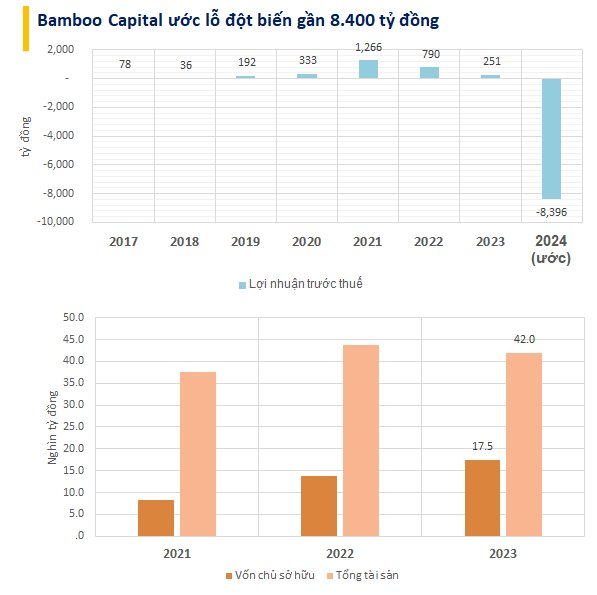

According to documents from the upcoming Extraordinary General Meeting of Bamboo Capital Joint Stock Company (stock code: BCG), the leadership forecasts a consolidated loss of approximately 20% of total assets as of the end of 2023, equivalent to around 8.4 trillion VND. This contrasts sharply with the pre-tax profit of 999 billion VND reported in the company’s self-prepared 2024 report.

The primary cause stems from provisions for investment impairments, bad debt, and other contingent liabilities, following legal issues involving former senior executives.

This situation forces BCG into a comprehensive restructuring phase until 2030, aimed at stabilizing operations and reducing debt pressure.

Where are the 25.7 trillion VND in receivables?

