I. MARKET TRENDS IN WARRANTS

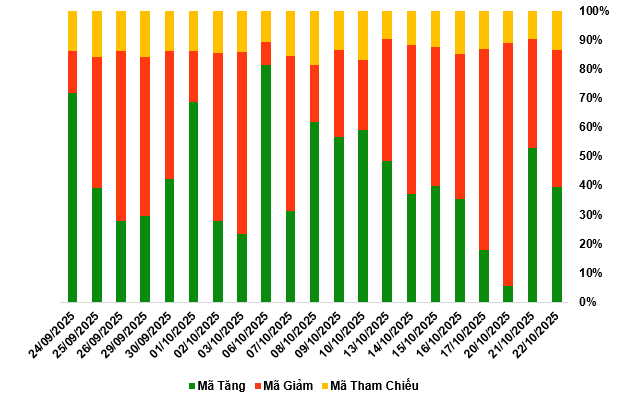

By the close of trading on October 22, 2025, the market recorded 106 gainers, 128 decliners, and 34 unchanged stocks.

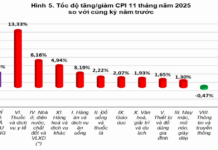

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

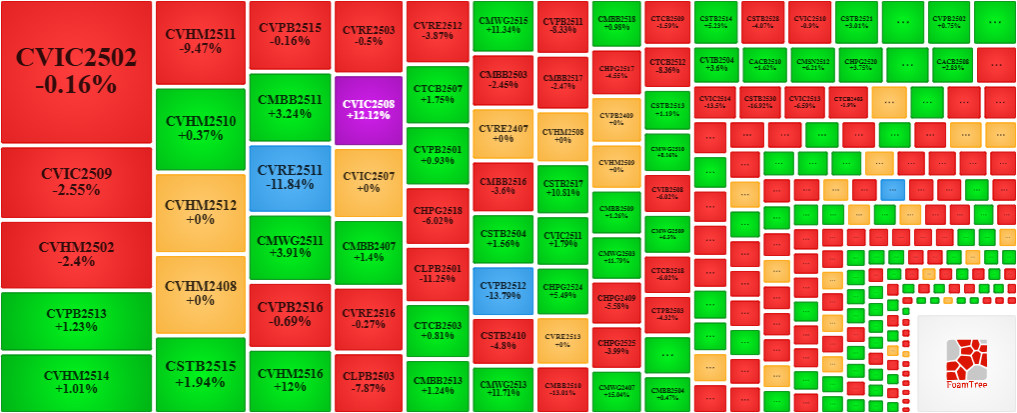

During the October 22, 2025 session, despite the underlying market’s robust performance, more warrant codes closed lower than higher. Notably, the major decliners included CVIC2502, CVIC2509, CVHM2502, CVHM2511, CVPB2515, and CVRE2511.

Source: VietstockFinance

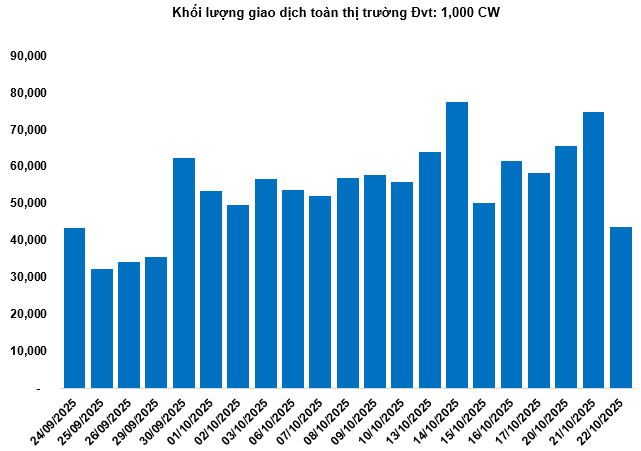

Total market volume on October 22 reached 43.61 million CW, down 41.57%; trading value hit VND 94.17 billion, a 43.98% decline compared to October 21. CHPG2406 led in volume with 1.43 million CW, while CVHM2514 topped in trading value at VND 4.22 billion.

