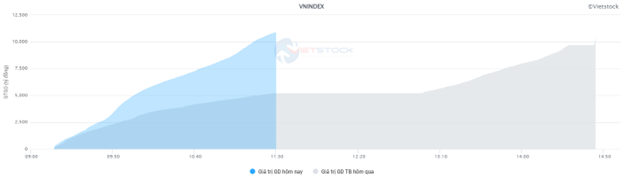

VN-Index unexpectedly reversed the trend to increase sharply in the first trading session of the week, led by banking and securities stocks. VN-Index closed on 22/4 with an increase of 15.37 points (1.31%) to 1,190 points. Contrary to the increase in points, the liquidity of matched orders on HOSE decreased sharply to only reach approximately VND 14,000 billion.

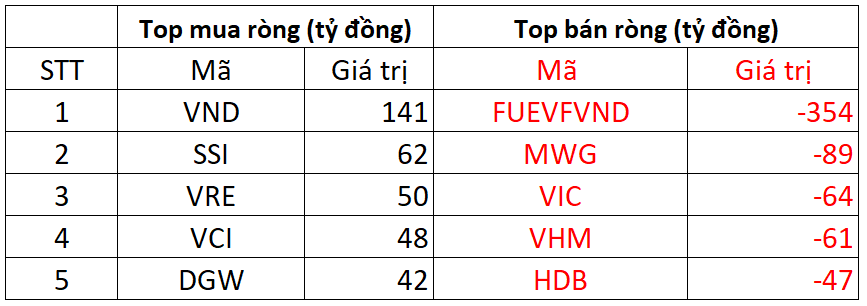

Foreign trading was not positive as they sold net VND 172 billion on the whole market.

On HOSE, foreign investors sold net with a value of approximately VND 242 billion.

In the buying direction, VND and SSI stocks were the most strongly bought by foreign investors with values of 141 and 62 billion dong, respectively. Besides that, VRE and VCI were the next two stocks to be net bought for 50 and 48 billion dong on HOSE.

On the other hand, FUEVFVND was under the strongest selling pressure from foreign investors, with a value of VND 354 billion, followed by MWG and VIC, which were also sold for VND 89 and VND 64 billion, respectively.

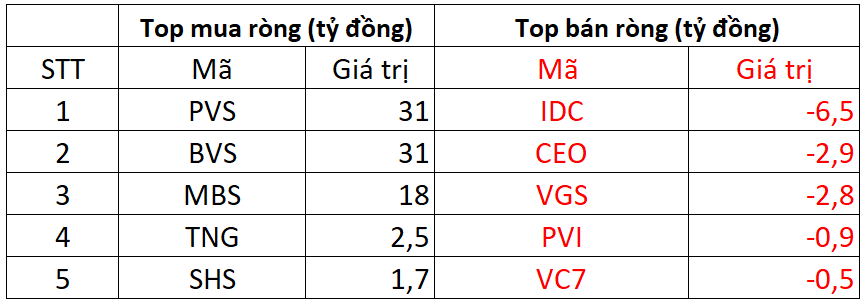

On HNX, foreign investors bought 72 billion dong net.

In the buying direction, PVS was the most strongly bought with a value of VND 31 billion. Besides that, BVS was next in the net buy list on HNX with VND 31 billion. Moreover, foreign investors also spent a few billion dong to collect MBS, TNG, SHS.

In contrast, IDC was the code that suffered the strongest net selling pressure from foreign investors, with a value of nearly VND 6.5 billion; followed by CEO, which was sold for approximately VND 3 billion.

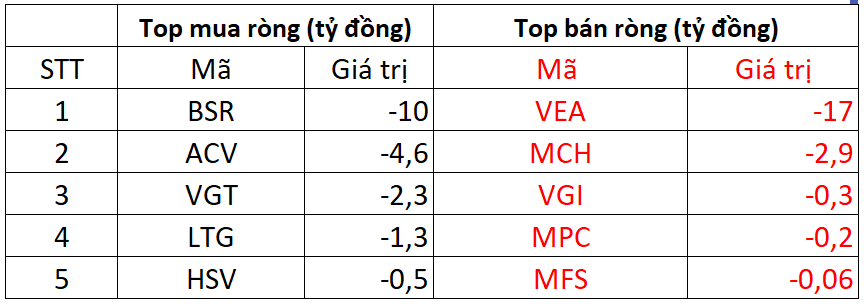

On UPCOM, foreign investors sold a net of VND 2 billion.

In the buying direction, BSR shares were bought by foreign investors for nearly VND 10 billion. Following that, ACV and VGT were also net bought for a few billion dong each.

In the opposite direction, VEA was sold net by foreign investors for about VND 17 billion today; besides that, they also sold net at MCH, VGI, …