The Commission for the Management of State Capital at Enterprises (CMSC) is a government agency responsible for managing state capital in businesses. The Vietnamese government has entrusted CMSC with the rights and responsibilities of state ownership in enterprises wholly owned by the state and state-owned capital invested in joint-stock companies and limited liability companies with two members or more, as stipulated by law.

Specifically, CMSC directly represents state ownership in 19 enterprises, including seven large groups: Vietnam National Petroleum Group (Petrolimex); Vietnam Chemicals Group (Vinachem); Vietnam Electricity (EVN); Vietnam Oil and Gas Group (PVN); Vietnam Rubber Group (VRG); Vietnam National Coal-Mineral Industries Group (TKV); and Vietnam Posts and Telecommunications Group (VNPT).

Along with these, there are 11 general corporations, including: State Capital Investment Corporation (SCIC); Vietnam Airlines Corporation; MobiFone Telecommunications Corporation; Vietnam National Tobacco Corporation (Vinataba); Vietnam Maritime Corporation (Vinalines); Vietnam Railways Corporation (VNR); Vietnam Highway Development and Construction Corporation (VEC); Airports Corporation of Vietnam (ACV); Vietnam National Coffee Corporation (Vinacafe); Southern Food Corporation (Vinafood 2); Northern Food Corporation (Vinafood 1); and Vietnam Forestry Corporation (Vinafor).

These are all leading groups and corporations in the country.

According to statistics, in 2023, the consolidated total assets of 17/19 Groups and General Corporations under CMSC, excluding Mobifone and VEC, amounted to nearly VND 2,390,000 billion. Of this, PVN alone accounted for over VND 1,000,000 billion in total assets.

Earlier, at the seminar “State Capital Management in Enterprises: Looking Back and Moving Forward,” CMSC reported that in 2022 alone, the combined total revenue of the 19 groups and general corporations reached VND 1,870,000 billion, accounting for 20% of the country’s GDP. The consolidated pre-tax profit was VND 103,309 billion, and consolidated state budget contribution was VND 227,990 billion.

The consolidated net revenue of 17/19 enterprises was approximately VND 1,770,000 billion, mainly from PVN with nearly VND 517,000 billion and EVN with over VND 500,000 billion. In addition, two other enterprises also recorded net revenue of over VND 100,000 billion: Petrolimex (approximately VND 274,000 billion) and Vinacomin (nearly VND 142,000 billion).

Among the enterprises for which CMSC represents state ownership, PVN is the largest in scale. As of December 31, 2023, PVN’s total assets exceeded VND 1,000,000 billion, an increase of 2.4% compared to the beginning of the year, making it the only non-bank enterprise with assets surpassing the VND 1,000,000 billion threshold. PVN’s owner’s equity stood at VND 532,000 billion.

