Services

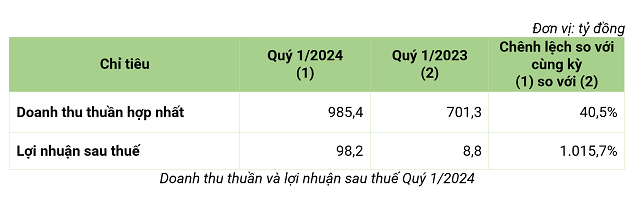

For the first quarter of 2024, Bamboo Capital Group recorded net revenue of VND 985.4 billion, a 40.5% increase compared to the same period in 2023. The primary contributors to revenue were renewable energy (VND 320.4 billion) accounting for 32.5%, infrastructure construction (VND 222.1 billion) accounting for 22.5%, real estate (VND 209.8 billion) accounting for 21.3%, and financial services (VND 185.7 billion) accounting for 18.8% of the Group’s total revenue.

The renewable energy division contributed VND 320.4 billion, representing 32.5% of Bamboo Capital’s revenue for the first quarter of 2024.

|

BCG Energy’s renewable energy division, after years of substantial investment, has proven its worth by emerging as the largest contributor to Bamboo Capital’s revenue. The financial services division, with significant contributions from AAA Insurance Corporation, also increased its revenue share to 18.8% (compared to 11% in the same period last year). This indicates that Bamboo Capital’s revenue structure has been evenly distributed across its core business segments, including renewable energy, construction, infrastructure, real estate, and financial services.

|

Bamboo Capital’s consolidated after-tax profit for the first quarter reached VND 98.2 billion, more than ten times higher than the same period last year. In addition to revenue growth, another significant factor that enabled Bamboo Capital to achieve this significant profit increase was its effective control over interest expenses. Specifically, the Group’s interest expenses decreased by VND 129.4 billion compared to the same period last year, representing a 32.7% reduction. The reduction in interest expenses was due to proactive efforts to repay debts and loans in 2023 to mitigate financial risks.

|

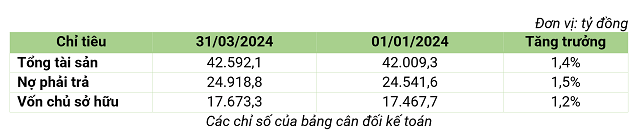

As of March 31, 2024, Bamboo Capital’s total assets reached VND 42,592.1 billion, a slight increase of 1.4% compared to the beginning of the year. The Group’s equity reached VND 17,673.3 billion, also a modest increase of 1.2%. Overall, the indicators in Bamboo Capital’s balance sheet maintained stability, with no significant changes compared to the end of 2023.

|

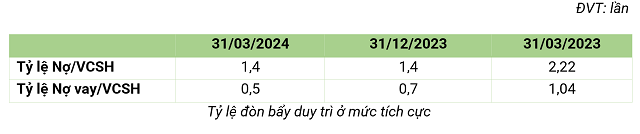

With a focus on maintaining asset quality, ensuring financial health, and creating room for future capital mobilization for projects, Bamboo Capital continued to proactively repay loans and debts to partners. Consequently, the debt-to-equity ratio was maintained at a secure level of 1.4 times, comparable to the level recorded at the end of 2023. Additionally, the debt-to-equity ratio further decreased to 0.5 times, compared to over 1 time in the first quarter of 2023.

In the cash flow statement, the net cash flow from investing activities was negative VND 298 billion at the end of the first quarter of 2024 due to the acquisition of Tam Sinh Nghia Investment – Development JSC by subsidiary BCG Energy to invest in the construction of a waste-to-energy incineration plant. The cash flow from operating activities was negative VND 432 billion, partly due to a portion of the investment in Tam Sinh Nghia being transferred to a partner to develop advanced waste incineration technology. On the other hand, net cash flow from financing activities recorded VND 62 billion in the first quarter of 2024 due to a capital increase by AAA Insurance Corporation.

On April 1, 2024, the Prime Minister approved the plan to implement the National Power Development Plan for the period 2021-2030, with a vision to 2050, aiming to increase the contribution of renewable energy to 30.9 – 39.2% by 2030 and target 67.5% – 71.5% by 2050. The implementation of Power Plan VIII not only marks a significant step forward in the electricity industry but also opens up growth opportunities for the renewable energy sector.

BCG Energy, a member of Bamboo Capital, currently owns a portfolio of up to nearly 1 GW approved under Power Plan VIII with a vision to implement by 2030. Notably, a series of large-scale wind power projects, including Dong Thanh 1 (80 MW) and Dong Thanh 2 (120 MW) in Tra Vinh province; and Khai Long 1 (100 MW) in Ca Mau, will be developed by BCG Energy this year and are expected to be operational in 2025. Once operational, these projects will increase BCG Energy’s total generation capacity by approximately 53%.

Perspective of the modern waste-to-energy incineration plant with an investment capital of over VND 5,000 billion that BCG Energy will build in Ho Chi Minh City during the period 2024-2025.

|

Significantly, during the 2024-2025 period, BCG Energy will construct a state-of-the-art waste-to-energy incineration plant in Ho Chi Minh City with an investment capital of over VND 5,000 billion. The plant will have a capacity to burn 2,000 tons of waste per day and night, generating 40 MW of electricity. In subsequent phases, BCG Energy’s waste-to-energy incineration plant can increase its processing capacity to 5,200 tons of waste per day and generate up to 130 MW of electricity, becoming one of the largest plants of its kind in the world. Concurrently, BCG Energy is also building waste-to-energy incineration plants in Long An, Kien Giang, and other provinces and cities. By continuing to drive the development of renewable energy projects under Power Plan VIII and constructing additional large-scale waste-to-energy plants, BCG Energy will continue to make positive contributions to the consolidated financial results of Bamboo Capital Group.

According to the 2024 shareholders’ meeting documents published by Bamboo Capital, the Group aims for consolidated total revenue of VND 6,102.5 billion and consolidated after-tax profit of VND 951.7 billion in 2024. Compared to the results achieved in 2023, Bamboo Capital Group’s 2024 business plan projects a 152% increase in revenue and a 556% increase in profit. Bamboo Capital’s 2024 annual general meeting of shareholders will be held virtually on April 27, 2024.