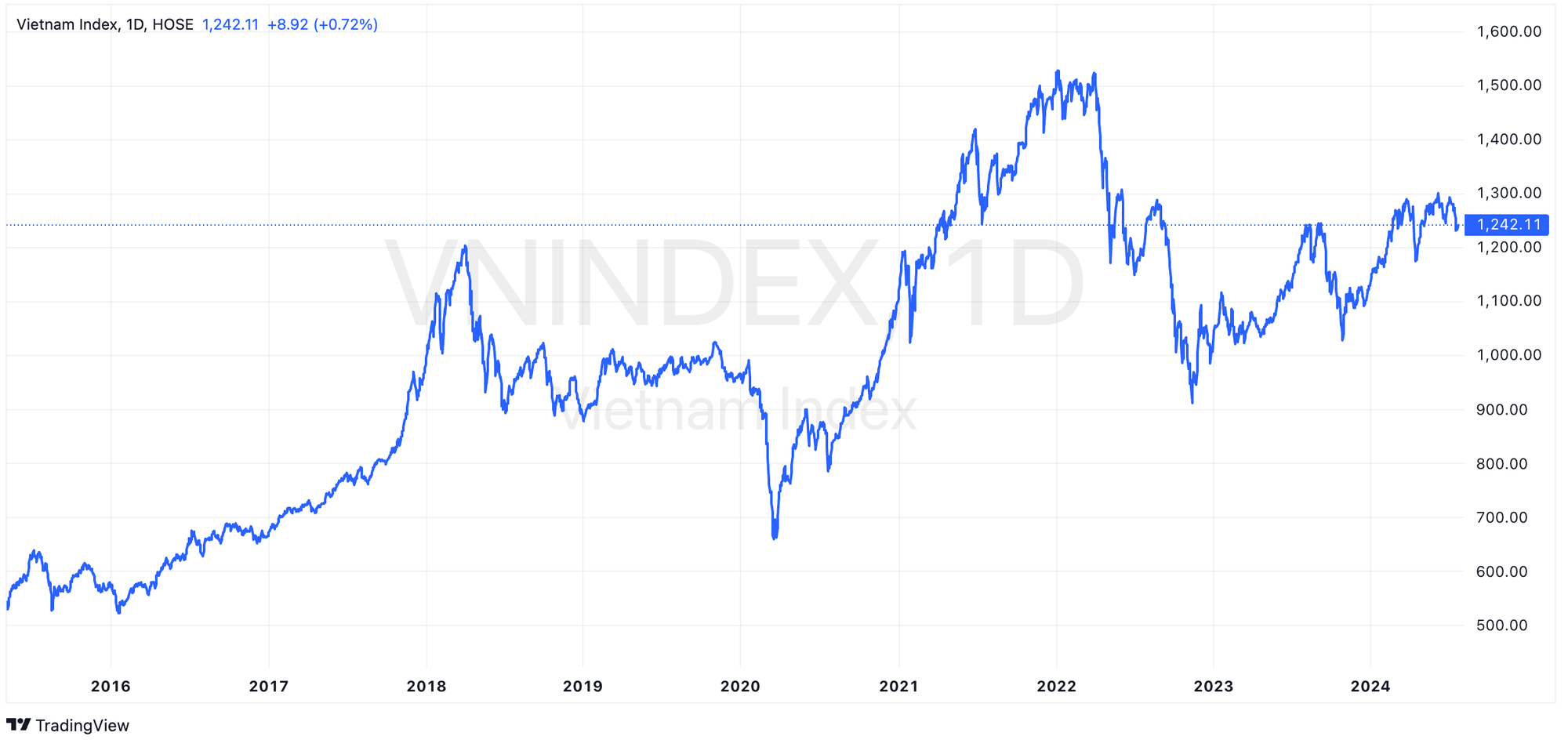

The VN-Index continued its downward trend, falling by nearly 23 points, or 1.8%, to 1,242.1 during the trading week of July 22-26.

