Illustrative photo

|

“2023 is the most difficult year in the export history of the textile and garment industry, excluding 2020 when the world was closed due to the pandemic,” said Mr. Le Tien Truong, Vice Chairman of the Board of Directors of Vietnam National Textile and Garment Group (Vinatex).

This is also the first year that Vietnam’s textile and garment exports have decreased by 11%, reaching only 40 billion USD, far from the initial target of 47-48 billion USD. The actual market situation under the worst-case scenario has greatly affected the production and business activities of textile and garment enterprises.

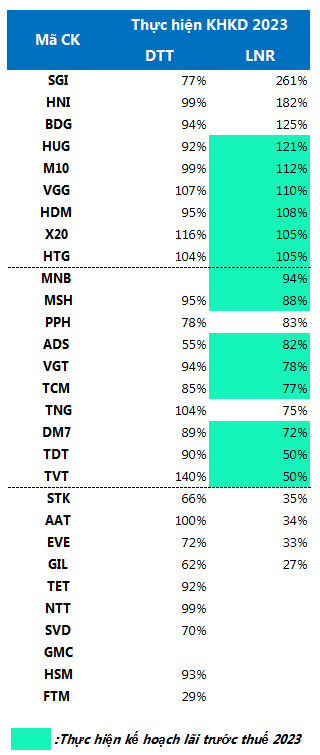

According to data from VietstockFinance, out of the 29 textile and garment companies listed on the stock exchanges (HOSE, HNX, UPCoM) that announced their 2023 business results, 22 companies experienced a decrease in profits, 5 companies reported losses, and only 2 companies saw an increase in profits. Total revenue and net profit reached nearly 72.5 trillion VND (a 13% decrease compared to the same period) and over 1.8 trillion VND (a 54% decrease), respectively.

In the fourth quarter of 2023 alone, the total revenue of these companies was about 18.7 trillion VND, a 2% decrease compared to the same period last year. However, net profit increased by 2% to 590 billion VND, mainly due to the gradual increase in orders for holiday and Tet occasions.

Overcoming difficulties

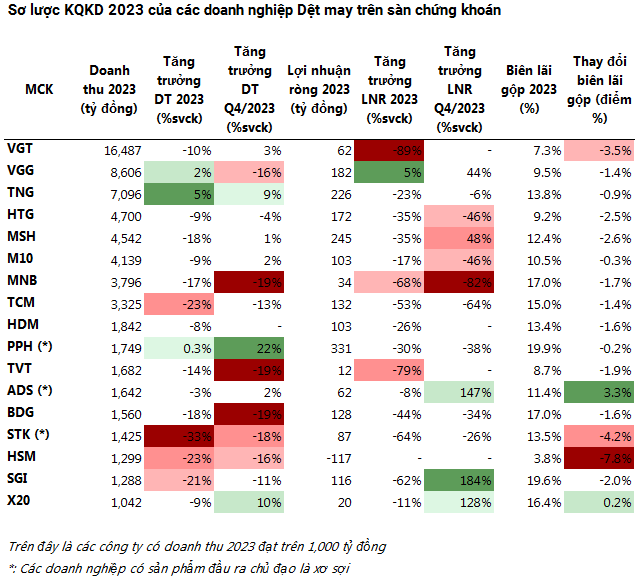

In terms of absolute figures, there were 17 textile and garment companies with revenues exceeding trillions of VND in 2023. Specifically, Vinatex achieved the highest revenue in the group with nearly 16.5 trillion VND, a 10% decrease compared to the same period; however, net profit decreased significantly by 89% to 62 billion VND. This is the lowest profit in the past 15 years for Vinatex, since 2009.

May Viet Tien (UPCoM: VGG) is one of the rare companies in the industry that has recorded growth in both revenue and profit. Specifically, VGG’s revenue increased by 2% to over 8.6 trillion VND, thanks to a decrease in returned goods, and net profit increased by 5% to 182 billion VND – the highest level in 4 years for VGG since 2020.

Thanks to maintaining orders with a stable customer base in 2023, TNG Investment and Trading Corporation (HNX: TNG) achieved a record high revenue of nearly 7.1 trillion VND, a 5% increase compared to the same period; however, net profit decreased by 23% to 226 billion VND due to high financial costs.

For yarn companies – the upstream segment in the textile and garment value chain – Damsan (HOSE: ADS) recorded positive growth in the fourth quarter of 2023. Overall, ADS’ net profit reached 62 billion VND, an 8% decrease, due to increased expenses for machinery upgrades throughout the year.

Tong Phong Phu Joint Stock Company (UPCoM: PPH) also recovered its growth momentum in the fourth quarter of 2023, with total annual revenue of 1.75 trillion VND (staying flat compared to the same period) and net profit of 331 billion VND (a 30% decrease).

