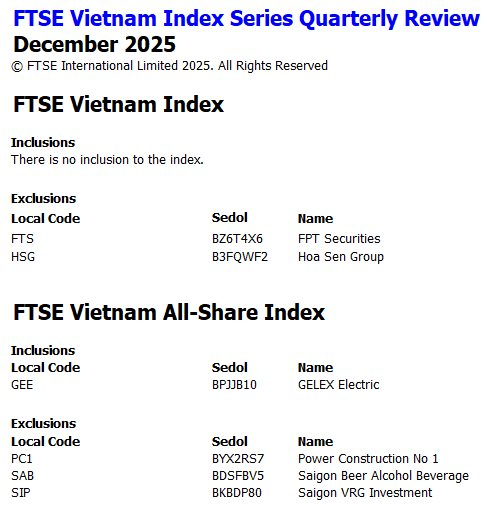

During the Q4 2025 review on December 5th, FTSE Russell made no additions to the FTSE Vietnam Index but removed two stocks: FTS (FPT Securities) and HSG (Hoa Sen Group).

Meanwhile, GEE was added to the FTSE Vietnam All-Share Index, while PC1, SAB, and SIP were removed.

These changes will take effect after the market close on Friday, December 19th, and will be implemented starting Monday, December 22nd.

Notably, there are currently no funds tracking the FTSE Vietnam Index after the Xtrackers FTSE Vietnam Swap UCITS ETF (formerly known as FTSE Vietnam ETF) changed its name and benchmark index in September. The fund is now named Xtrackers Vietnam Swap UCITS ETF and tracks the STOXX Vietnam Total Market Liquid Index.

Consequently, the Q4 rebalancing of the FTSE Vietnam Index holds less significance for the Vietnamese stock market due to the absence of tracking funds.

As of early December, the Xtrackers Vietnam Swap UCITS ETF had assets under management exceeding 270 million GBP, equivalent to nearly 9.5 trillion VND.

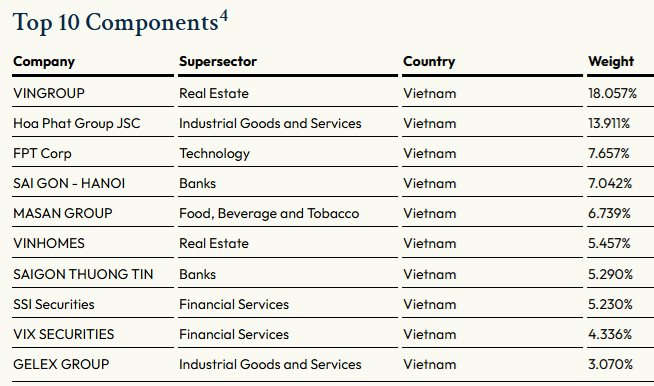

The STOXX Vietnam Total Market Liquid Index is designed to measure the performance of highly liquid stocks on the Vietnamese stock market. Developed and managed by STOXX Ltd., the index is reviewed in March and September annually. As of late October, the top holdings in the STOXX Vietnam Total Market Liquid Index included VIC (18%), HPG (13.9%), FPT (7.7%), and SHB (7%).

STOXX Vietnam Total Market Liquid Index constituents as of October 31, 2025

On December 12th, another key index, the MarketVector Vietnam Local Index (benchmark for the VanEck Vectors Vietnam ETF – VNM ETF), will announce its constituents. December 19th is expected to be the completion date for the rebalancing of the ETF’s portfolio based on this index.

Vingroup’s Market Cap Surpasses $43 Billion, Equal to Combined Value of Vietcombank, VietinBank, and BIDV

Vingroup’s remarkable surge has propelled its market capitalization beyond the $43 billion mark, making it the first Vietnamese enterprise to achieve this historic milestone.