Specifically, the VN-Index fell sharply in the first two sessions of the week, followed by a technical recovery in the latter part of the week, with liquidity declining. This week, BCM (+6.9%), MSN (+4.2%), and VIC (+2.1%) were the main drivers of the market. In contrast, HVN (-20.1%), BID (-3%), and CTG (-4%) put pressure on the index.

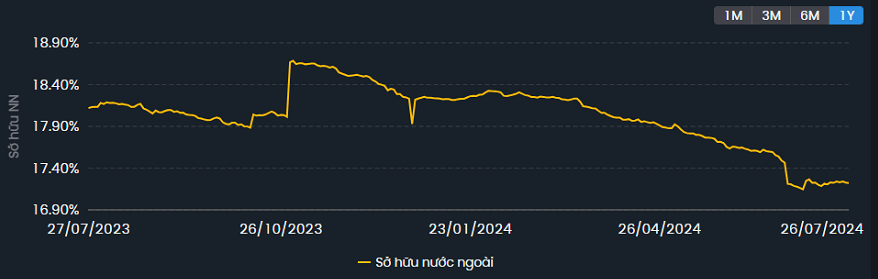

Liquidity decreased by 17% compared to the previous week. Foreign investors unexpectedly returned to net buying, mainly in negotiated deals, while they continued to net sell over VND 400 billion in matched orders.

Commenting on the market trend for the coming week, experts are cautious as the main index fell sharply and liquidity declined during the VN-Index’s correction phase. However, according to experts, the market still has many opportunities, and the story is to choose the right stocks for the next six months.

Start building an investment portfolio for a 6-12 month horizon

According to Mr. Dinh Quang Hinh, Head of Macroeconomics and Market Strategy, VNDIRECT Analysis Division, the VN-INDEX shows signs of bottoming out and recovering after falling to the lowest level of 1,218 points in the past trading week. Notably, selling pressure has weakened significantly, while buying demand has shown slight improvement in the last trading sessions.

Entering the new trading week, the market trend can be confirmed as important information is about to be released, including July’s domestic macroeconomic data, the Fed’s updates from the late July meeting on the path of interest rate cuts, and especially the deadline for listed companies to announce their Q2 business results.

In the base-case scenario, VNDirect experts expect the VN-Index to build a base and accumulate again in the range of 1,230-1,260 points in the coming week. With the market valuation becoming more attractive, mid- and long-term investors can “start building an investment portfolio for a 6-12 month horizon,” focusing on sectors with improved business prospects, such as banking, consumer-retail, and import-export.

In contrast, short-term traders need to wait for the market to “confirm the short-term trend” and “improvement in cash flow” before increasing their stock holdings.

Short-term trend turns bearish, V-shaped recovery scenario unlikely

According to Mr. Nguyen Anh Khoa, Head of Research, Agriseco Securities, the selling pressure during the downward session mainly came from domestic individuals. The VN-Index has rebounded after reacting to the 1,220-point region. However, the short-term trend has turned bearish, and selling pressure may increase again as the VN-Index approaches the 1,250 (+-5) point region in the coming sessions. Mr. Khoa believes that the scenario of a V-shaped recovery, which some investors in the market are hoping for, is unlikely, especially given the current strong selling pressure from individual investors.

The decline in liquidity during the VN-Index’s correction phase reflects the market’s cautious sentiment. Investors had high expectations for a brighter economic outlook and continued profit recovery in Q2/2024. Along with this, after the market’s recent correction, the VN-Index is in a technical rebound phase and has not yet clearly determined the next trend, which also makes investors hesitant to increase disbursement at this stage.

According to the expert from Agriseco, investors can expect a reversal in foreign capital flows to occur soon as the Fed cuts its policy rate in September, narrowing the interest rate differential and reducing pressure on exchange rates. The VN-Index adjustment brings the market and stock valuations to reasonable levels, which could attract foreign investment inflows.

