According to information from the Joint Stock Corporation for Investment Development and Construction (DIC Corp, stock code DIG), Mr. Nguyen Thien Tuan, Chairman of the Board of Directors, passed away on August 10th, at the age of 68.

Mr. Nguyen Thien Tuan was born in 1957 in Thanh Hoa province and held a Master’s degree in Economics. He began his career at the age of 21 and, after a decade of hard work, rose through the ranks to become the director of the Ministry of Construction’s guest house in 1990.

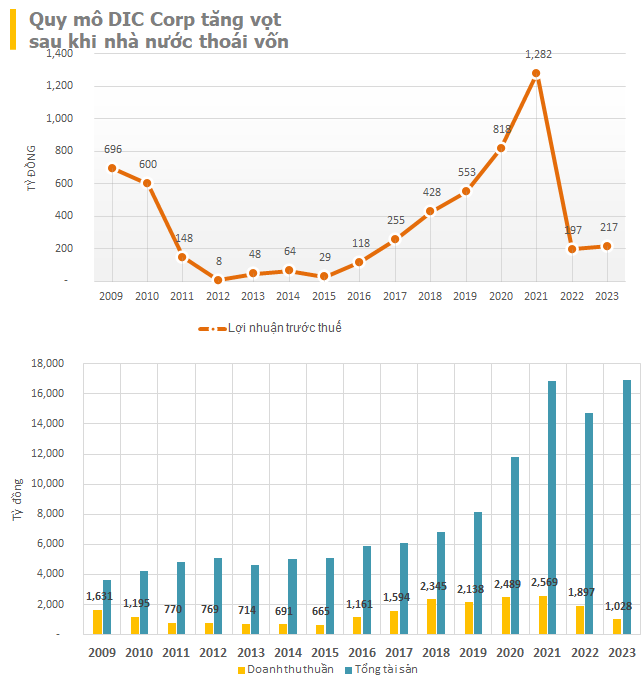

In 2008, DIC, which was previously under the Ministry of Construction, was equitized into the Joint Stock Corporation for Investment Development and Construction (DIC Corp), with its charter capital increased to VND 370 billion and over 30 member companies.

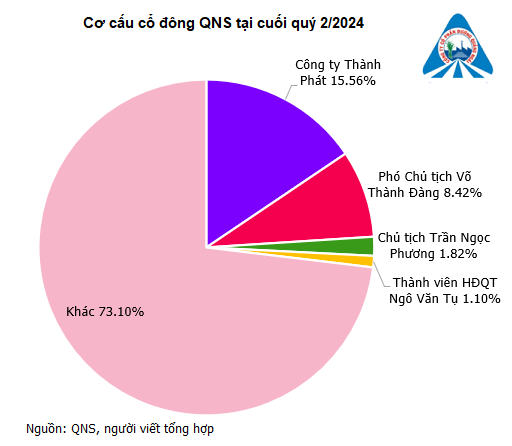

At that time, Mr. Nguyen Thien Tuan, as Chairman and General Director, represented 32.5% of the state capital in DIC Corp. In August 2009, the Company officially listed on the stock exchange with the code DIG.

Under the leadership of Mr. Nguyen Thien Tuan, DIC Corp not only achieved breakthrough developments over the years but also contributed to the transformation of Vung Tau city with large-scale tourism real estate projects such as the Cap Saint Jacques Complex, DIC Star Landmark Vung Tau, and Pullman Hotels & Resorts Vung Tau…

Owning over 800 hectares of land and developing a range of resort real estate, transforming the face of Vung Tau beach city

Over 34 years of establishment and development under Mr. Nguyen Thien Tuan’s leadership, DIC Corp has made significant imprints and become one of the leading real estate companies in Vietnam with a brand value of VND 18,444.5 billion and owner’s equity of over VND 7,889 billion.