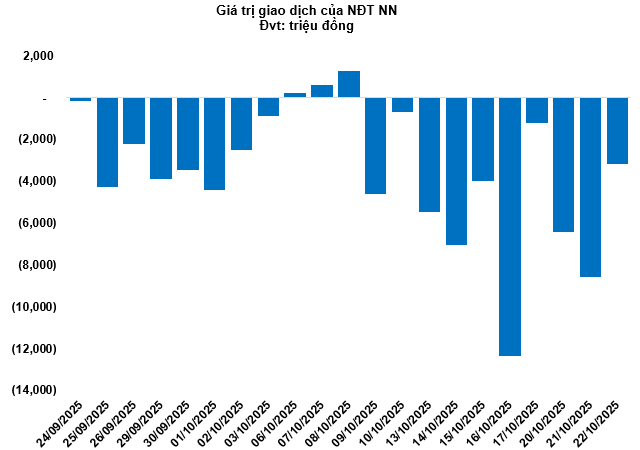

Foreign investors continued net selling on October 22, totaling nearly VND 3.19 billion. CVHM2521 and CVHM2522 were the most net-sold codes.

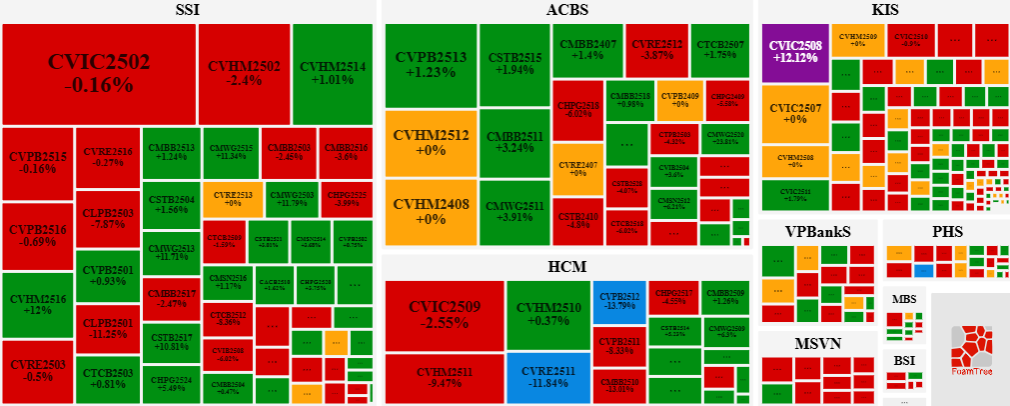

Securities firms SSI, ACBS, KIS, and HCM are currently the leading issuers of warrants in the market.

Source: VietstockFinance

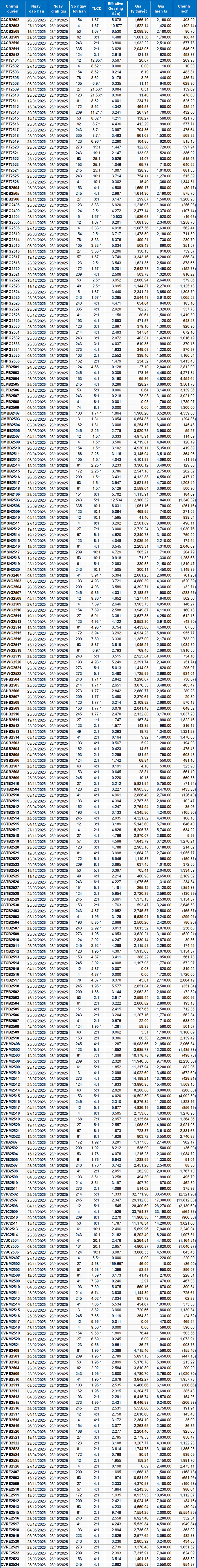

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

Based on the valuation method applicable from October 23, 2025, the fair prices of warrants currently trading are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to align with the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with tenure adjustments for each warrant type.

According to the valuation, CVIC2507 and CVRE2515 are currently the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CVNM2502 and CMSN2503 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:58 October 22, 2025

“Exclusive Insights: Two Investment ‘Sharks’ Discuss Stocks vs. Real Estate Amid VN-Index’s Historic Crash and Year-End Investment Trends”

In just a few months, the investment landscape has witnessed a dramatic shift: stock markets soared to new highs only to plummet nearly 100 points, gold surged exponentially, and real estate began showing signs of recovery. As 2025 draws to a close, amidst the turbulent market waves, investors once again face the age-old question: which asset—gold, stocks, or real estate—truly serves as the safest haven?

SMB to Distribute Remaining 2025 Dividends, Sabeco Poised for Significant Gains

On October 21, the Board of Directors of Saigon Beer – Central Joint Stock Company (HOSE: SMB) passed a resolution to pay the second dividend installment of 2025 in cash at a rate of 20% (VND 2,000 per share). The ex-dividend date is set for November 13, with the dividend payment scheduled for November 26.

October 22, 2025: Optimism Returns to the Warrant Market

As the trading session closed on October 21, 2025, the market witnessed 138 stocks advancing, 99 declining, and 24 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 8.55 billion worth of shares.