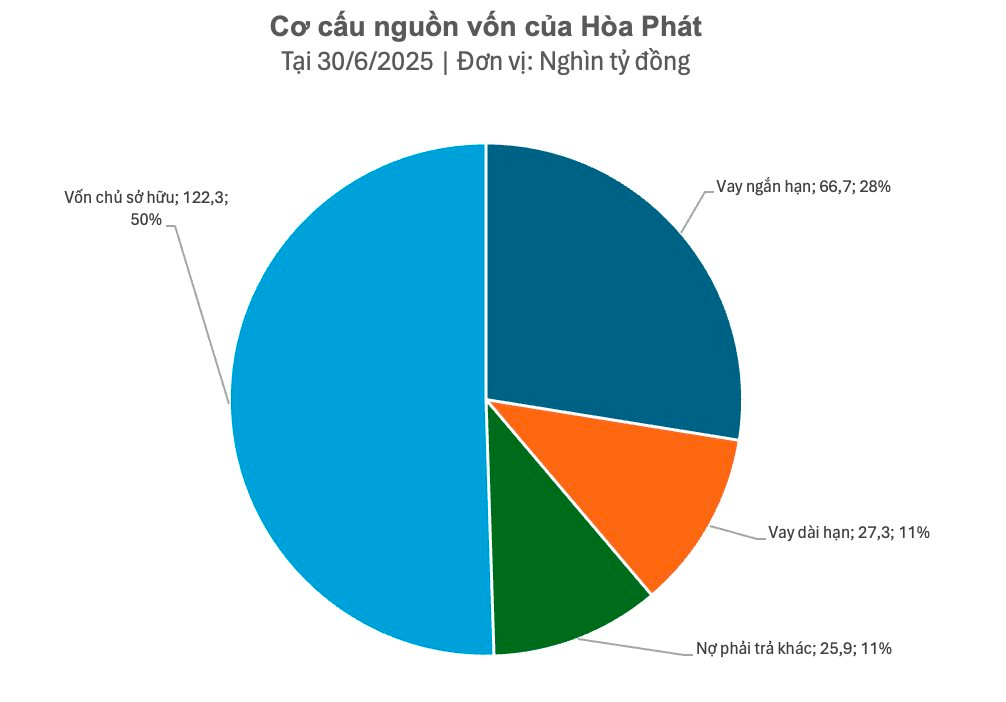

Hòa Phát (code: HPG) has released its audited semi-annual financial report, revealing that as of June 30, 2025, the company’s loan balance reached a record high of VND 94,004 billion, a 13% increase from the beginning of the year and accounting for 39% of total capital sources.