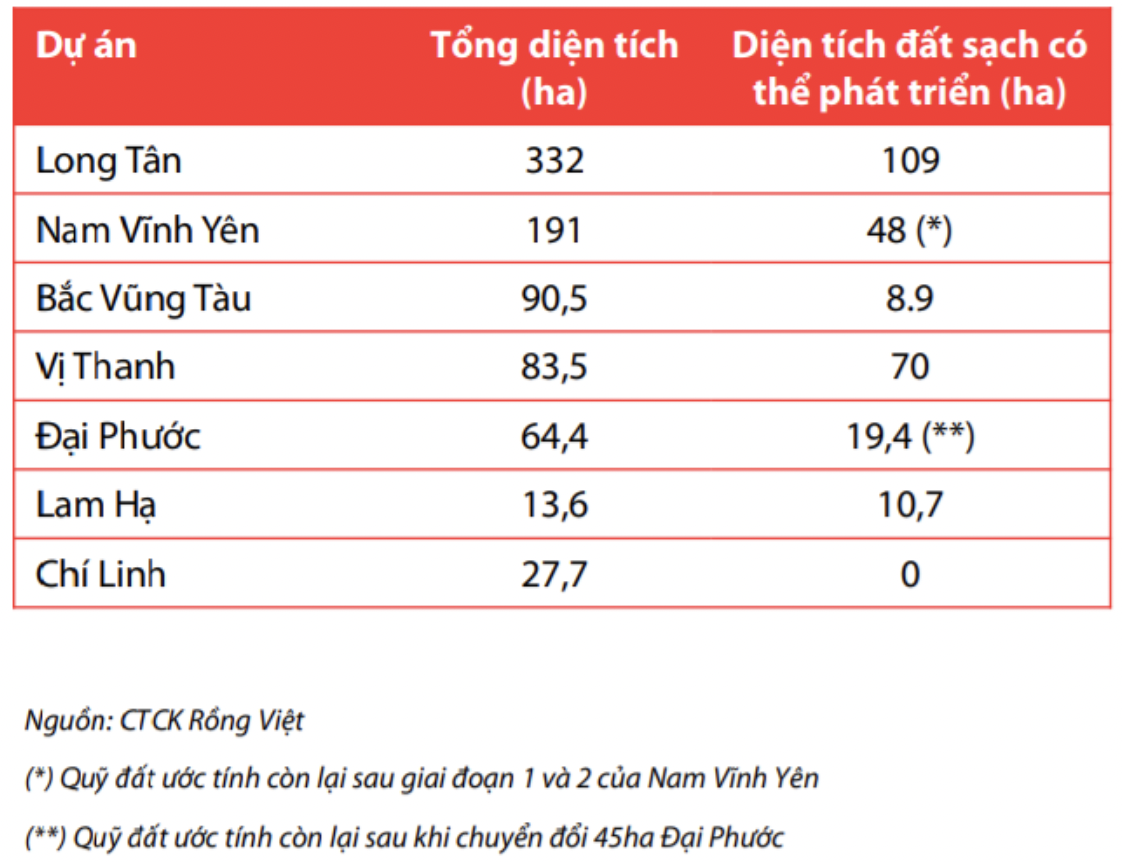

Currently, the Company owns several large-scale projects under the DIC Star brand in Vung Tau, Hau Giang, Quang Binh, and other provinces in the field of resorts, as well as large-scale urban areas such as DIC Chi Linh City (99.7 hectares), DIC Solar City Vung Tau (90.5 hectares), DIC Phu My Ba Ria (35 hectares), and more, with a total land fund of over 800 hectares.

Figure: Statistics of land funds and large urban projects of DIC Corp.

Every year, DIG earns thousands of billions of VND in revenue and hundreds of billions in profits. In 2023, despite challenges in the market, DIG still achieved VND 1,039 billion in revenue and nearly VND 118 billion in net profit.

For 2024, DIC Corp set a plan to achieve a revenue of VND 2,300 billion, an increase of 72%, and a projected profit before tax of VND 1,010 billion, a surge of 509% compared to the performance in 2023. In the first six months of the year, the Company’s consolidated revenue reached approximately VND 875 billion, and the profit before tax was VND 40 billion, fulfilling 38% of the revenue plan and about 4% of the profit plan.

The late Chairman’s ambitious legacy

2024 also marks the beginning of the late Chairman’s ambitious plans. “My biggest mistake was only focusing on urban areas and neglecting industrial zones, missing out on a significant source of revenue. Now, the opportunity has presented itself, and it’s a once-in-a-millennium chance. Industrial zones must now be eco-industrial zones. If we don’t adapt, we will be left behind, and our revenue will decline. All urban areas are now being developed with this eco-friendly orientation,” Mr. Tuan shared with shareholders at the recent 2024 Annual General Meeting of Shareholders.

Mr. Tuan mentioned that DIC Corp is eyeing four land areas for eco-industrial zone development: Chau Duc II with a scale of 1,000 hectares (including 400 hectares for urban areas), for which they have reached an agreement with Ba Ria-Vung Tau province; Pham Van Hai with 270 hectares, where they are seeking to become the investor; Hang Gon at the end of the Long Thanh-Dau Giay highway, which has 400 hectares of rubber tree land; and Long Son, a joint venture with a partner, where DIC could own 30%.

“We must focus on developing eco-industrial zones. Now, investors are frantically searching for land, offering rents as high as $500/m2, but there are no more available land plots. If existing industrial zones adjust and upgrade themselves into eco-industrial zones, rents could increase by 50% to 100%,” Mr. Tuan added.

In addition to industrial zones, the DIC Corp management also intends to expand into the tourism sector, including golf courses, and has ambitions in renewable energy, starting with plans to bid for a power plant in My Xuan, Ba Ria-Vung Tau.

Regarding tourism, the Company aims to sell its remaining ownership in the Pullman Hotel and, in return, develop two hotels on Thuy Van Street, Vung Tau city (formerly the guest house for officers and employees) and strive to purchase additional land to build six blocks of hotels (maximum height of 32 floors and a minimum of 25 floors) in the Chi Linh area.

The Company also plans to build two cities in southern Thanh Hoa and Vung Tau, as these two provinces boast long coastlines and high-quality medical centers catering primarily to foreigners. According to Mr. Tuan, there is a significant population of Japanese and Korean nationals living and working in Vietnam without their families, and they are willing to stay in the country for 10-20 years.

Additionally, the Company is considering purchasing a golf course, which includes 6 hectares of land earmarked for a 5-star hotel. DIC Corp recently established a company to manage the golf course, which could be operated by foreigners (from South Korea or Japan). By calculations, the Company has about 20 locations nationwide that are potential sites for golf courses, and the site in Dong Hoi, Quang Binh province, has already compensated for most of the area.

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.