September 16, 2024, will mark a significant turning point in Vietnam’s telecommunications industry as the 2G network will officially cease to serve subscribers using 2G-only mobile phones. This is the first step in the roadmap to discontinue 2G technology, as announced by the Ministry of Information and Communications on July 5, 2024.

This decision is part of the government’s strategy to develop telecommunications infrastructure and promote smartphone penetration, with the aim of boosting 4G/5G mobile services and ensuring that every citizen owns a smartphone by 2030. This also means that consumers need to quickly adapt and upgrade their devices to avoid communication disruptions.

In fact, a wave of phone replacements and upgrades to affordable smartphones or 4G-enabled feature phones has been taking place very “noisy”. At a recent online investor meeting, Doan Hong Viet – Chairman of the Board of Digiworld (DGW) opined that this trend will support the growth of the ICT segment.

Sharing the same view, a research report by DSC Securities also assessed Digiworld’s growth potential this year as quite positive, benefiting from (1) the 2G shutdown in September 2024, (2) the cycle of renewal of mobile phones and computers will take place and (3) diversification of product portfolio.

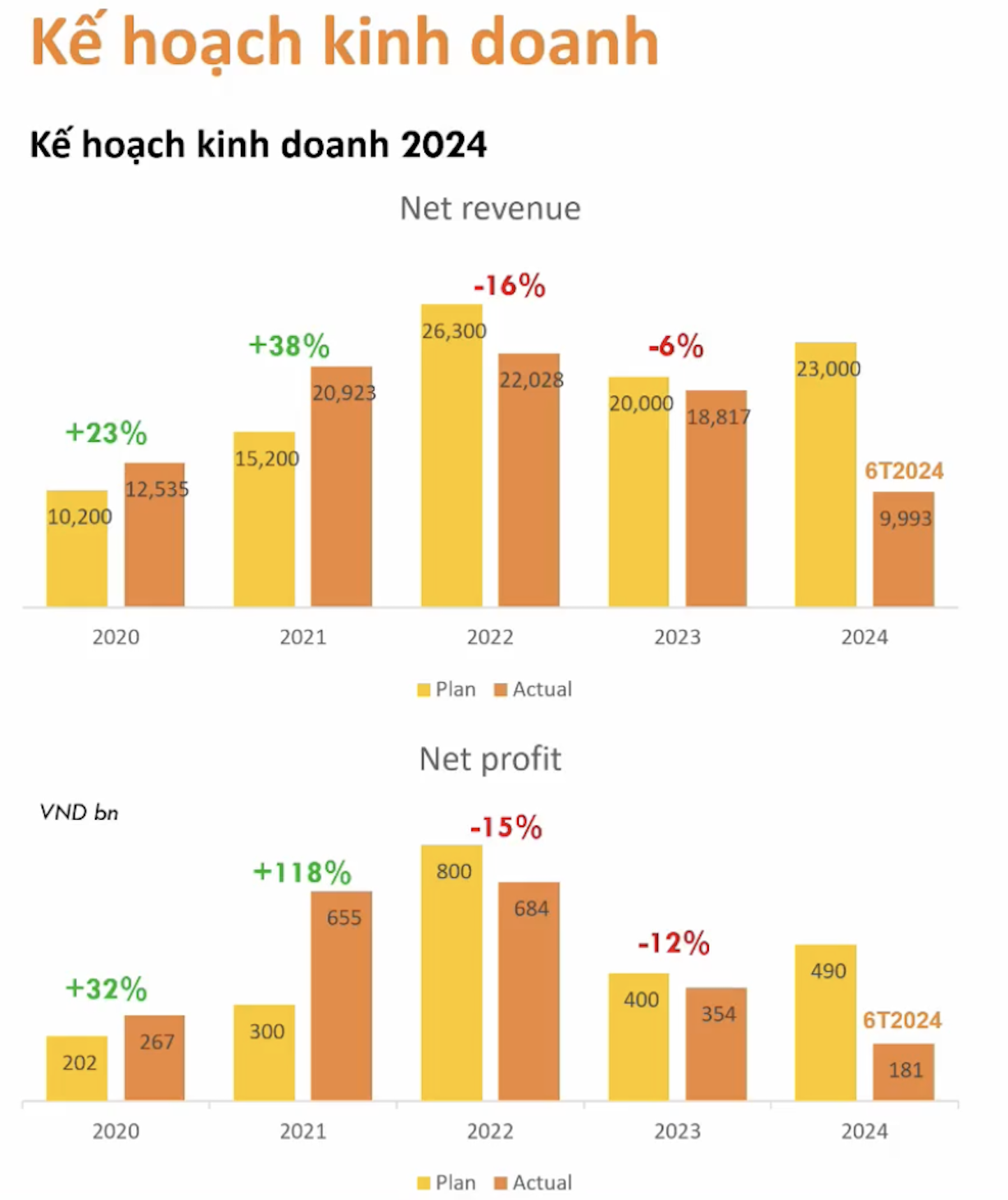

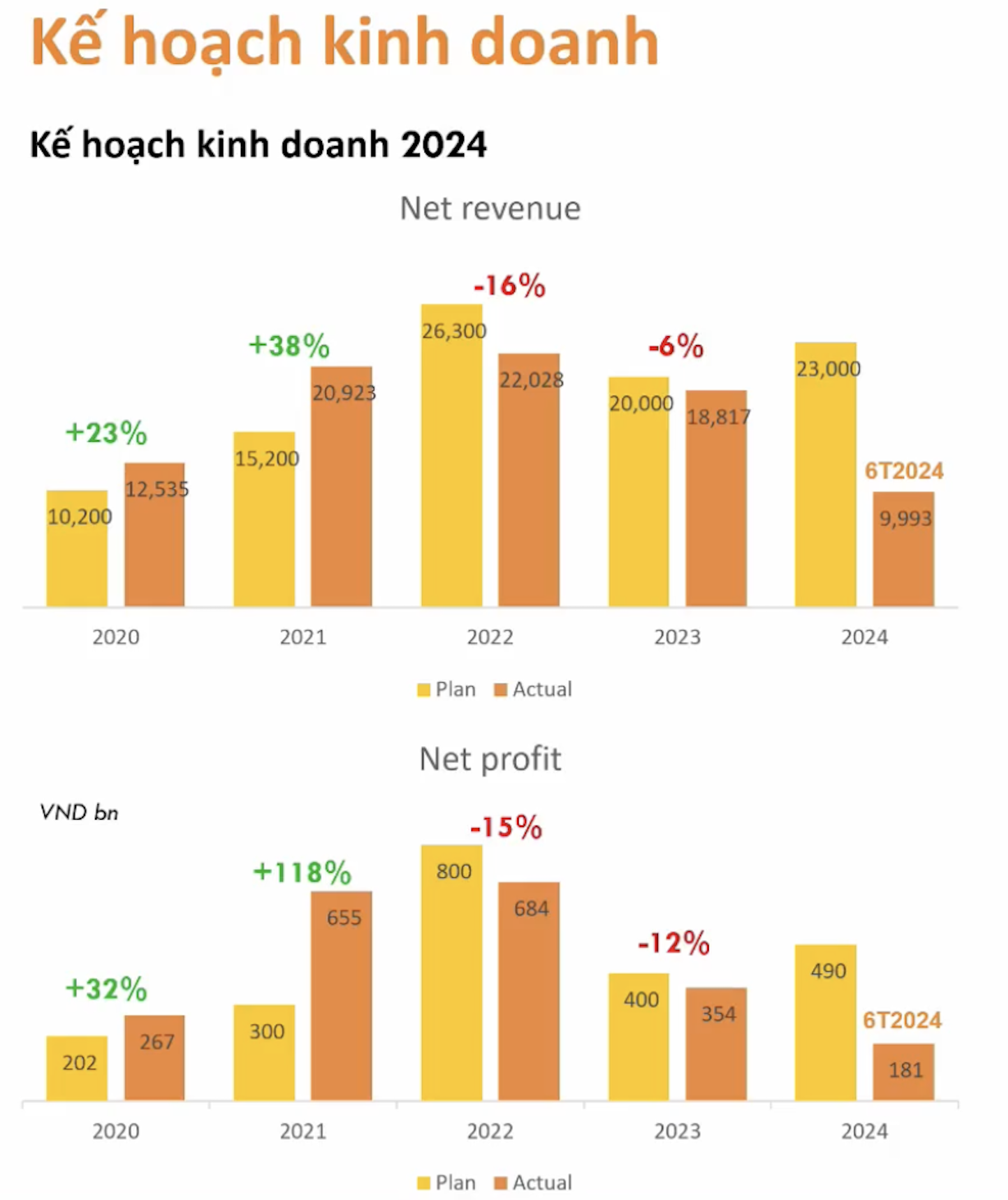

In 2024, Digiworld has set ambitious business plans with targets of VND 23,000 billion in net revenue and VND 490 billion in net profit, up 22% and 38% respectively compared to the realized figures in 2023. Apart from the phone business, due to the slow recovery in demand, Digiworld expects double-digit growth in all other segments.

In the context of the ICT segment finding it challenging to maintain good growth in the coming years, Digiworld has carried out a series of M&A deals while moving towards product portfolio diversification to create new profit growth drivers, thereby reducing dependence on the ICT segment.