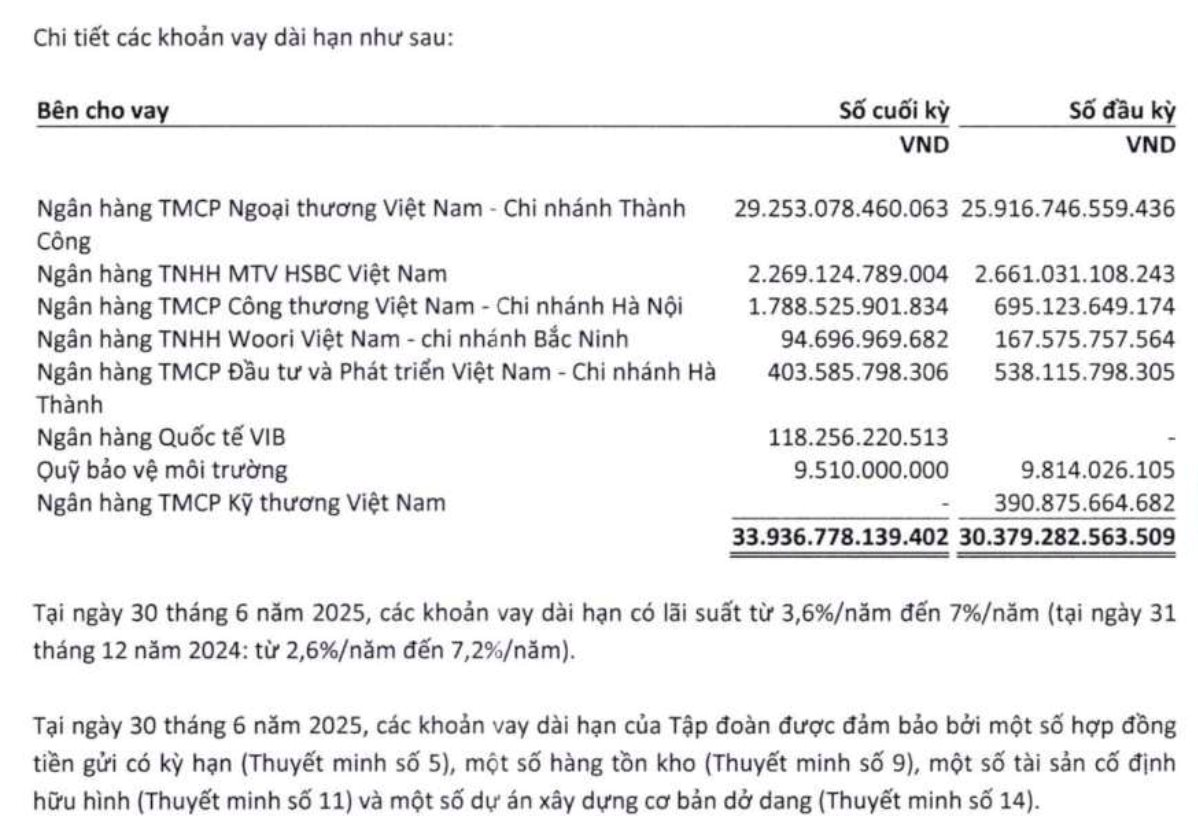

Vietcombank – Thanh Cong Branch is the largest creditor with long-term loans of over VND 29,253 billion, while the remaining loans are from HSBC, VietinBank, BIDV, and VIB. These loans carry interest rates ranging from 3.6% to 7% per annum and are secured by deposits, inventory, and fixed assets.

Short-term debt accounts for a significant proportion (VND 66,692 billion), mainly in VND with interest rates ranging from 3.75% to 4.8% per annum. Hòa Phát has significantly reduced its USD debt exposure in the context of exchange rate fluctuations, mitigating foreign exchange risks.

In the first six months of the year, the corporation recorded financial expenses of VND 1,950 billion, including interest expenses of VND 1,066 billion (an 11% decrease from the previous year due to capitalized interest for the Dung Quat project) and exchange rate losses of VND 468 billion. On the other hand, with over VND 28,000 billion in deposits, Hòa Phát earned VND 543 billion in interest income.

