Illustration

In recent years, a wave of credit card payments has swept through Vietnam, riding the tide of the growing “cashless” trend. Among the various options available, cashback credit cards have become a favorite among consumers due to their ability to provide cash rewards on purchases.

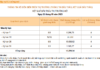

A survey of 30 commercial banks and several digital banks in the country revealed approximately 60 credit card lines offering cashback services, with rates ranging from 0.1% to 20%.

Specifically, some credit cards currently offer the highest cashback rate of 20%, including the Cake Freedom and VieON Cake credit cards from Cake by VPBank, MSB’s Mastercard mDigi, MSB Visa Online, and OCB MasterCard Lifestyle.

Cake by VPBank, a digital bank, has recently updated its cashback policy for the Cake Freedom and VieON Cake credit cards, effective for transactions from the September 2024 billing cycle.

Cake by VPBank has expanded the number of eligible cashback categories from 5 to 12, including both fixed and flexible categories. The three fixed categories for cashback are e-commerce platforms, travel agencies and tour operators, and fashion.

Starting from the September 2024 billing cycle, customers can enjoy a 20% cashback of up to 1,000,000 VND per billing cycle across these three fixed categories and two flexible categories of their choice when using the Cake Freedom and VieON Cake credit cards.

For each spending category in each billing cycle, the maximum cashback amount depends on the transaction value. For transactions of 200,000 VND or more, the maximum cashback is 50,000 VND. For transactions below 200,000 VND, the maximum cashback is 10,000 VND. For the Supermarket category, only one transaction per day is eligible for cashback, and it applies to the first transaction only.

Another credit card offering a cashback rate of up to 20% is MSB’s Mastercard mDigi, with a maximum cashback of 300,000 VND per billing cycle. Cardholders can choose to receive cashback in categories such as dining, coffee, travel, hotels, and digital entertainment.

Similarly, the MSB Visa Online card offers a 20% cashback, equivalent to 300,000 VND per month (up to 3,600,000 VND per year), when purchasing movie tickets online from partner cinemas. In addition, cardholders can also enjoy a 10% cashback on all online shopping spends at popular e-commerce platforms: Shopee, Tiki, Lazada, Amazon, Alibaba, and Ebay.

OCB, a leading bank in Vietnam, offers its OCB MasterCard Lifestyle cardholders a 20% cashback on movie ticket purchases through partner cinemas. Additionally, cardholders can receive a 3% cashback on online shopping transactions.

OCB is one of the banks offering the best cashback credit cards in Vietnam.

In addition to the above-mentioned credit cards, several other banks offer lines of credit with cashback rates of up to 15%. For example, Sacombank’s JCB Ultimate card offers a 15% cashback on dining transactions made abroad during the weekend. Domestic dining transactions made during the weekend are eligible for a 10% cashback.

VPBank also boasts an impressive lineup of credit cards with cashback rates of up to 15%, including the VPBank Lady MasterCard and VPBank StepUP cards.

There are also several credit cards on the market offering a 10% cashback rate, such as VIB Cash Back from VIB Bank, Visa Platinum/Signature from ACB, MSB (Visa Signature/Signature Mfirst), Happy Digital from NamABank, OCB Mastercard Platinum, TPBank Evo Visa, and VPBank (Diamond World/Diamond World Lady).

For those seeking lower cashback rates, there are options ranging from 0% to under 10%. These include Visa travel/cashback cards from ABBank, JCB/Visa cards from Eximbank offering between 0.5% to 8% cashback, HDBank VietJet Platinum with a 0.3% cashback, and SeABank cards offering between 0.3% to 8% cashback depending on the card type.

With attractive cashback offers, consumers can strategically combine promotions from brands with credit card benefits to save significantly on their expenses, while banks also benefit from increased card usage.

Today, most banks offer a diverse range of credit cards to cater to different customer segments. Typically, cards with higher cashback rates come with higher spending requirements or annual fees. Therefore, it is essential for consumers to carefully consider their spending habits and financial situation before choosing a credit card that best suits their needs.