In the third quarter, Digiworld will distribute all MSI products and add some Xiaomi products such as refrigerators and air conditioners. The laptop segment is expected to grow during the “back to school” season along with the trend of AI laptops. “AI will strongly drive the demand for computer replacement. It is predicted that by 2027, about 70-80% of laptops sold will have AI support. This trend will favor the laptop market,” emphasized the Chairman of Digiworld.

In terms of business plans for the third quarter, Digiworld sets a target of VND 6,000 billion in net revenue and VND 120 billion in profit after tax, up 11% and 18% respectively over the same period in 2023. Previously, Digiworld announced business results for the second quarter of 2024 with revenue of VND 5,020 billion and net profit of VND 90 billion, up 9% and 8% respectively over the same period last year. This is the second consecutive quarter that the company has recorded positive profit growth compared to the same period last year.

With the idle cash on hand, Digiworld will focus on M&A instead of financial investments (stocks, bonds) like some other companies. M&A will also be a bridge for Digiworld to “go global” in the future but not a priority for now. Doan Hong Viet said that the domestic market is still wide open for Digiworld to grow and this is simpler than “going global.”

Unraveling Digiworld: Has the ICT Segment’s Contribution to Revenue Declined, and What Has the M&A Strategy Achieved?

“Despite a notable improvement in revenue for the ICT sector, reaching 75%, DSC Securities predicts a potential decline in the contribution of this sector to overall revenue. This is attributed to the faster growth rate of other business segments, which could overshadow the ICT sector’s performance in the future.”