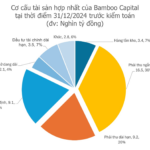

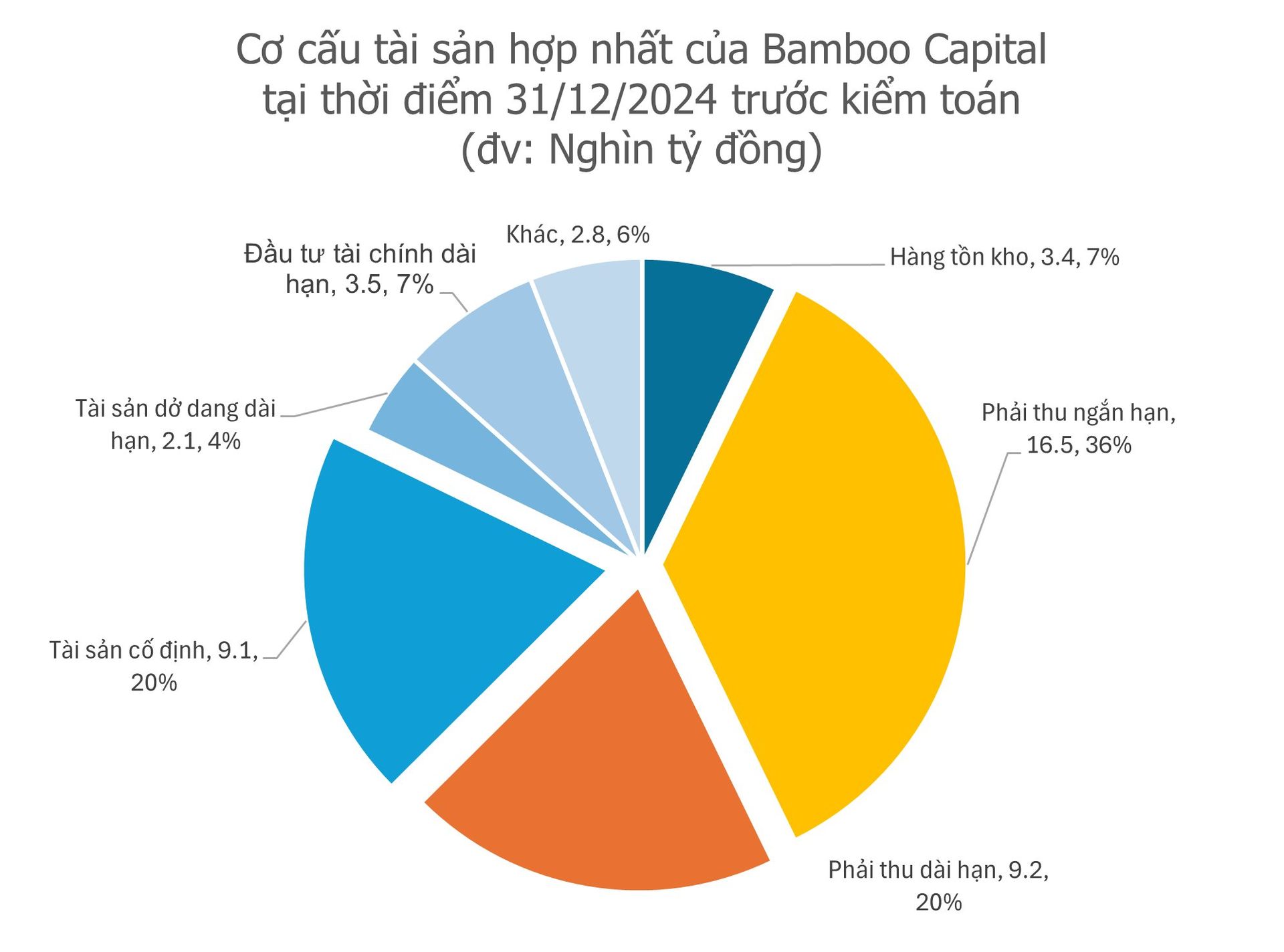

The company’s self-prepared report reveals that a significant portion of Bamboo Capital’s assets is tied up in receivables.

Unaudited 2024 financial statements show total short-term and long-term receivables exceeding 25.7 trillion VND (nearly 1 billion USD) by year-end, accounting for over 55% of consolidated assets.

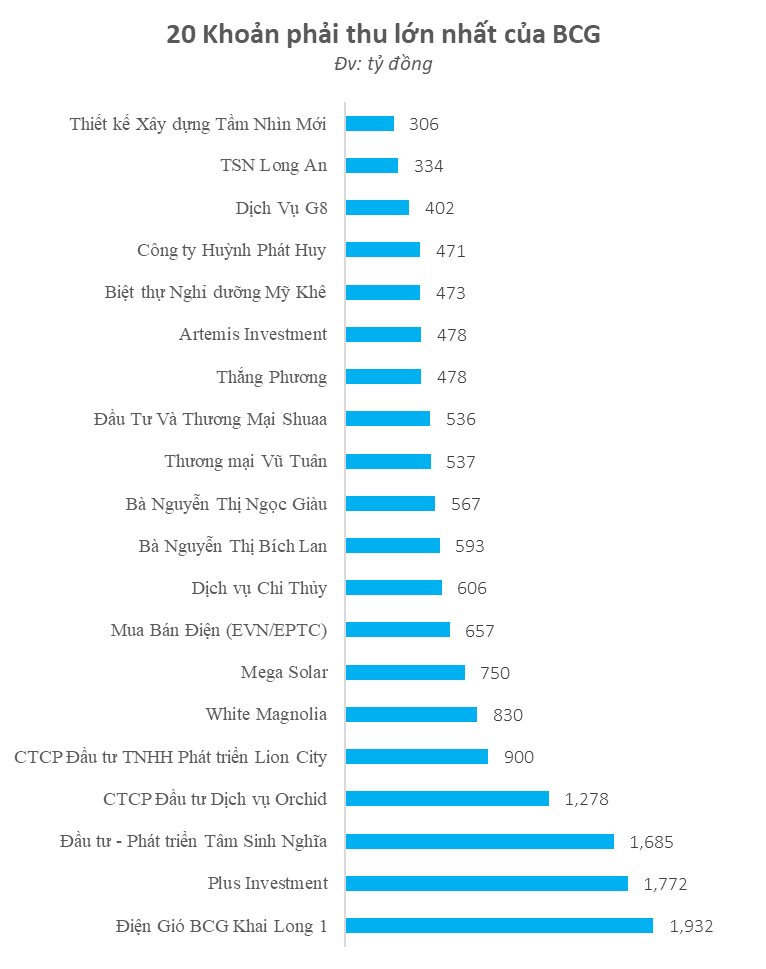

These receivables are concentrated among entities within BCG’s ecosystem. For instance, receivables from BCG Khai Long 1 Wind Power JSC total over 1.9 trillion VND, including 1.66 trillion VND in short-term business cooperation receivables (BCC) and 273 billion VND in short-term loans. BCC receivables from Tam Sinh Nghia Investment-Development JSC exceed 1.684 trillion VND.

Notably, alongside corporate entities, Bamboo Capital’s asset structure includes substantial prepayments and investment partnerships with individuals.

Financial reports indicate prepayments to individuals such as Nguyen Thi Bich Lan (593 billion VND) and Nguyen Thi Ngoc Giau (567 billion VND).

