Starting July 1st, customers who wish to make online money transfers over VND 10 million per transaction or a cumulative amount over VND 20 million per day will be required to perform facial biometric authentication. The biometric data collected by banks must match the biometric data stored in the chip of the citizen identification card (CCCD) issued by the police or authenticated through the VNeID electronic identification account.

Commercial banks are currently rushing to complete the collection of their customers’ biometric data to comply with this new regulatory requirement. They have been continuously sending out notifications urging customers to update their biometric data. However, many individuals have not yet been able to do so for various reasons. Apart from those who are unaware of the new regulation and elderly individuals who may not be technologically savvy, there are also other factors such as incorrect facial recognition and the lack of NFC technology on their phones.

Avoid Updating Through Unfamiliar Links

When registering for facial biometric authentication, customers should be cautious and refrain from updating their facial biometric data through any website or application other than the official app of their bank. For instance, BVBank, in its notification, emphasizes the importance of security and advises customers to be vigilant. They will not request customers to provide OTP, passwords, card numbers, or security codes through phone calls or links.

Customers do not need to log in through any specific link. Instead, they can simply log in to their Digimi mobile banking app and easily find the notification requesting the setup of facial biometric authentication. Alternatively, they can visit any BVBank branch for assistance if they encounter difficulties with the process.

Follow Instructions for Facial Recognition

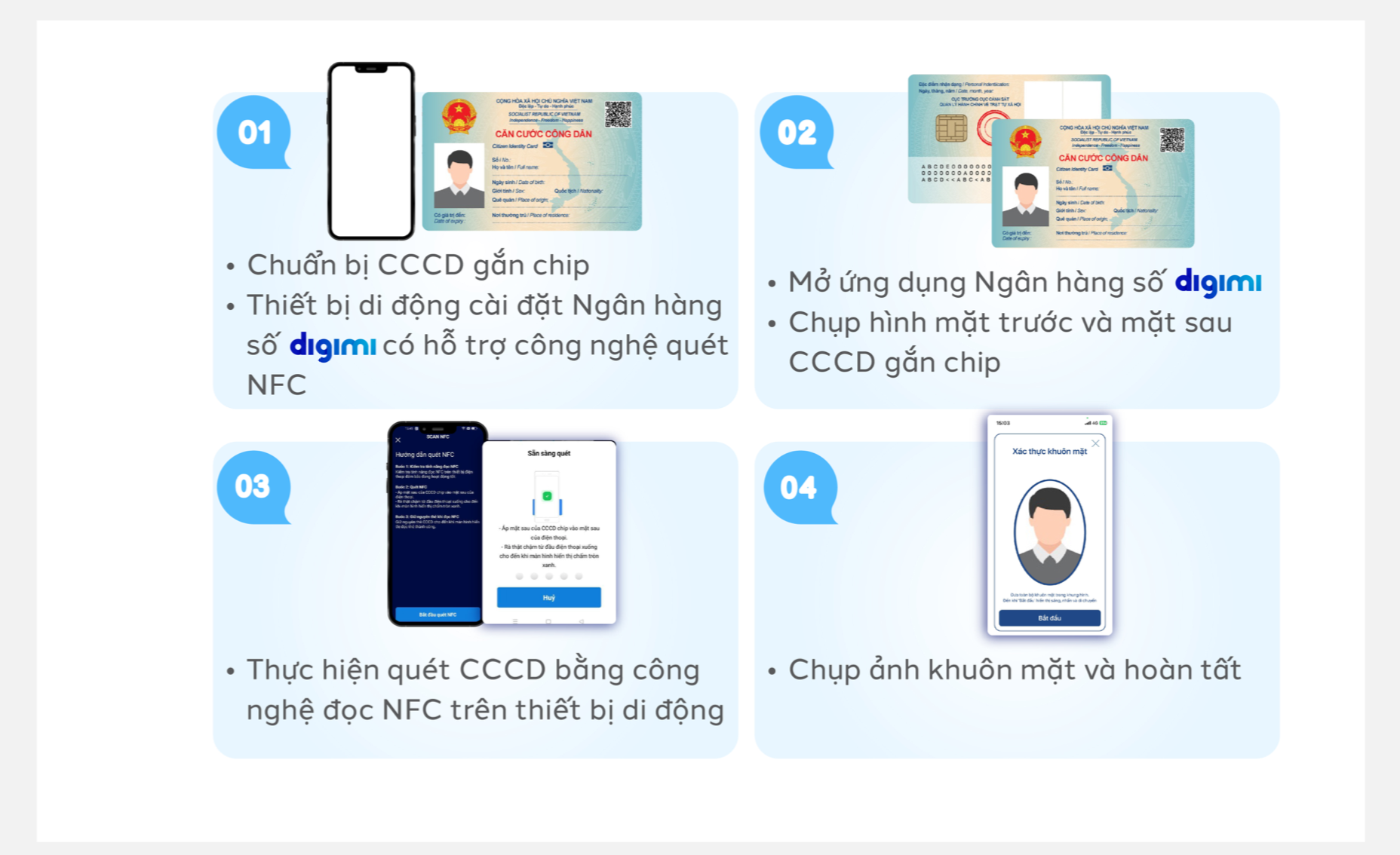

The next step is to take photos of the front and back of the chip-embedded CCCD. It is important to place the CCCD on a flat surface, avoid glare, and ensure that the images are clear and focused.