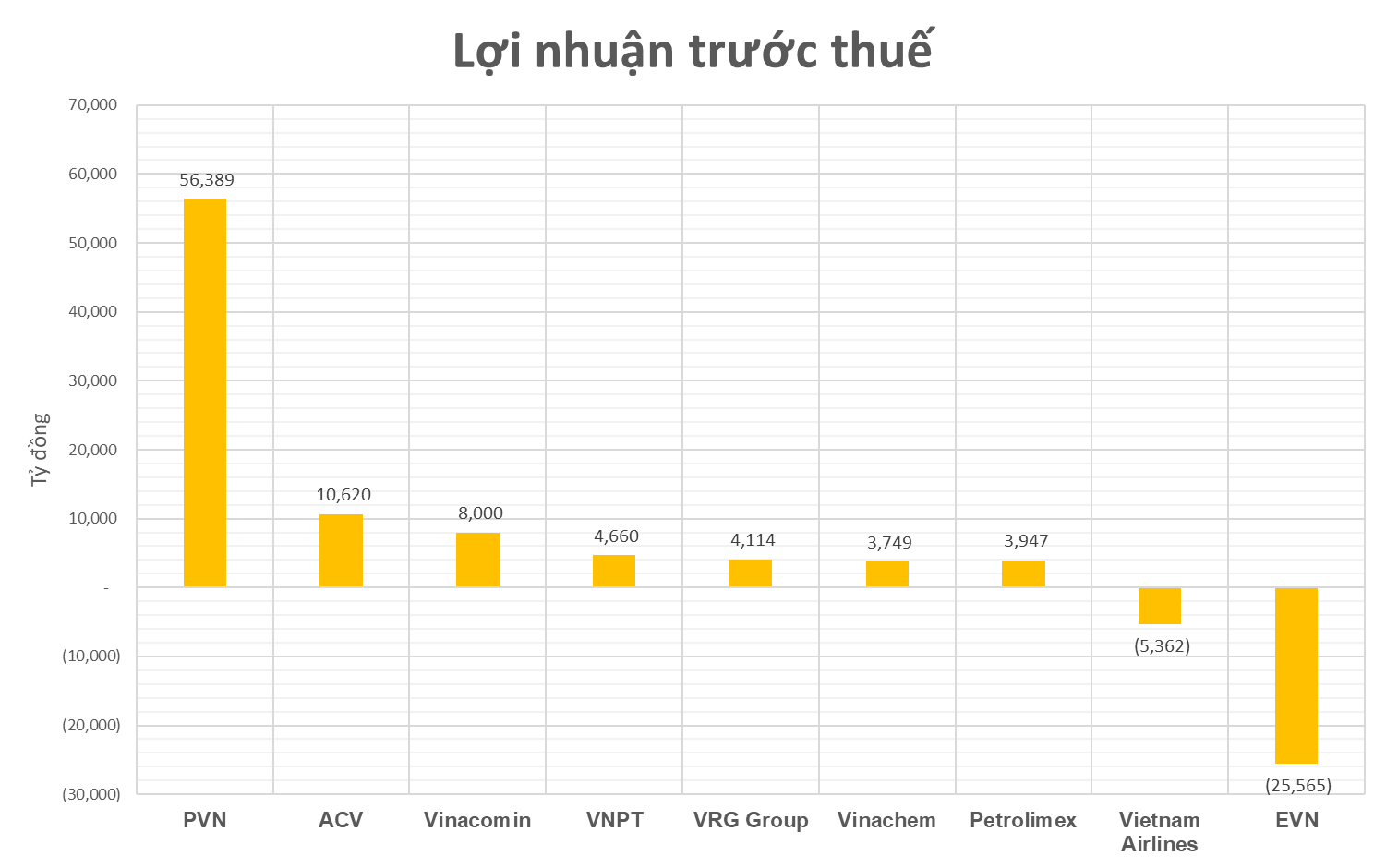

In 2023, PVN recorded net revenue of nearly VND 517,000 billion, a decrease of nearly 8% compared to the previous year. Most of the revenue came from commercial and distribution activities, accounting for 41% of revenue excluding inter-sector sales, and oil and gas processing activities, accounting for nearly 26%. Pre-tax profit was VND 56,390 billion, a decrease of 26% compared to 2022.

Apart from PVN, one other enterprise recorded pre-tax profit above VND 10,000 billion: ACV with VND 10,620 billion. This was followed by Vinacomin with a profit of VND 8,000 billion. Most of the remaining enterprises reported pre-tax profits of a few thousand billion VND, with Petrolimex, Vinachem, VRG Group, and VNPT earning between VND 3,700 and VND 4,700 billion.

Notably, EVN and Vietnam Airlines reported losses. Specifically, in the past year, EVN recorded a pre-tax loss of VND 25,565 billion, and Vietnam Airlines lost VND 5,362 billion.

Regarding Vietnam Airlines, while its profit has improved compared to the loss of nearly VND 11,000 billion in 2022, this is the fourth consecutive year of loss for the airline. As of December 31, 2023, Vietnam Airlines’ accumulated loss exceeded VND 41,000 billion.

In 2024, the airline targets a revenue of nearly VND 106,000 billion, an increase of 13.6% compared to the previous year. If achieved, this will be a record revenue for the enterprise. Vietnam Airlines also expects to make a post-tax profit of more than VND 4,233 billion in 2023, with a projected profit for the parent company of VND 105 billion.

As for EVN, despite achieving a record revenue of VND 500,719 billion, an increase of 8.1% over the previous year, it incurred a pre-tax loss of VND 25,565 billion in 2023, compared to a loss of VND 18,613 billion in the previous year.

Explaining this situation, Mr. Nguyen Anh Tuan, General Director of the Vietnam Electricity Group (EVN), said that despite efforts to reduce costs and two retail price adjustments, they could not offset the high cost of purchased electricity. As a result, EVN could not balance its production and business results in 2023. With consecutive heavy losses in the past two years, EVN is currently facing accumulated losses of over VND 41,800 billion.

Additionally, some enterprises represented by CMSC have accumulated losses of thousands of billion VND, despite making profits in 2023. These include Vietnam Railways with accumulated losses of VND 2,080 billion, Vinacafe with VND 1,090 billion, Vinafood 2 with VND 2,778 billion, and VIMC with VND 240 billion.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.