This is also the highest trading volume since the stock of Saigon - Hanoi Insurance Corporation (UPCoM: BHI) was listed on UPCoM (on July 21st, 2023).

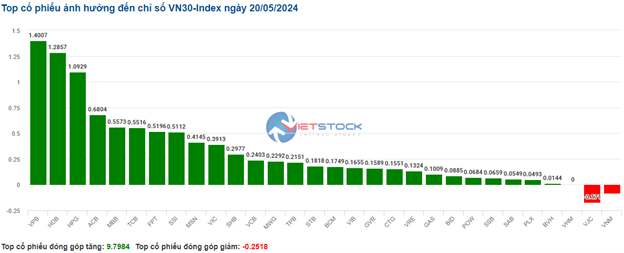

Closing the trading session, VN-Index surged by 15.27 points (1.26%) to reach 1,224.97 points; HNX-Index also rose by 0.33 points (0.14%) and settled at 233.37 points. The market breadth favored the buyers with 468 stocks advancing and 322 stocks declining. The color green dominated the VN30 basket with 21 stocks rising and 9 stocks falling.

On the sidelines of the Gong-beating Ceremony to mark the opening of the 2024 Lunar New Year trading session at the Ho Chi Minh City Stock Exchange (HOSE) on the morning of February 19th, 2024, Chairwoman of the State Securities Commission Vu Thi Chan Phuong shared her insights on market upgradation as well as her assessment of the market's prospects for the new year.

The warrant market is heating up towards the end of 2023. Securities companies (SCs) have been actively issuing numerous warrant codes to the market. Here are some aggregated figures that partly demonstrate the effectiveness of SCs' issuance in the warrant market.

Securities companies recommend buying NT2 due to increased mobilization of production and good selling price as hydropower will face difficulties due to El Nino; buy HDG with growth momentum from Charm Villa project phase 3; monitor HAH as it is still influenced by the excess capacity of the transportation sector.

The transaction statistics for the week of 02/05-02/16/2024 indicate a dominating trend of stock sales by executives and their relatives leading up to the Lunar New Year. Despite the first week of trading after the holiday, the volume of registered sales remains significant.

This morning (19/02), The Ho Chi Minh City Stock Exchange (HOSE) held a ceremony to kick off the stock trading of the Spring 2024.

At the end of the morning session, the upward momentum gradually narrowed along with continuous net selling by foreign investors in recent times. This indicates that investors are still trading cautiously. The key indices moved in opposite directions; the VN-Index increased by 4.42 points, reaching 1,214.12 points; the HNX-Index decreased by 0.4 points, falling to 232.64 points. Temporarily, the number of declining stocks outnumbered the number of advancing stocks with 301 gainers and 354 decliners.

VN-Index and HNX-Index are moving in opposite directions with an expected increase in trading volume that will surpass the 20-day average, reflecting the investors' indecisiveness.

The process of changing the support level is still clearly taking place after the two initial trading sessions of the new week. Stocks such as VIC, VHM, GAS, MSN... have attracted significant capital flows, but it is still not enough to eliminate the pressure from the banking stocks group. The VN-Index gradually decreased in the latter half of this morning's session despite the record-high liquidity on the exchange since the beginning of December last year...