels, below regional averages, further downside potential narrows.

Current selling pressure stems mainly from psychological and technical factors, including margin calls, rather than fundamental corporate weakness. Thus, a V-shaped bottom formation remains possible, with the equilibrium zone nearing.

Technically, after losing the 1,650-point mark, the VN-Index will likely test the 1,580–1,622 support zone. This critical buffer precedes more bearish scenarios, where the index could revisit the 1,531-point peak.

To confirm a halt in the decline and a shift to accumulation, the VN-Index must avoid forming a new lower low on the weekly chart, i.e., decisively breaching 1,580. Many blue-chips and fundamentally strong companies have retreated to hard support levels, with attractive P/E valuations.

A reversal signal will be confirmed once forced selling pressure subsides in 1–2 sessions, and proactive buying absorbs floor-priced stocks, stabilizing the 1,580 support.

However, experts caution against bottom-fishing now, as risks remain latent. With indifferent capital flows and persistent foreign net selling (six consecutive sessions), sentiment remains pressured. Opportunities will arise only with clear capital consensus supporting the index. Catching a falling knife in low-liquidity, panic-driven conditions is extremely risky. Investors should patiently await a new equilibrium.

Attractive Valuation Levels

According to Đỗ Bảo Ngọc – Deputy Director at Kien Thiet Securities, last week’s sharp drop was driven primarily by large-caps, especially the Vingroup ecosystem. Selling pressure from this group quickly spread to Real Estate, Securities, and Banking sectors, dragging many pillar stocks down and creating negative sentiment.

On the macro front, experts cite no new negative factors. The Fed’s rate cut is positive, and domestic data remains neutral. However, market liquidity has weakened significantly: interbank tensions, rising interbank rates, and higher year-end cash demands from institutions. These factors, though not new, are amplified in a weak-liquidity environment, exaggerating reactions to large-cap negatives.

Short-term trends clearly point downward. After four consecutive losing sessions, the VN-Index shed 100 points, breaching key supports like MA10, MA20, MA50, and MA100. Without improved supply-demand dynamics or new supportive information, the index may retreat to 1,600 ± 10 points, the nearest pre-correction base.

The medium-term uptrend remains intact but could be jeopardized if 1,600 is breached. Deeper declines depend on large-cap performance, as many stocks are already deeply discounted below previous bottoms.

After steep declines, many stocks now offer attractive valuations. This could enable calmer, more balanced trading from next week, as medium-to-long-term capital targets fundamentally strong, well-valued stocks.

Vietstock Weekly: December 15-19, 2025 – Rising Risks Ahead?

The VN-Index plunged dramatically, marked by the emergence of a Big Black Candle pattern, while slicing below the Middle line of the Bollinger Bands. Trading volume persistently remained below the 20-week average, indicating investors are still gripped by caution. With the MACD indicator widening its gap from the Signal line following a sell signal since late October 2025, market volatility is likely to persist in the near term.

QCG Stock Plunges for the Second Consecutive Session as VN-Index Takes a Sharp Dive

Amidst a declining market, Quốc Cường Gia Lai’s QCG stock defied the trend, surging to its upper limit for the second consecutive session on December 11th. This remarkable performance stands in stark contrast to the benchmark VN-Index, which continued its downward spiral, shedding over 20 points during the same trading day.