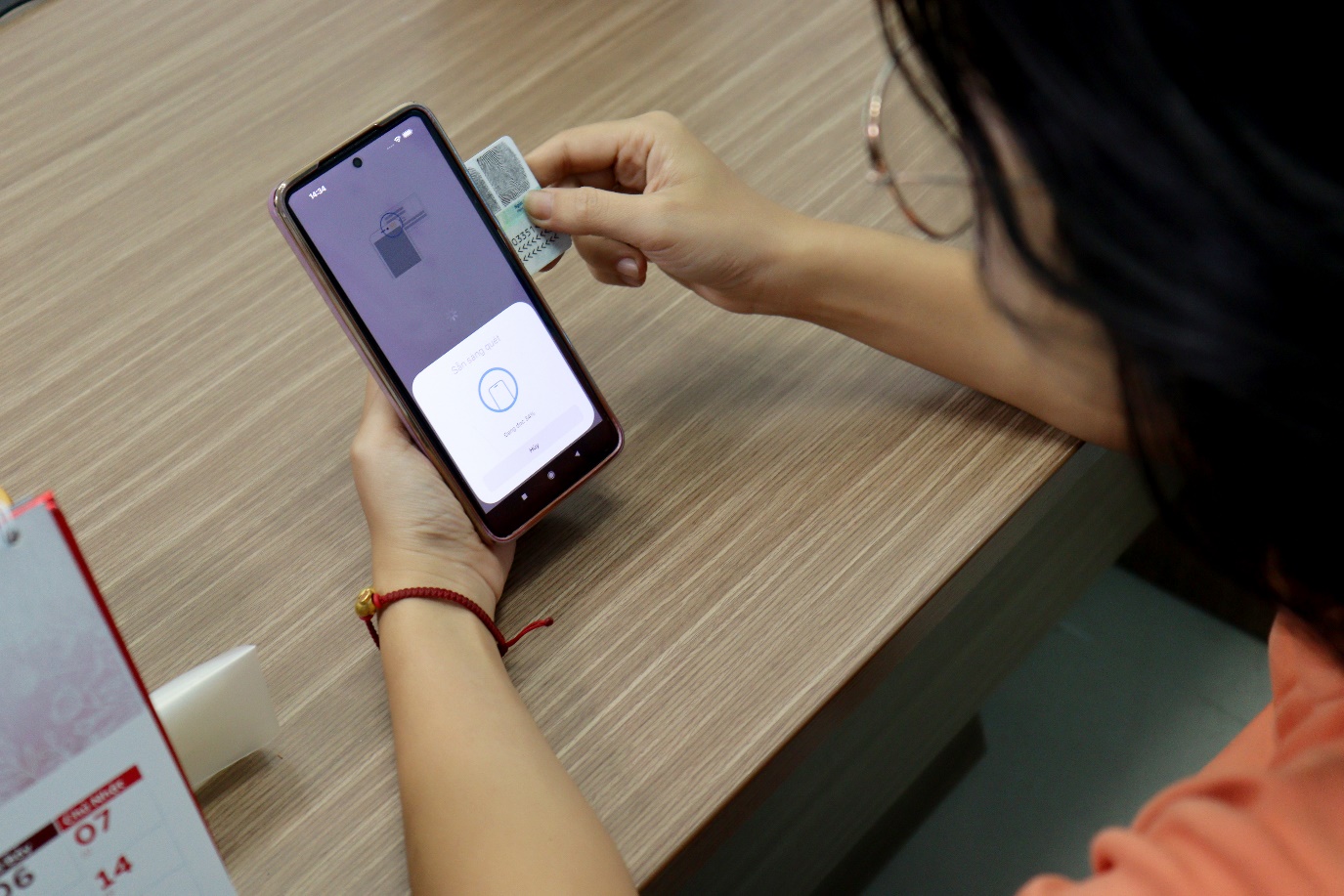

Then, customers can proceed to scan the CCCD using NFC technology on their mobile device. Slowly move the CCCD close to the phone and keep it in place for 3-4 seconds to allow the Digimi mobile banking app to read the information from the CCCD chip.

The final step is facial authentication. The Digimi mobile banking app will provide specific instructions, and customers should follow them carefully, performing the process slowly and holding their pose for a few seconds to avoid having to repeat it multiple times.

Simple 4-step guide to facial biometric authentication by BVBank

What to Do If Your Phone Doesn’t Support NFC?

For customers who have a chip-embedded CCCD but use a phone that does not support NFC, it is necessary to visit a BVBank branch. There, they can match their biometric data with the data stored in the CCCD chip through the bank’s CCCD chip-reading device or phone.

No Need to Panic for Customers Who Rarely Transfer Large Amounts

Customers who rarely make money transfers over VND 10 million need not worry if they haven’t completed the biometric data update by July 1. After this date, transactions below VND 10 million per transaction or a total amount below VND 20 million per day will still be allowed without facial authentication. Customers can update their biometric data at a later date when they need to perform a transaction exceeding VND 10 million.

According to experts, facial biometric authentication will help reduce instances of fraud and protect customers’ assets. A representative from BVBank explains that NFC-based biometric authentication utilizes magnetic induction to connect devices (smartphones, tablets, etc.) to chip-embedded CCCDs for data transfer, enabling individual identification and verification through facial recognition. This technology is considered the most secure and virtually impossible to counterfeit, ensuring the safety of customers when performing financial transactions. It prevents unauthorized access and minimizes the risk of fraud, providing peace of mind and trust for online transactions, especially for high-value transfers.

This solution also allows regulatory authorities and service providers to accurately identify account holders, transaction initiators, and beneficiaries. This not only safeguards customers’ accounts but also helps banks reduce the risk of fraud.