In recent years, a boom in small- and medium-sized convenience stores has been observed in Vietnam. These stores provide essential daily items along with dining options and free air-conditioning and wifi.

According to economic experts, modern retail channels account for 25% of the market share in Vietnam’s modern retail market, indicating significant room for growth. With a young demographic, there is a growing preference for modern shopping channels over traditional grocery stores.

Additionally, the rise of the middle class and the development of the tourism industry are also driving the growth of the convenience store sector.

CONVENIENCE STORES: LEADING THE GROWTH IN VIETNAM’S RETAIL MARKET

According to the General Statistics Office, in 2023, the total retail sales of goods and consumer services reached VND 6,231.8 trillion, a 9.6% increase from 2022. Among the various retail formats, convenience stores are one of the fastest-growing models in Vietnam’s modern retail sector.

Although they account for a small proportion of total retail goods revenue (approximately 0.3%), this format has witnessed strong growth, with a CAGR of about 18.4% during the 2020-2022 period.

In fact, this sector has long been a vibrant playground for domestic and foreign brands, with thousands of stores nationwide. Alongside foreign brands such as Circle K, FamilyMart, and Ministop, many Vietnamese corporations are also eyeing a piece of the pie with ambitious plans. These include Co.op Smile by Saigon Co.op, Winmart+ by Masan, and FujiMart by the BRG Group and Japan.

