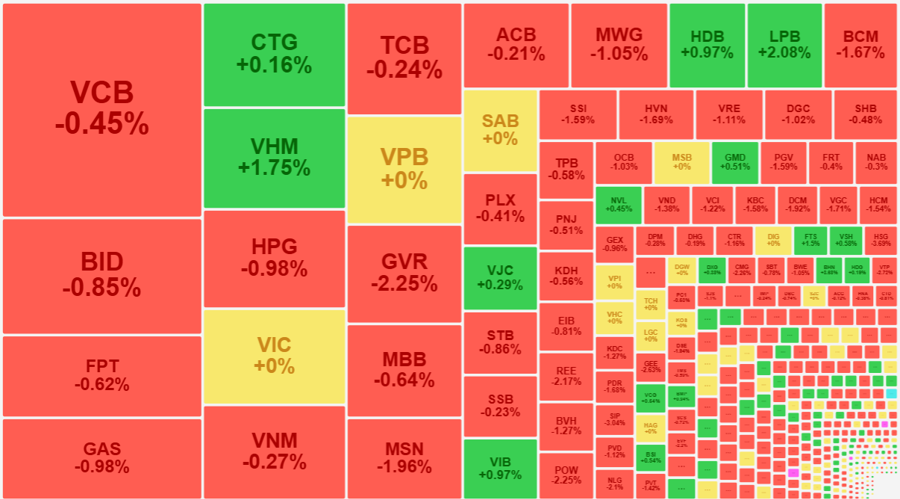

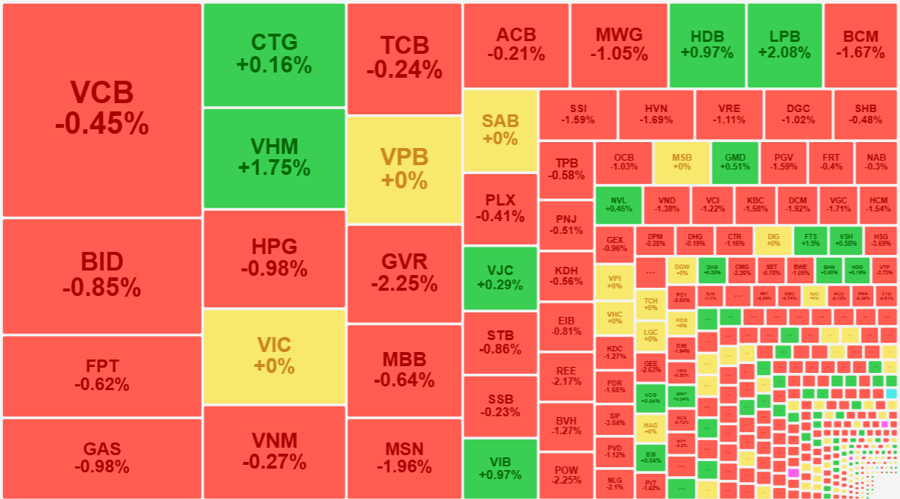

Blue-chip stocks remained relatively stable in the final minutes of the futures expiration session, but the pressure on small and mid-cap stocks intensified significantly. The VN-Index closed slightly lower by 0.55%, with 125 stocks (34.2% of HoSE codes) falling by more than 1%, while blue chips contributed only 8 codes.

The stocks that fell by more than 1% in the VN30 basket were not the largest caps either. In the top 10 market caps that fell deeply, GAS and HPG lost only 0.98%. Expanding to the top 15 caps, GVR appeared with a decrease of 2.25% and MSN decreased by 1.96%.

The stocks that plunged the most among the blue chips, apart from GVR and MSN, were POW, down 2.25%, BCM down 1.67%, SSI down 1.59%, and BVH down 1.27%… These are not stocks that can seriously affect the indexes. The VN30-Index closed down 0.4% with 5 gainers and 22 losers. In the last 15 minutes of the continuous matching phase and the ATC phase (the time for calculating the final settlement price on the futures expiration day), the index fluctuated normally, concluding a relatively peaceful expiration session, despite the heavy damage to stocks.

Indeed, although the representative indexes fell slightly (Midcap also lost only 0.46%, and Smallcap decreased by 0.76%), 125 stocks on the HoSE closed with a decrease of more than 1%. This group accounted for about 38.4% of the total trading value of the exchange. Many stocks fell sharply with large liquidity compared to the general background, such as HSG falling 3.69%, matching 219.4 billion VND; PDR down 1.68% matching 132.1 billion; DCM decreased by 1.92% with a match of 125.5 billion VND; CSV fell 5.35% with 120.5 billion; and NKG decreased by 2.7% with 99.7 billion… The group of MWG, SSI, MSN, and VRE also fell by more than 1% with liquidity of hundreds of billions of VND each code.

The HoSE also had about 30 stocks falling between 3% and 6%, all in the mid-cap and small-cap groups. The downward trend in this group even intensified in the afternoon session, indicating that selling pressure increased as money flow was too weak.

The two-floor matching transactions this afternoon also increased 34% in liquidity compared to the morning session, reaching 6,150 billion VND. However, this is still the afternoon session with the lowest liquidity in the last 15 days.

From an index perspective, the VN-Index’s adjustment of 6.8 points is not significant, but it is still the second-strongest decline in the upward momentum from the bottom on August 5. The index turned downward after a gain of about 3.6%. This range is slightly larger than the recovery momentum at the end of July but is still within the limit of a technical bounce. The index is in a bad state when blue-chip stocks are losing strength. Although the pillars today have not fallen much (less than 1%), the weakness is evident. The liquidity of the VN30 group decreased significantly, as the four sessions this week averaged only 5,441 billion VND/day, a decrease of 29% compared to the previous week’s average.

For blue chips, weak money flow is never a good sign, as capitalization weight makes it difficult for prices to rise. Weak money flow can only help prices hold steady if sellers don’t dump their stocks.

The group that went against the market trend this session had 109 codes, but the majority had unreliable liquidity. Trading in just a few million or 1-2 billion VND made the price increase – even a sharp increase – more misleading than substantial. A few notable stocks were VHM, up 1.75% with a liquidity of 671.5 billion VND, FTS up 1.5% matching 144.7 billion; LPB increased by 2.08% with 127.4 billion; HHV rose 3.59% with 83.8 billion; and KSB increased by 1.38% with 15.9 billion.

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.