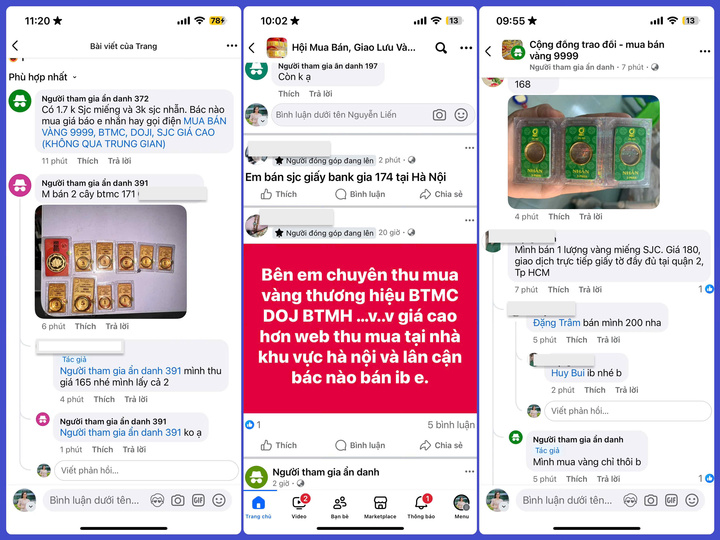

Amid soaring domestic gold prices, numerous online gold trading groups on social media have become hotspots for speculators and individuals looking to hoard gold.

The ‘Black Market’ Gold Trade Flourishes

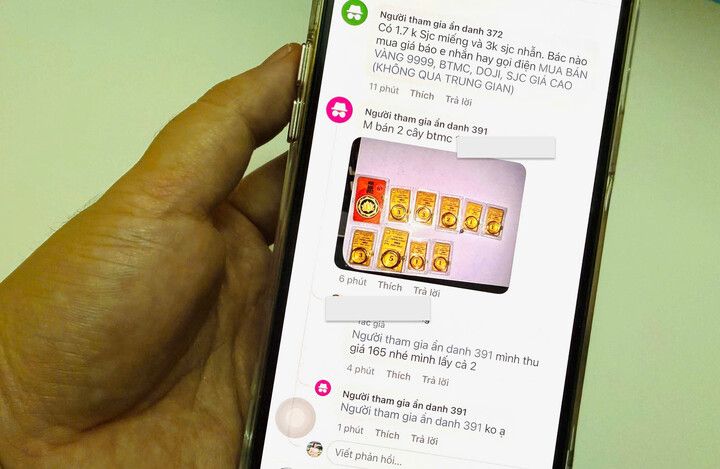

In groups with tens of thousands of members, posts offering to “buy” or “sell” gold appear every few minutes, accompanied by contact phone numbers. Beneath each post, a flurry of comments negotiate prices openly.

While official gold prices hover around 150 million VND per tael, prices in these groups surge to 170–180 million VND per tael, with some even higher. Remarkably, many still engage in transactions, messaging privately to negotiate, despite the risks involved.

Posts offering to buy or sell gold flood social media platforms.

Ms. Lê Minh Trang (Bình Thạnh District, Ho Chi Minh City) shared, “I planned to buy a few taels of SJC gold for savings, but after reading posts on social media, I found sellers from various locations with differing prices. They claim the gold is genuine, with old invoices, but I’m unsure of its authenticity. What if I transfer the money and lose everything?” she said anxiously.

According to financial expert Trần Duy Phương, this situation is an inevitable consequence of the scarcity of gold bars coupled with heightened speculative sentiment. Fear of missing out drives people to buy outside official channels at higher prices, a risky and reckless practice.

Gold prices in these groups significantly deviate from official market rates.

Mr. Phương noted instances where transactions were arranged at cafes, with buyers transferring full payment but sellers claiming non-receipt, leading to disputes without legal recourse.

“In unofficial transactions, buyers lack invoices, authenticity certificates, and legal grounds for complaints. While the gold may be genuine, the risks remain due to the extralegal nature of these deals,” he warned.

Expert Trần Duy Phương attributed the surge in unofficial gold trading to fear of missing out as prices hit record highs. With SJC gold surpassing 150 million VND per tael, many believe the rally isn’t over, fueled by rumors of economic stimulus packages and global geopolitical tensions.

Meanwhile, domestic gold bar supplies remain limited, and surging speculative and hoarding demand have caused shortages, with many gold shops displaying “temporarily out of stock” signs.

Mr. Trần Duy Phương added that the vast gap between domestic and global gold prices, now exceeding tens of millions of VND per tael, has spurred underground activities. “Such disparities create clandestine flows, with people seeking cheaper gold outside official channels or selling unofficially to profit from the difference,” he explained.

Risks Lurking in ‘Black Market’ Transactions

Gold transactions via these “black market” groups carry numerous risks. Many deals are conducted through private messages, personal transfers, or photo confirmations of gold bars. Some even offer to buy gold without invoices, violating market regulations and leaving buyers vulnerable to losses in disputes.

Economist Nguyễn Hoàng Dũng analyzed, “The black market gold trade is an inevitable result of supply-demand imbalances and speculative fervor. However, participants must recognize the high risks: counterfeit gold, replicas, or outright scams. In a volatile gold market, even minor shifts in confidence can severely impact buyers.”

Gold is openly sold on social media, with uncertain authenticity. (Source: Social Media)

Mr. Dũng also viewed the vibrancy of black market gold groups as a warning sign of regulatory gaps. “When legal gold access is limited, people seek alternatives. This calls for revisiting gold bar supply mechanisms, pricing methods, and state intervention to ensure market transparency and reduce black market appeal,” he stated.

Mr. Trần Duy Phương noted that stabilizing the domestic gold market will take time due to complex and lengthy gold import licensing procedures.

“Gold imports require multiple steps and stringent regulations. Companies or banks must first obtain import quotas from the State Bank, a process taking about a month for review and approval,” he explained.

Once approved, companies can place orders and initiate imports, adding another 2–3 months.

“Thus, market supply improvements are expected around or after the Lunar New Year 2026, with the earliest by January 2026 and the latest by late February 2026,” he predicted.

Gold shops buzz with activity as prices soar.

Experts also urged authorities to enhance monitoring and public awareness of unofficial gold trading risks. With social media’s rapid growth, transactions in private groups or online marketplaces are hard to control. Regulators must collaborate with online platforms to detect and address fraud while educating the public on vigilance.

Gold remains a traditional safe-haven asset for Vietnamese, but in a volatile market with proliferating black market channels, asset safety hinges on buyer awareness.

“Buyers should prioritize official channels or purchase gold bars with clear invoices. Gold retains value only when legally and transparently traded,” expert Nguyễn Hoàng Dũng emphasized.

Why the Court Ordered the Former SJC CEO to Return a Massive Amount of Gold

The damages in this case are the actual losses incurred, directly resulting from the criminal act in question.

The Top Movers and Shakers in the Stock Market Today

The stock market is a dynamic and ever-changing landscape, and keeping track of the biggest movers is crucial for investors. Vietstock’s statistical insights offer a glimpse into the stocks that have been making the most significant gains and losses in recent sessions. This information is pivotal for savvy investors looking to make informed decisions and stay ahead in the game.