Duc Giang Chemicals Group Corporation (DGC) has just announced its Q1/2024 financial statement with a revenue of 2,385 billion VND, down 4% compared to the same period last year. On the contrary, the cost of goods sold increased, causing the gross profit margin to narrow from 35.8% in the same period to 32.1%. The gross profit correspondingly reached over 766 billion VND, a decrease of nearly 14% compared to Q1/2023.

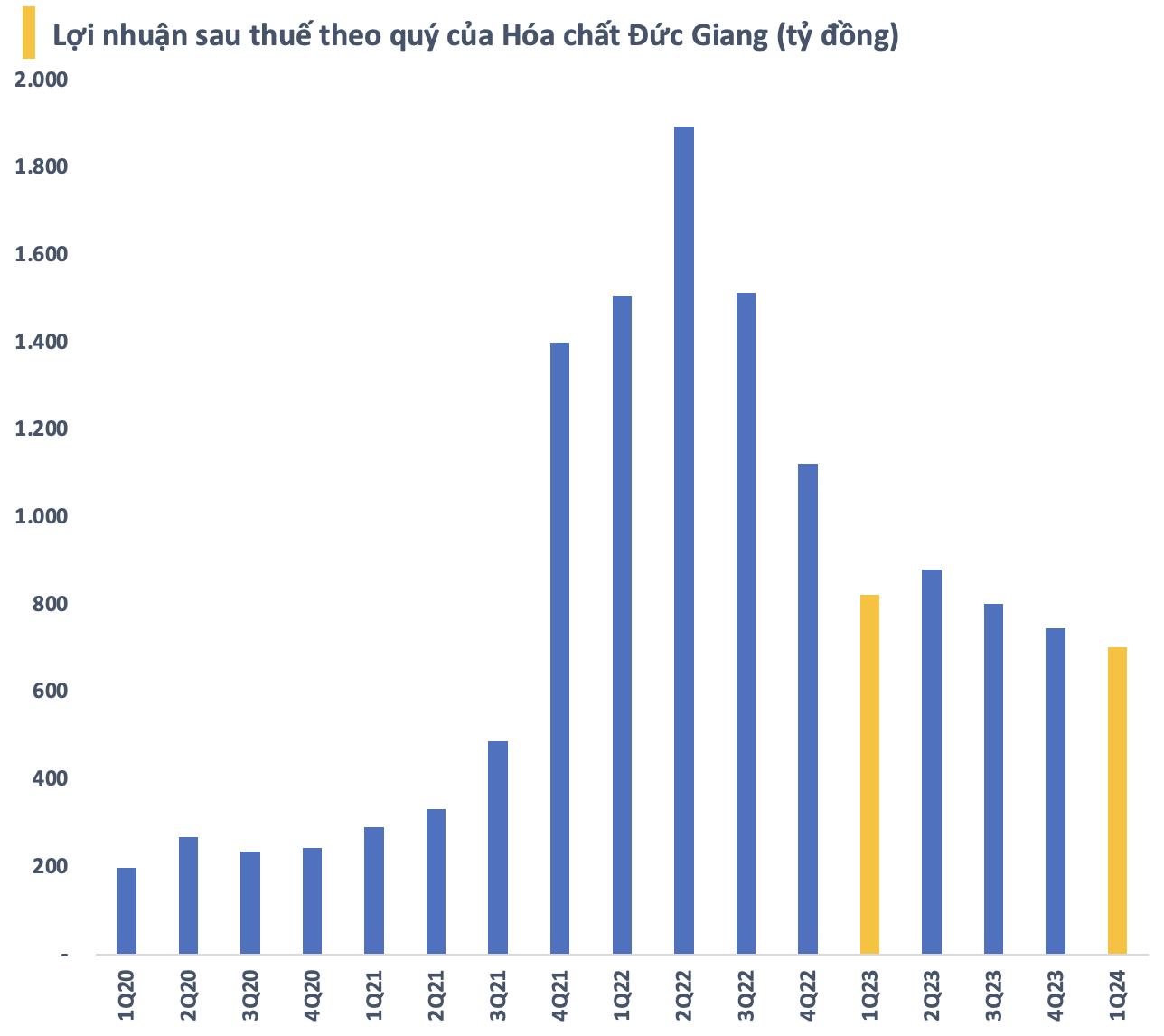

After deducting expenses, Duc Giang Chemicals earned nearly 704 billion VND after tax, down 14% compared to the same period in 2023 and is the lowest level in the last 10 quarters since Q4/2021. This is also the third consecutive quarter that this business has recorded negative growth in profit compared to the previous quarter.

In 2024, Duc Giang Chemicals planned to maintain business with a consolidated revenue of 10,202 billion VND and after-tax profit of 3,100 billion VND, respectively up 4.6% and down 4.4 % compared to 2023. With the achieved results, the business has reached 23% of its revenue and full-year profit targets.

By March 31, 2024, Duc Giang Chemicals’ total assets decreased by more than 1,000 billion VND compared to the beginning of the year to nearly 114,500 billion VND. The decline mainly came from the cash amount decreasing from over 1,060 billion VND at the beginning of the year to 113 billion by the end of Q1. However, this business still has short-term deposits of nearly 9,500 billion VND, accounting for nearly 2/3 of total assets.

Answering shareholders at the 2024 Annual General Meeting of Shareholders about this “huge” amount of money, Mr. Dao Huu Huyen – Chairman of Duc Giang Chemicals’ Board of Directors said that the company will not invest in bonds or industrial real estate. Instead, Duc Giang Chemicals needs to hold on to a large amount of cash to prepare for the bauxite project, as this is a very large project and is of great interest to the government.

In 2023, Duc Giang Chemicals recorded a revenue of 9,748 billion VND and after-tax profit of 3,241 billion VND, respectively decreasing by 32% and 46% compared to 2022. The reason is that the yellow phosphorus market is not favorable, and due to high domestic and foreign competition and rapidly decreasing prices, the demand is lower than in previous years. Meanwhile, other items such as fertilizer, animal feed additives, etc., have stable prices and production tends to increase.

With the 2023 business results plus dividends received from Vietnam Apatite Fertilizer (PAT) and Tia Sang Battery (TSB), Duc Giang Chemicals’ Board of Directors also approved a 30% dividend payment for 2023 (already provisionally paid). According to the plan approved by shareholders, the 2024 dividend is expected to remain at 30%.