The VN-Index had a positive start to 2024 with a 3% increase in January, as money began to flow into the Banking sector, supported by the return of foreign investors and a 22% growth in Q4/2023 earnings.

In its February stock market strategy report, Dragon Securities (VDSC) highlighted an important data point about the characteristics of the stock market: the margin debt and investor deposit levels at securities companies have also been revealed.

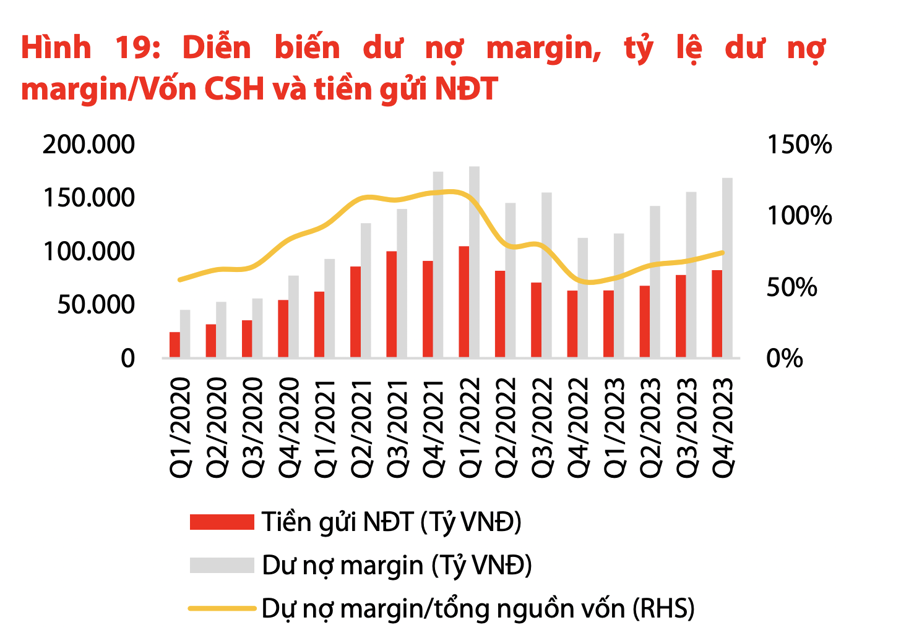

The total market-wide margin debt at the end of Q4/2023 is estimated to reach 169 trillion VND, an increase of 13 trillion VND from the previous quarter (+8% QoQ) and a 50% increase compared to the beginning of 2023. Margin lending activities have seen a local uptrend in securities companies such as TCBS, VPBS, MBS, and VCI, with a total increase of over 10 thousand billion VND. Excluding this group, the margin debt of the remaining securities companies increased by about 2.3% compared to the previous quarter. The margin debt ratio/Total market equity is relatively healthy, reaching about 74% compared to the peak of the Covid years (~110%).

On the other hand, this trend is supported by a 6% increase in investor deposit balance at the end of Q4/2023, estimated at 82 trillion VND. This figure has also increased by 30% since the beginning of 2023, significantly outperforming the deposit growth of the Banking system (+13.2%).

VDSC assesses the scale of margin debt at the end of 2023 to be relatively healthy based on the margin debt/equity ratio and a slight increase compared to the previous quarter (after excluding some abnormal cases in securities companies like TCBS, VPBS, MBS, VCI).

Importantly, the trend of increasing investment in the stock market continues to be reinforced as the investor deposit at securities companies has increased by another 5 trillion VND compared to the previous quarter (+6%), in the context of savings interest rates still at a low level, and the return of confidence in other major investment channels is not expected to recover soon.

It is noteworthy that the increase compared to the previous quarter in the investor deposit balance as well as the margin debt reveals a contrast to the liquidity decline of the three stock exchanges, which decreased by 25% in Q4. This suggests that although investors have been more cautious in the late stages of 2023, most of them continue to choose to “stay in the market,” especially when savings interest rates are still at a low level, and confidence in other major investment channels has not yet recovered.

VDSC believes that the temporarily sidelined money will return after the Lunar New Year holiday, especially with more active movement of large funds that have a high market directional impact through affecting Bluechip stocks, in the coming time with the news flows of the 2024 Shareholder Meetings.

On the other hand, the sudden sharp decline with more attractive investment opportunities in the market may also trigger the return of the waiting money.

The market will temporarily enter an information vacuum period after the Q4/2023 financial results reporting season. Along with the effects of the Lunar New Year holiday, VDSC does not expect the market to have strong fluctuations in February. However, the information flow about the Shareholders’ Meetings with new business planning for 2024 is likely to make the market more active in the second half of February.

On the downside, the market’s deep downside risk is limited, thanks to the relatively low valuation of large-cap sectors, the net selling trend of foreign investors may temporarily end, and the investor deposit balance is waiting to re-enter the market. For February, the expected range of VN-Index is 1,160-1,200.