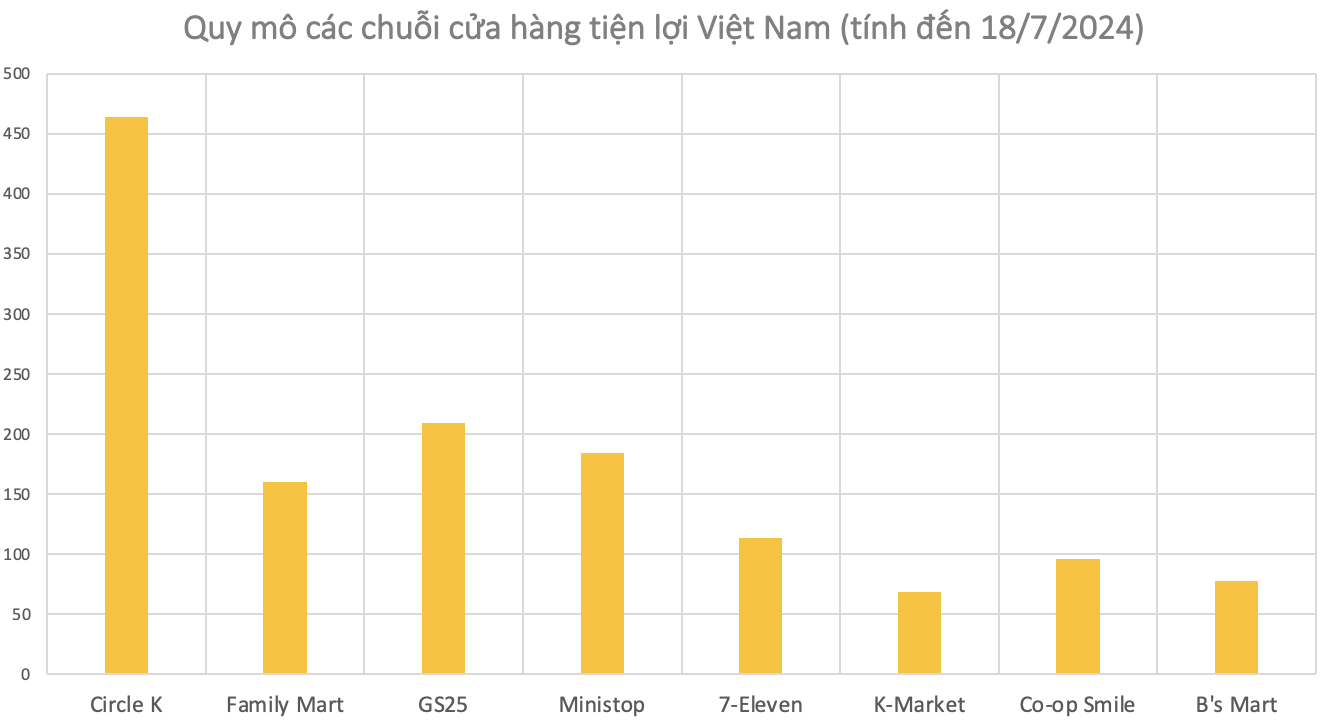

Source: Tri Túc Synthesis

CIRCLE K LEADS THE WAY, WHILE GS25 AND FAMILY MART COMPETE FOR SECOND PLACE IN THE RACE TO VND 1.5 TRILLION IN REVENUE

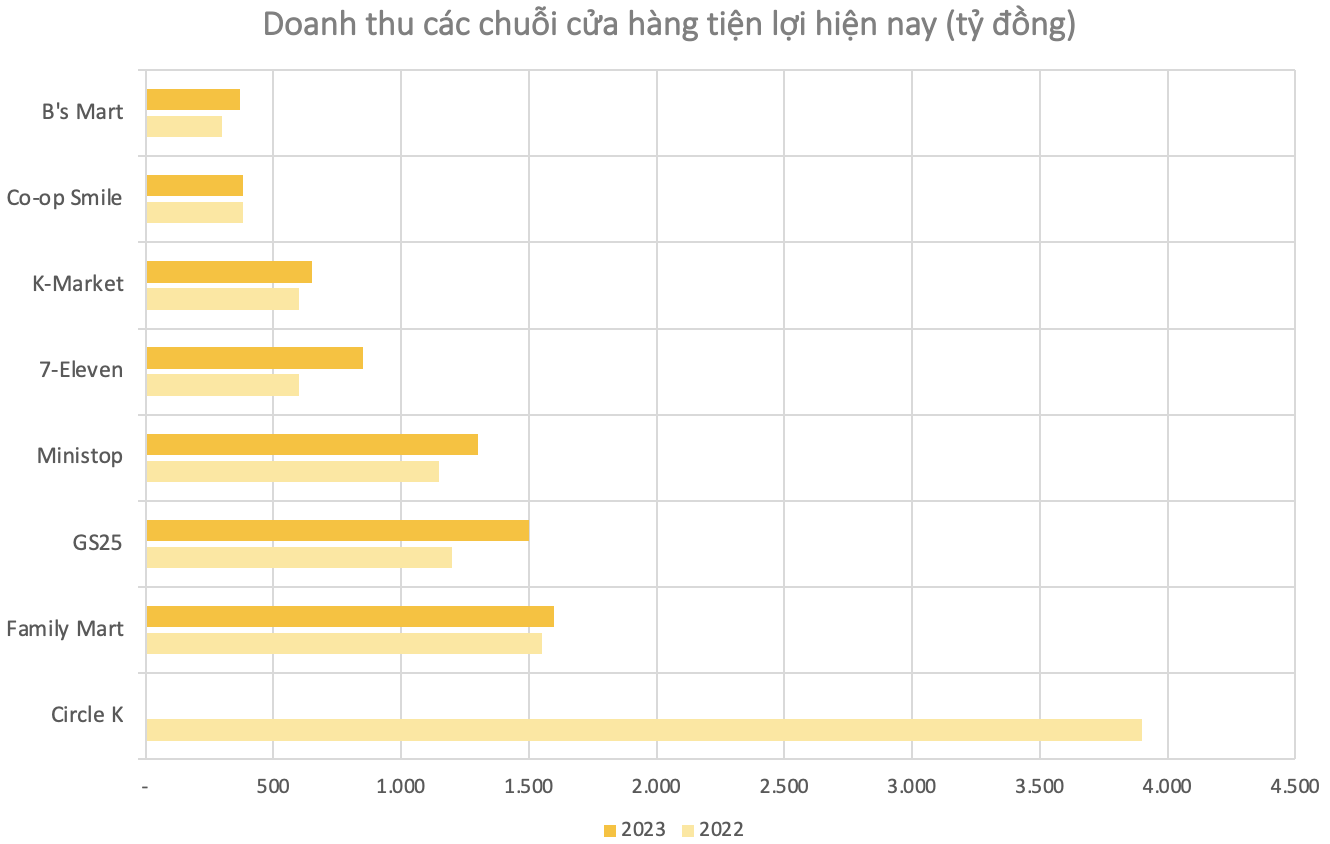

The fertility of the market is evident in the annual revenue of these chains. Despite the crowded market, foreign brands are still raking in thousands of billions of VND in revenue each year from their convenience store operations in Vietnam.

At the top is Circle K, according to data from Vietdata. In 2022, the chain’s revenue far outpaced its competitors, reaching nearly VND 4,000 billion. As of July 18, 2024, Circle K also boasts the widest reach in Vietnam with a total of 464 stores.

Circle K was the first international convenience store chain to enter Vietnam, arriving in 2008. Today, Circle K continues to win over Vietnamese customers with its innovative automatic payment systems, modern QR code scanning, and diverse delivery services through applications like Grab, ShopeeFood, and NowFood…

Following Circle K is a close race between GS25 and Family Mart, with revenues in the region of VND 1,500 billion in 2022 and 2023. Family Mart, the third-largest convenience store chain in Japan, is gradually establishing its presence in the Vietnamese market.