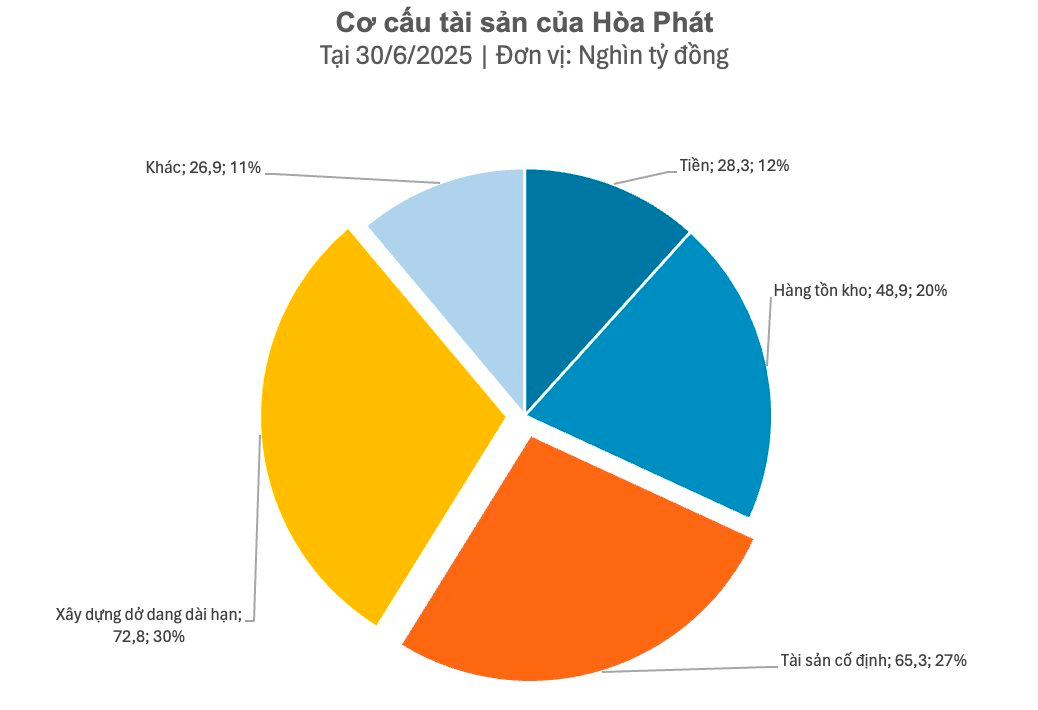

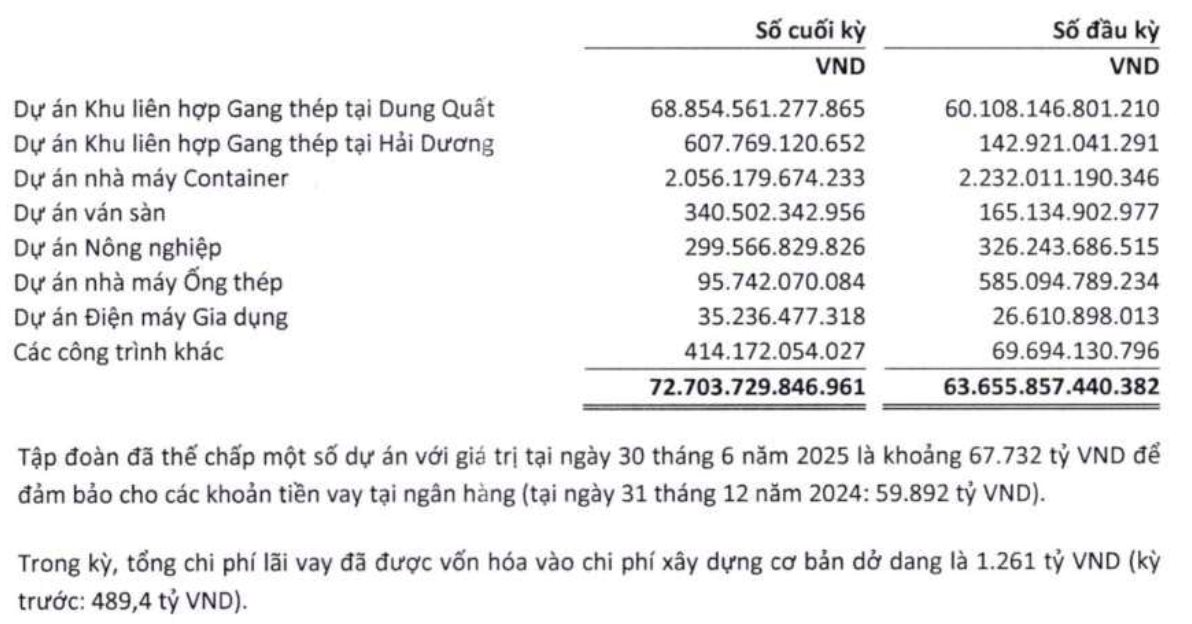

As of June 30, 2025, Hòa Phát’s total assets amounted to VND 242,224 billion. Construction-in-progress expenses accounted for the largest portion, with over VND 72,000 billion, mainly attributed to the construction of the Dung Quat Integrated Steel Complex (VND 68,854 billion), an increase of more than VND 8,000 billion from the beginning of the year.

As of June 30, 2025, owner’s equity stood at VND 122,359 billion, an increase from the beginning of the year. Short-term loans amounted to nearly VND 66,700 billion.

The short-term loans in VND and USD had book values of VND 49,630 billion and VND 828 billion, respectively, and were secured by certain cash equivalents, term deposits, short-term receivables, inventory, prepayments of land rent, property, plant and equipment, investment properties, construction in progress, and assets under formation of some projects within the Group. The VND-denominated loans carried interest rates ranging from 3.75% to 4.8% per annum, while the USD-denominated loans had interest rates from 3.8% to 4.2% per annum.

In terms of business results, in the first six months of 2025, Hòa Phát recorded consolidated net revenue of over VND 73,532 billion, a 4.44% increase compared to the same period last year.

According to the Hòa Phát Group, the steel manufacturing and trading sector contributed over 90% to the Group’s consolidated business results. In the first half of 2025, the steel sector witnessed strong growth due to the domestic market demand for steel billets and the production of construction steel, flat steel, and fuel, which decreased compared to the previous year.

Consequently, the steel sector’s consolidated after-tax profit reached VND 6,587 billion, an increase of VND 1,257 billion (or 23.6%) compared to the same period. Additionally, the consolidated after-tax profit of other sectors amounted to VND 1,027 billion, an increase of VND 169 billion (or 19.7%) compared to the previous year.

Big Group Holdings Fined by SEC for Information Disclosure Violations:

This title maintains the essence of the original text while incorporating an SEO-friendly structure and natural English fluency.

The State Securities Commission (SSC) has recently issued an administrative fine of VND 125 million to Big Group Holdings Joint Stock Company (BIG on UPCoM) for violations pertaining to incomplete and delayed disclosure of information during a routine inspection in August 2025.

The Stock Code Surges Against All Odds: A Dramatic Rise Amidst a Falling Market

The stock market has been on a downward spiral, but amidst the gloom, a few stocks have emerged as bright spots, surging against the tide and even hitting the upper circuit.

The Prodigal Son’s Strategic Maneuver: Unraveling the Persistent Accumulation of Hoang Anh Gia Lai Shares

“In a recent display of confidence in the company, Doan Hoang Nam, son of business tycoon Bầu Đức, acquired 27 million shares of HAG, the stock of Hoang Anh Gia Lai Joint Stock Company. Valued at approximately VND 426 billion, this transaction signifies a substantial investment. Now, Nam is poised to purchase an additional 25 million HAG shares from August 28 to September 12, boosting his ownership stake to 4.92% of the company’s capital, equivalent to a substantial holding of 52 million HAG shares.”