Illustration Photo

SBV deploys exchange rate intervention measures

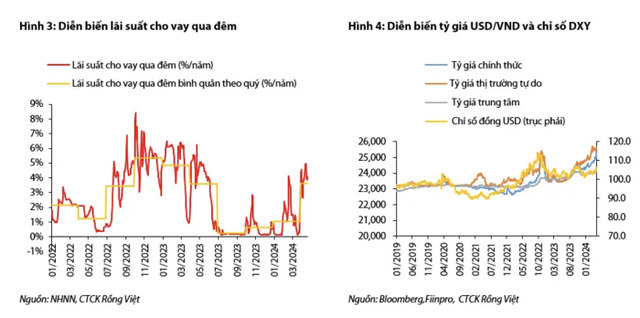

In a recently published market update report, Viet Dragon Securities (VDSC) stated that the shift in investor expectations regarding the Fed’s direction in early 2024 has created stronger pressure on the Vietnamese dong than previously estimated.

As of April 25, the dong has depreciated by approximately 3.8-4.3% in the official and unofficial markets. In response, the State Bank of Vietnam (SBV) has implemented two intervention measures to stabilize the exchange rate: selling foreign exchange on the spot market and auctioning gold.

Accordingly, on April 19, the SBV announced the sale of foreign exchange on the spot market with an intervention selling rate of VND 25,450/USD, which is 27 dong lower than the ceiling exchange rate currently being traded by some banks.

By selling foreign exchange on the spot market, the SBV has set out to manage expectations of dong depreciation around the VND 25,500/USD mark. According to unofficial data, the SBV sold approximately USD 350-370 million (equivalent to VND 8,907-9,416 billion) on April 22-23.

Subsequently, the SBV announced the commencement of gold auctions from April 22 with the aim of increasing the supply of SJC gold and narrowing the gold price spread between Vietnam and global markets. However, out of three gold auctions held, two were canceled due to insufficient participation. In the only successful auction on April 23, only two members were awarded contracts for a very small amount of 3,400 taels of gold (equivalent to approximately VND 276.5 billion).

According to VDSC, the lack of interest in the SBV’s gold auctions may be attributed to two factors: the global gold price being unclear in its trend near its peak (global gold prices peaked at over USD 2,417/ounce on April 14 and adjusted down to around USD 2,305/ounce on April 25); and the reference gold price set by the SBV for calculating deposits being insufficiently attractive for institutions.

Therefore, considering both gold and foreign exchange sales, the amount of dong that the SBV has withdrawn is less than VND 10 trillion.

On the other hand, VDSC cites data from the SBV and the IMF, stating that Vietnam’s foreign exchange reserves as of the end of 2023 and early 2024 are estimated at around USD 93-100 billion, of which gold reserves are estimated at only USD 666 million (equivalent to 7-8 tons of gold) as of November 2023. With an average 12-month import value of approximately USD 28 billion per month, the foreign exchange reserve level is only slightly above the safe threshold. The SBV’s most recent intervention in 2022 resulted in a decrease in foreign exchange reserves of approximately USD 22 billion compared to 2021.

According to VDSC’s analysts, while the room for intervention using foreign exchange reserves exists, the ability to control the dong’s depreciation within a 5% range will still depend heavily on external factors.

“If the DXY index continues to rise above 110, it will be difficult to contain the exchange rate at 5%, as desired by the SBV,” VDSC noted.

SBV raises OMO interest rates to control dong depreciation

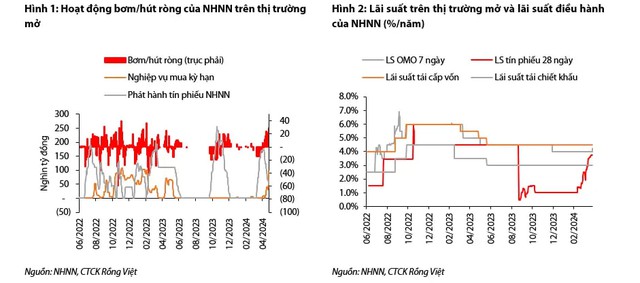

In the open market, the SBV has resumed net injections this month, with net liquidity injected into the system as of April 25 totaling around VND 220,000 billion, contrasting with the VND 171,000 billion net withdrawal in March. Of this amount, approximately VND 122,000 billion is due to the maturity of 28-day term bills issued last month.

At the same time, the SBV has begun using the repo channel more frequently since the beginning of April, with net injections through the repo channel reaching approximately VND 98,000 billion as of April 25. This is also the current outstanding size of the repo channel, nearly double the size of the SBV’s outstanding term bills, which is around VND 50,000 billion.

Additionally, the number of participants in the repo auctions has gradually increased towards the end of the month, indicating that liquidity demand in the system is rising again.

More notably, in the auctions from April 22 onwards, the winning interest rate on the repo channel has increased by 25 basis points compared to previous auctions, to 4.25% per annum. VDSC believes that this increase is moderate given that the SBV is currently focused on controlling the pace of dong depreciation.

Accordingly, the increase in interest rates on the repo channel remains lower than the refinancing interest rate set by the SBV, and this increase has been maintained for three trading sessions, while the liquidity pressure on the system is different from the period in August-September 2022.

In the short term, VDSC suggests that this development should be closely monitored, and it is also possible that this is an exploratory move in preparation for the SBV to raise its policy interest rate in response to depreciation pressures on the domestic currency.

System liquidity shows signs of slight tension

According to the analyst team, it is unlikely that the SBV’s intervention to stabilize the exchange rate is the sole reason for the net injections into the open market. Furthermore, the amount of liquidity injected in April 2024 exceeds the amount withdrawn by the SBV in the previous month. This indicates that the domestic banking system’s intrinsic liquidity is showing signs of stress, which may have begun in mid-April 2024.

Cross-checking with the interbank interest rate development can also validate this. Interest rates for terms under two weeks have increased by 139-177 basis points compared to the end of last month, to 4.1% per annum for overnight terms and 4.4-4.5% per annum for 1-2 week terms, respectively. Similarly, interbank interest rates for 1-6 month terms have increased more sharply than last month, with the highest increase recorded in the 6-month term (6.6% per annum on April 23), the highest level since October 2023.

According to VDSC, the positive aspect is that due to the increase in interbank interest rates, the interest rate spread between the USD and VND has narrowed significantly. As of April 25, the USD-VND interest rate spread for terms under 1 month ranged between 60-120 basis points, which should help curb interest rate arbitrage activities.