The government recently issued Decree 310/2025/NĐ-CP, amending Decree 125/2020/NĐ-CP, which outlines administrative penalties for tax and invoice violations. Notably, it includes provisions regarding the disclosure of employee salaries. Specifically, Clause 12 of Article 1 in Decree 310/2025/NĐ-CP addresses administrative penalties for tax violations by organizations and individuals.

Businesses must disclose employee salaries and income

Accordingly, fines ranging from 10 million to 16 million VND will be imposed for certain violations. These include failing to provide information related to salaries, wages, or income of taxpayers held by the entity, as required by law or upon request by tax authorities.

Remedial measures: Mandatory provision of complete and accurate information as stipulated.

Effective from January 16, 2026, businesses are obligated to provide information related to employee salaries, wages, or income as required by law or upon request by tax authorities.

Failure to comply or attempts to withhold such information will result in administrative penalties, with fines ranging from 10 to 16 million VND. The penalty amounts are determined in accordance with Clause 4 of Article 7 in Decree 125/2020/NĐ-CP.

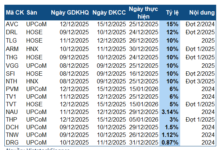

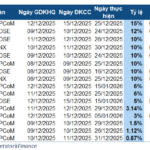

Penalties Imposed on a Securities Firm

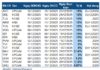

Mirae Asset has been penalized for administrative violations in the securities and stock market sector.

Viglacera Fined for Administrative Tax Violations

Viglacera has received a decision from the Large Enterprise Tax Department regarding administrative penalties for tax violations, as outlined in the tax inspection report.