11.5 trillion VND in debt: Bonds account for 37%, VietinBank as top lender

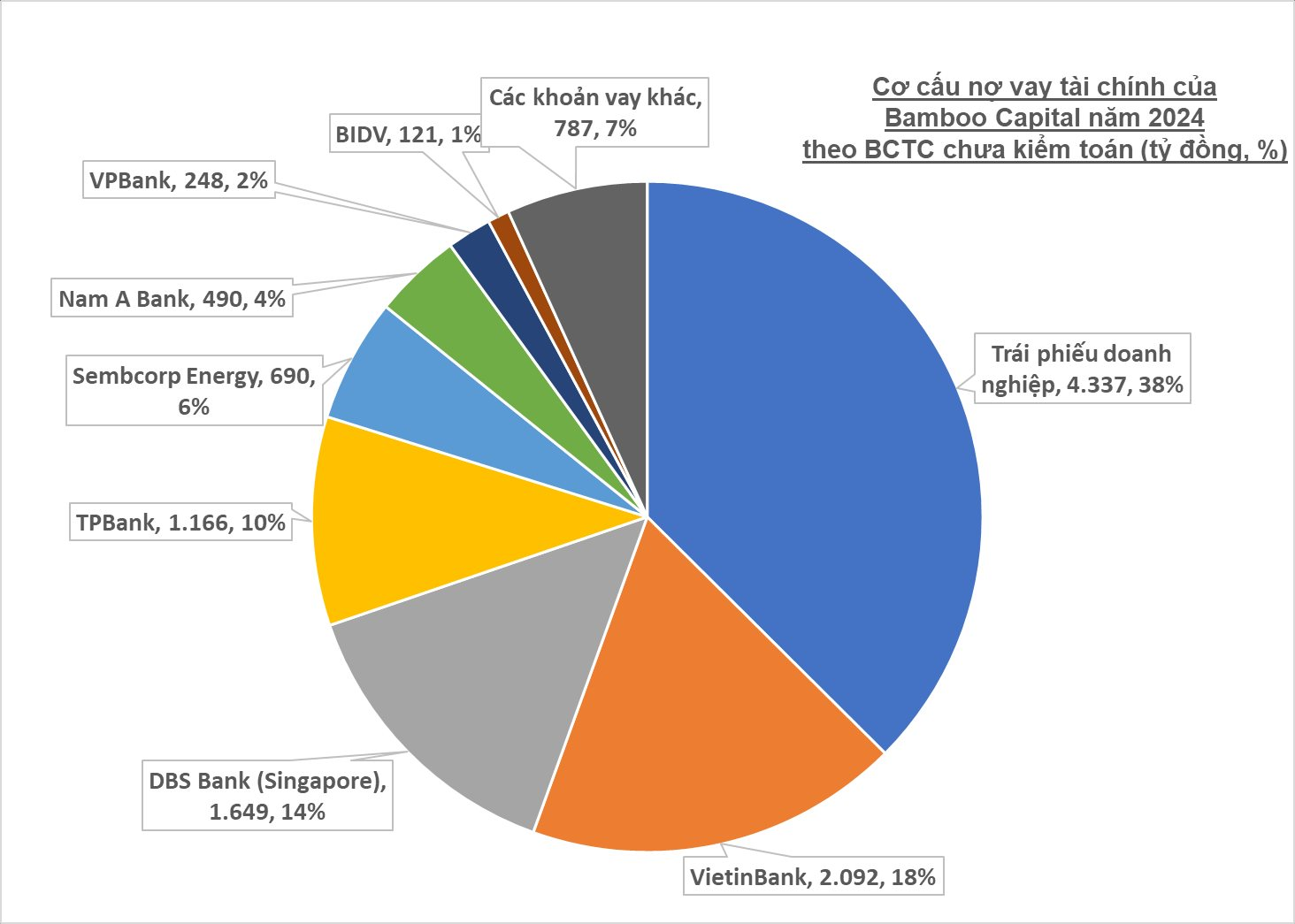

As of year-end 2024, BCG’s total liabilities exceed 25.129 trillion VND (54% of capital), with financial debt surpassing 11.580 trillion VND.

Debt structure reveals heavy reliance on bonds, totaling 4.337 trillion VND. Notably, the TCDH2227002 bond (2.5 trillion VND, maturing in 2027) is secured by the Bai Chay project.

Additionally, the publicly issued BCG122006 bond (982 billion VND) faces early redemption pressure, alongside the TNECH2227001 bond (357 billion VND) linked to the Krong Pa 2 solar project.

Bank loans secured by energy and real estate projects also dominate. VietinBank leads with 2.092 trillion VND (Phu My project), followed by a syndicated loan from DBS Bank Ltd (Singapore) at 1.649 trillion VND.

TPBank holds 1.166 trillion VND in outstanding loans. Other lenders include Sembcorp Energy, Nam A Bank, and VPBank, each with loans in the hundreds of billions of VND.

Bamboo Capital Anticipates Losses Until 2027, Unveils Comprehensive Restructuring Plan

Bamboo Capital Group (HOSE: BCG) has unveiled a comprehensive restructuring plan for the 2025-2030 period, anticipating three consecutive years of losses before returning to profitability in 2028. The company is also setting aside significant provisions for 2024 and optimizing its Board of Directors to support this strategic transformation.

Bamboo Capital Announces Devastating Loss: Estimated 8.4 Trillion VND Deficit Following Legal Turmoil Involving Former Leadership

Meanwhile, according to a self-reported statement, BCG recorded a consolidated pre-tax profit of VND 999 billion in 2024.

Quốc Cường Gia Lai Sells Subsidiary to Settle Debts with Trương Mỹ Lan

To address the financial obligations arising from the purchase agreement for the Bac Phuoc Kien Residential Area project with Sunny Island Investment Corporation, Quoc Cuong Gia Lai Corporation proposes that shareholders approve the transfer of capital contributions in its subsidiaries and affiliated companies within this year.