Family Mart set an ambitious target of owning 1,500-2,500 stores in 2023. However, as of July 2024, the number of Family Mart stores in Vietnam has only reached 160. Nevertheless, Family Mart Vietnam has shown positive signs, with consistent revenue growth over the past three years, reaching VND 1,600 billion in 2023 and gradually reducing losses.

GS25, a newcomer to the market since 2018, can be considered one of the younger players. Owned by GS25 Vietnam, a joint venture between GS Retail Korea (holding 30% stake) and Son Kim Retail JSC, GS25 has benefited from substantial investment and a clear development strategy. Their revenue in Vietnam has grown steadily during the 2021-2023 period, surpassing VND 1,500 billion in 2023, a 23% increase compared to the previous year.

Other players like B’s Mart, Co-op Smile, and K-Market have also generated billions of VND in revenue from the market.

According to a survey by Nielsen Vietnam Market Research Company, Circle K currently leads the market with a 48% share, followed by Family Mart at 18.8%, Ministop at 14.3%, and 7-Eleven at 7.3%. Explaining the reason for foreign companies’ heavy investment in convenience store systems, Vu Thi Hau, former Chairman of the Vietnam Retailers Association, said that opening a supermarket requires a lot of time to find a location and obtain various permits. In contrast, obtaining permits and finding locations for stores under 500 square meters is not too difficult, and the investment capital is lower than that of supermarkets.

THE RACE TO SEE WHO CAN LOSE MORE

Everything comes at a cost. As vibrant as it is, the modern retail chain market is facing cut-throat competition. Challenges in finding suitable locations and rising rental costs are among the barriers that have caused many units to put their expansion plans on hold.

In the past, Vissan closed nearly 60 stores out of its 100-store convenience store chain. A representative of Vissan once stated that the market competition is very fierce, and if a business is not effective, it is better to close down and find a new direction rather than continue operating.

Similarly, the Japanese convenience store brand Family Mart has, according to industry experts, stopped investing in Vietnam after achieving stability in terms of customer numbers and sales.

GS25, which has been aggressively raising capital, once announced plans to open more than 2,500 stores within ten years, including through franchising. However, as of July 2024, more than six years after entering Vietnam, the chain has over 200 stores in major provinces and cities (mainly in Ho Chi Minh City). Compared to the target of 2,500 stores by 2028, GS25 has only achieved 8% of its plan.

In addition to the race to expand market share, this sales channel also faces intense competition from the booming e-commerce sector. According to the 2023 e-commerce report published by the Ministry of Industry and Trade, 74% of Vietnam’s population regularly participates in online shopping through websites, social media platforms like Facebook and Zalo, and e-commerce floors.

E-commerce B2C revenue in 2023 was estimated at $20.5 billion, a growth of over 25% (an increase of about $4 billion compared to 2022), accounting for 7.8-8% of the total retail sales of goods and consumer services nationwide.

Overall, online shopping channels have been gradually overtaking direct retail channels, including convenience stores.

