Illustrative image

China’s decision to ban urea exports in late 2023 sent shockwaves through global markets. As recently as 2020, China was the world’s second-largest exporter of fertilizers, only behind Russia.

However, soaring prices, particularly after the conflict in Ukraine, have forced Beijing to impose export restrictions, which they periodically loosen and tighten depending on circumstances. China’s export disruptions have prompted many Asian countries, including Japan, to turn to Vietnam for their fertilizer needs.

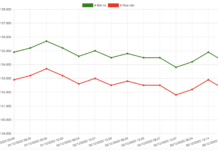

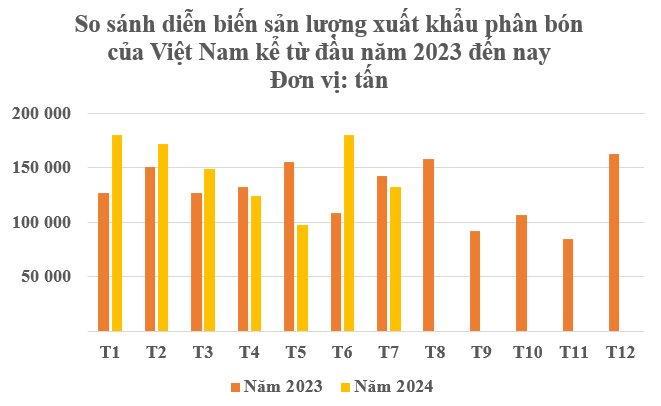

According to preliminary statistics from the General Department of Vietnam Customs, in July, Vietnam exported over 132,000 tons of fertilizers, valued at more than $58 million, representing a 23.6% decrease in volume and an 8.5% decline in value compared to the previous month.

Cumulatively, in the first seven months of 2024, Vietnam exported over 1.03 million tons of fertilizers, totaling nearly $420.32 million, reflecting a 9.7% increase in volume and a 7.5% rise compared to the same period in 2023.

Vietnam’s fertilizers are mainly exported to the Cambodian market, which accounts for 30.8% of the total volume and 31.5% of the total export value of fertilizers from Vietnam, with over 318,000 tons worth $132 million.

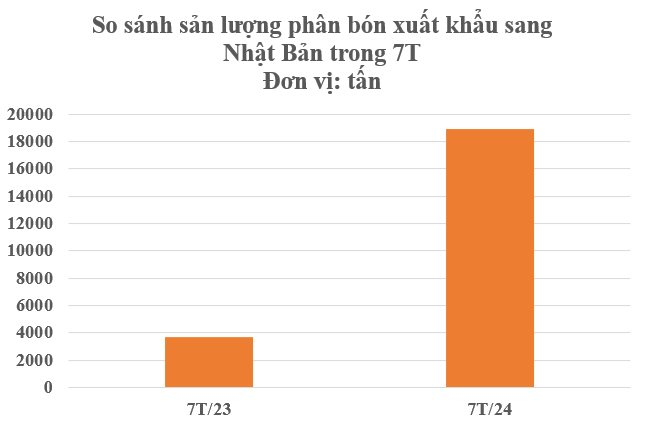

Notably, Japan has emerged as the fastest-growing importer of Vietnamese fertilizers, with imports totaling 18,895 tons in the first seven months, valued at over $8.2 million, representing a remarkable 413% surge in volume and a 389% increase in value compared to the same period last year.

Nevertheless, exports to Japan account for a very small proportion, nearly 2% of Vietnam’s total exports, ranking 8th among export markets.

The average export price reached $436/ton, a 12% increase compared to the previous year.

Additionally, the Philippines and South Korea were the two markets with double-digit growth rates, with increases of 144% and 136%, respectively.

Japan relies heavily on imports to meet its domestic demand for all types of fertilizers. The country imports 90% of its phosphate fertilizers from China, one of the world’s leading producers.

However, since October 2021, the Chinese government has repeatedly restricted fertilizer exports to ensure sufficient supply for its domestic market. Due to the uneven distribution of phosphate fertilizer sources worldwide, Japan faces challenges in finding alternative suppliers. Japan’s domestic consumption of phosphate fertilizers currently stands at around 300,000 tons per year.

The Japanese government is planning to subsidize local governments to build several plants to extract phosphate fertilizers from sewage sludge. While large-scale production of phosphate fertilizers from such sources is challenging, the Japanese government is seriously considering this option.

According to the Vietnam Fertilizer Association, the global urea market is expected to become more active in the second half of this year as major consumers like China, India, the US, Brazil, and Europe return to the bidding market.

The International Fertilizer Association (IFA) forecasts a 4% increase in global fertilizer consumption this year compared to 2023, reaching 192.5 million tons. Factors such as geopolitical instability and extreme weather conditions have kept the prices of key agricultural commodities, including rice, wheat, and corn, significantly higher than the 10-year average.

Unveiling the Illicit Invoice Scheme: A Damaging 743 Billion Dong Scandal

Over the course of 5 years, the leadership team at Thanh An Company directed their subordinates to establish two accounting systems for financial reporting, tax declaration, and internal accounting. They also instructed them to create fictitious purchase contracts and invoices to conceal actual profits, reduce tax liabilities, and fraudulently benefit at the expense of the state budget.