A series of miserable days

Sharing the common difficulties faced by the industry, the business operations of Binh Thanh Production, Business and Import-Export Joint Stock Company (Gilimex, HOSE: GIL) became even more challenging due to a contractual dispute with retail giant Amazon.

Thanks to an extraordinary fourth-quarter profit, the company managed to escape a year of significant losses, with a net profit of 28 billion VND for the whole year, but a sharp decrease of 92% compared to the same period. This is also the lowest level of profit for GIL in the past 17 years, since 2007.

| GIL’s net profit from 2007-2023 |

Garmex Saigon (HOSE: GMC), the main partner of GIL, also suffered from production line disruptions and incurred losses for 2 consecutive years (2022-2023) amounting to 85 billion VND and 52 billion VND, respectively.

However, the most disappointing company in this group is Duc Quan Investment and Development Joint Stock Company (UPCoM: FTM), which incurred a loss of 222 billion VND in 2023, extending its streak of 5 consecutive years of losses since 2019. The accumulated loss has reached nearly 900 billion VND, leading to negative equity of 385 billion VND for the company’s owner.

| FTM’s net profit from 2018-2023 |

Due to the provision for doubtful receivables, which had to be increased more than 8 times at the beginning of the year to 64 billion VND, Hanoi Textile and Garment Joint Stock Company (UPCoM: HSM) unexpectedly suffered a record loss of 117 billion VND in 2023, wiping out the company’s entire retained earnings after tax. As of December 31, 2023, HSM’s accumulated loss was nearly 98 billion VND.

Many companies failed to meet their plans

Considering the anticipated difficulties, most textile and garment companies were cautious in their plans for 2023. Many of them had to revise their growth targets to lower double-digit figures.

However, by the end of 2023, only 9 out of 29 textile and garment companies announced that they had exceeded their annual profit targets. The companies that achieved this included SGI, VGG, M10, HDM, HTG, and more. Four companies that failed to achieve half of their profit targets for 2023 were GIL, AAT, EVE, and STK.

|

2023 performance against targets of textile and garment companies

Source: VietstockFinance

|

Job outlook at the end of the year

In 2023, labor in the textile and garment industry suffered the most from job cuts. Garmex, for example, reduced its workforce to only 35 people, a reduction of 1,947 employees compared to the beginning of the year. In total, Garmex has reduced its workforce by 3,775 people over the past 2 years.

Not only on the stock exchange, Hansae Vietnam Co., Ltd. – a company specializing in the production of sports apparel for export in the Northwest Cu Chi Industrial Park, Ho Chi Minh City – also cut its workforce from nearly 11,000 to about 2,500 workers.

Outside of the wave of layoffs, Vinatex had to sacrifice profits and dividends in order to retain its workforce of 62,000 employees and ensure that salaries were not cut too deeply. TNG Investment and Trading Corporation maintained stable employment and income at a level of 9.4 million VND per person per month for 18,000 workers.

Reality shows that many companies already have orders for 2024, which means that these companies no longer have to reduce their workforce. On December 14, 2023, the Ho Chi Minh City Labor Federation announced that there are more than 80 companies in the area that want to recruit employees, with the textile and garment industry having a high demand for over 20,000 workers.

May Viet Tien has a demand to recruit more than 1,000 positions in Ho Chi Minh City, including garment workers, production line managers, and sample makers, with monthly incomes ranging from 10 to 30 million VND.

Expectations for recovery in the second half of 2024

Regarding textile and garment exports in 2024, the Vietnam Textile and Apparel Association (VITAS) has set an optimistic target for the industry’s total export turnover to reach 44 billion USD, a 9.2% increase compared to 2023.

In reality, the export situation of Vietnam’s textile and garment industry in January 2024 was quite positive, with a 28.6% increase in export turnover compared to the same period. The industry’s production indices have also increased significantly, especially in natural fiber weaving with a 57% increase.

Speaking at the year-end review in 2023, Cao Huu Hieu, CEO of Vinatex, said that there are positive signals in some major markets, such as the U.S., which is starting to recover. The group has set a target of a 10% increase in revenue and profit compared to 2023; however, this is a difficult target to achieve because in the long run, “it is still impossible to predict how the market will be affected by geopolitical conflicts”.

According to Mr. Hieu, the textile industry is expected to show good progress from the third quarter of 2024, while the fiber industry is expected to recover by the fourth quarter of 2024.

Meanwhile, evaluations from many financial institutions show that the order prospects for Vietnam’s textile and garment industry in 2024 will be more positive, but difficulties still remain.

A report from SSI Research noted that tensions in the Red Sea may have a ripple effect on the business operations of export-oriented companies in the first quarter of 2024. In 2024, it is expected that gross profit margins of textile and garment companies will gradually improve to the range of 14-15% due to slow recovery of demand throughout the year.

Thế Mạnh