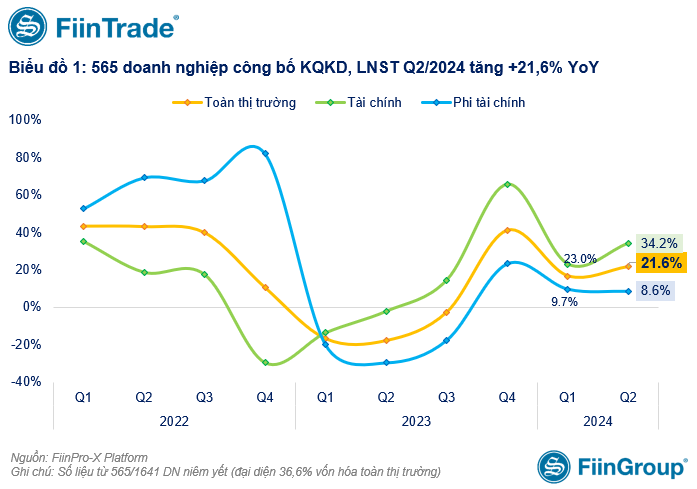

Regarding the ongoing earnings season, companies are gradually revealing their Q2 financial statements. Currently, nearly 600 listed companies have announced their financial statements or provided estimates for Q2/2024. Among them, net profit increased by 21.6% over the same period, higher than the 16.7% growth rate in Q1. This is a positive signal, indicating that the economy is still recovering, as reflected in the business results of listed companies.

However, there is a clear differentiation between sectors, and this differentiation may continue in Q3 and the second half of 2024 as the low base effect of the same period last year fades. Therefore, investment decisions and opportunities need to be made carefully.

Currently, the market has only gone through a correction phase, bringing the VN-Index to the lower bound of the accumulation range, thereby bringing the valuations of many stocks to more reasonable levels for accumulation. Mr. Khoa recommends that investors can open buying positions during the market correction, prioritizing banks and the VN30 group, focusing on leading stocks whose prices have been deeply discounted.

The story of choosing the right stocks for the next six months

More positively, Mr. Bui Van Huy – Director of DSC Securities Branch in Ho Chi Minh City assesses that the domestic and global contexts do not raise significant concerns. The global stock market fluctuated somewhat due to profit-taking in technology stocks, which flowed into other sectors. Inter-market factors are not overly worrying.

Similarly, domestic factors are also not too concerning. Last week showed that foreign investment transactions seemed to be gradually balancing again. Regarding margin lending, although the absolute number hit a record high, in my capacity as a person working in the industry, I believe that the supply capacity of many securities companies after the series of capital increases is still abundant. At the same time, as mentioned many times, securities companies now perform part of the lending function of banks, so the absolute number is high, but the risk is not high.

The VN-Index recovered slightly at the end of the week and held the 1,240-point level, but many strong stocks broke through their 3-6-month highs. This indicates that money is not leaving the market but rotating into stocks with solid fundamentals, positive Q2/2024 business results, and growth potential in the last six months of 2024. According to Mr. Huy, the question is not whether the VN-Index will recover but rather the story of choosing the right stocks for the next six months.

“I expect a recovery for the VN-Index, although next week, the market will have to face the question of whether liquidity will return. The 1,240 level is relatively important at the moment, and if the market holds above this level next week, along with the return of liquidity, market sentiment will be more stable after the recent events,” said Mr. Huy.

The highlight of the half-year financial report season is the clear differentiation between businesses in the same industry. Sectors with improved business performance and outstanding profit growth compared to the same period were retail, textiles, rubber, banking, fertilizer, steel, and water transport. Notably, the banking sector maintained a good profit growth rate despite the challenges anticipated earlier.

There were also many disappointments in the “Non-financial” group, such as some real estate construction companies and a few securities companies, and some businesses reported losses. However, overall, the Q2 earnings season is going as expected and reflects the recovery in the performance of listed companies.

Mr. Huy recommends that investors observe and select stocks from sectors that develop with the economy. In addition, with foreign direct investment (FDI) in the first six months of 2024 being the highest for the same period in the last five years, the industrial real estate sector has much potential to benefit.