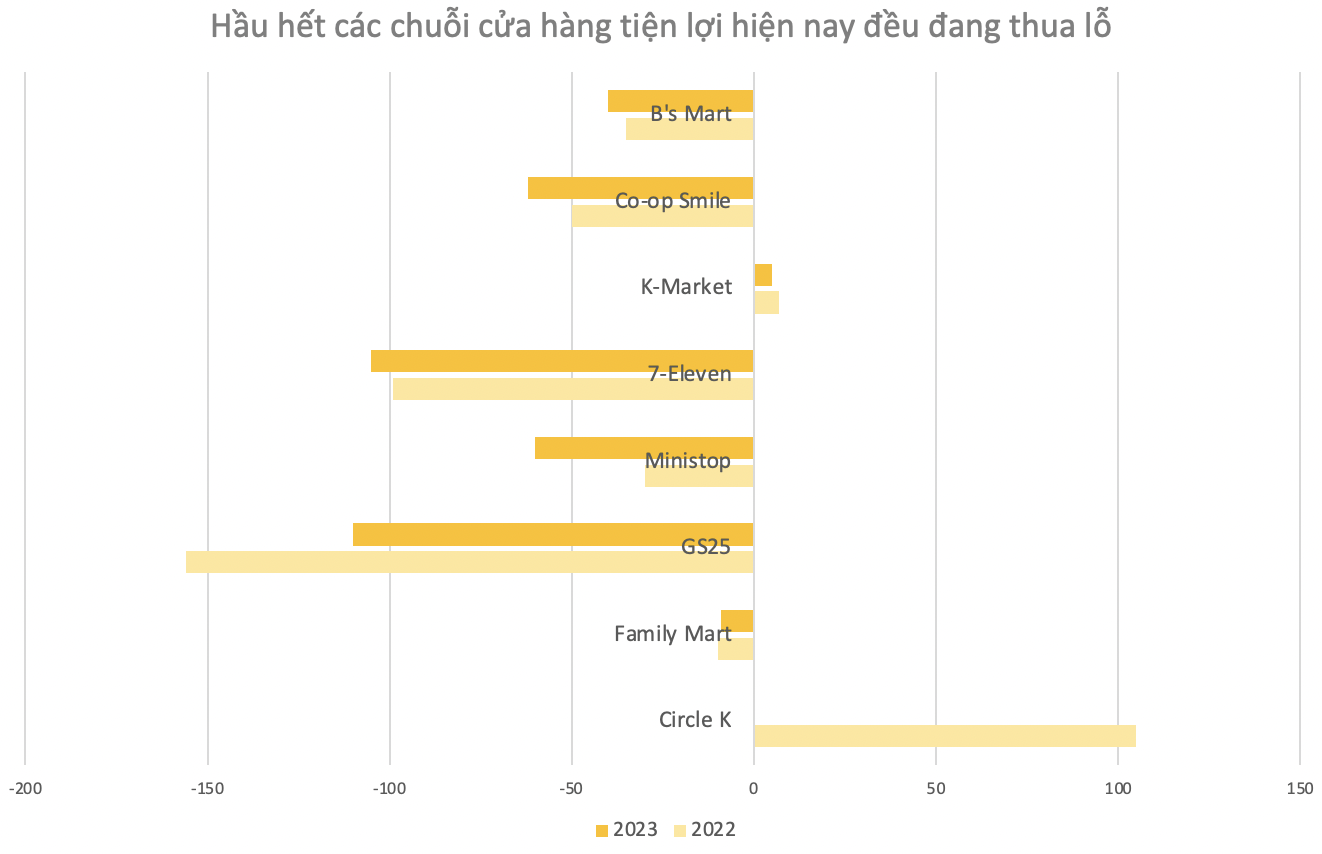

And in this “money-burning” war, most participants are incurring losses.

Leading the pack is GS25, which recorded a loss of over VND 100 billion in 2023. The year before, GS25 lost more than VND 150 billion. 7-Eleven, another player, also suffered losses of over VND 200 billion in the past two consecutive years, 2022 and 2023. Co-op Smile, Saigon Co.op’s new venture, increased its loss by tens of billions in the last year…

Circle K and K-Market are the only two chains that turned a profit.

K-MARKET: A KOREAN-FACED, VIETNAMESE-OWNED BUSINESS

K-Market is the only convenience store chain that has consistently recorded positive profits during the 2021-2023 period.

Making its debut in 2006, K-Market was the first Korean supermarket in Vietnam, serving the Korean community living here. After 18 years, K-Market now operates 69 stores in major cities such as Hanoi, Ho Chi Minh City, and Hai Phong…

The largest K-Market store is located in Golden Place (Me Tri, Hanoi), with an area of 1,200 square meters. It is a complex consisting of various sections, including K-Mart, K-Food, souvenirs, and bakery.

Interestingly, despite its Korean appearance, K-Market is a Vietnamese-owned brand, belonging to K&K Global Trading Co., Ltd. – a Vietnamese company. The Korean element may be attributed to the support of Mr. Ko Sang Goo, Chairman of the Korean Association in Hanoi, who is also a founding advisor of the company.

In addition to operating convenience stores, K-Market, according to its representative, is also a supplier to major retail partners such as AEON, BigC, and Lotte, rather than just a retailer. K&K is an importer of Korean goods to Vietnam, distributing to supermarkets and selling directly within the K- Mart chain, with approximately 3,000 product lines. This strategy has enabled the chain to operate efficiently amid the ongoing war of attrition among its competitors, who are willing to accept losses to gain market share.

Moreover, K-Market has also adopted a cautious approach, focusing on “walking steadily rather than rushing,” as Ms. Nguyen Thuy Ha, Director of K&K Global Trading Co., Ltd., once shared. In K&K’s revenue structure, K-Market contributes 60%, while the import and supply of goods account for 40%.

As a result, while many businesses struggled with losses due to expansion and the impact of the Covid-19 pandemic, K-Market maintained stable revenue growth, achieving an increase of 8.3% in 2022 and 6.9% in 2023, with revenue surpassing VND 650 billion.

A K-Market store in Ho Chi Minh City, Vietnam.

Although K-Market recorded positive profits, its profit figure in 2022 was significantly lower compared to Circle K, which is known to have made a profit of over VND 100 billion in the same year.

EBITDA Continuously Increases for 4 Quarters, WinCommerce Plans to Open 700 More Stores

In 2023, despite the challenges both domestically and internationally, the retail market in Vietnam is gradually becoming a lucrative investment opportunity and a fiercely competitive battleground. Amidst this backdrop, WinCommerce (a subsidiary of Masan Group) emerges as the solution for an optimized store model, expanding networks, and sustaining market share for Vietnamese businesses…