Vietnam National Reinsurance Corporation (VNR) has announced that September 12th will be the record date for a cash dividend payment for the year 2023. The payment date is expected to be September 27th, with a dividend rate of 10% per share.

With nearly 166 million shares outstanding, the insurance company will have to spend approximately VND 166 billion on this dividend payment.

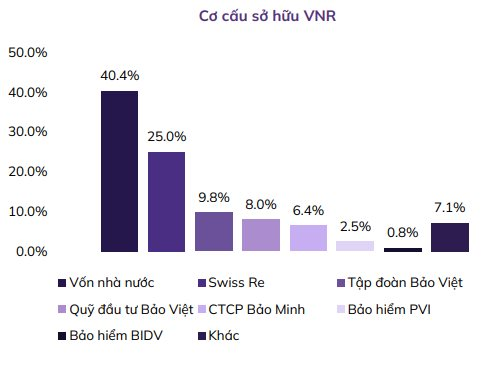

As of June 30, 2024, the State Capital Investment Corporation (SCIC) was VNR’s largest shareholder, owning 40.36% of the shares and expected to receive nearly VND 67 billion in dividends. The second largest shareholder is Swiss Reinsurance Company, holding 25% of the shares, and will receive more than VND 41 billion in dividends.

Source: ABS Report

Vietnam National Reinsurance Corporation (VNR) was formerly known as Vietnam National Reinsurance Company, established in 1994. In 2005, the company transformed its business model and became a joint-stock company on March 13, 2006.

VNR’s main business is accepting and ceding reinsurance for all non-life and life insurance businesses in the domestic and foreign markets, as well as financial investments such as government bonds, stocks, corporate bonds, real estate, and capital contributions to other enterprises.

In a recent report, An Binh Securities (ABS) assessed VNR as one of the strongest companies in the reinsurance market. Additionally, VNR has strategic shareholders, including some of Vietnam’s largest insurance companies, such as Bao Viet Insurance and BIDV Insurance, which contribute to VNR’s leading market share in reinsurance.

In the second quarter of 2024, VNR’s net revenue from insurance business activities reached VND 449 billion, a 5.7% increase compared to the same period last year. However, total direct insurance business expenses decreased by 7.3% year-on-year to VND 336 billion due to a lower claims ratio, which fell from 85.2% in the second quarter of 2023 to 74.7% in the same period this year.

As a result, VNR recorded a gross profit from insurance business of VND 114 billion, a significant increase of 81% compared to the same period in 2023. This was also the highest quarterly profit in the company’s history for this segment.

After deducting other expenses, the company’s post-tax profit reached VND 156 billion, a substantial increase of 44% compared to the previous year. For the first six months of 2024, post-tax profit stood at VND 301 billion, a slight decrease of 5.2% year-on-year.

According to ABS, the Vietnamese insurance market is on a recovery trend as public trust in the industry returns and demand for insurance increases from businesses and individuals as the economy rebounds. This bodes well for VNR’s expansion plans and enhances its revenue potential from reinsurance, especially considering that VNR’s affiliated partners are leading companies in the insurance sector.

The ABS analysis team forecasts that VNR’s post-tax profit attributable to shareholders in 2024 will reach VND 529 billion, representing a 28% growth compared to 2023.

Profit from Sugarcane, Durian, and Leafy Vegetables with the Lunar New Year approaching

Good news for farmers in the Mekong Delta provinces as the prices of sugarcane, durian, and vegetables… have skyrocketed during the days leading up to the Lunar New Year, providing them with attractive sources of income.