Home Search

NX 2022 - search results

If you're not happy with the results, please do another search

How does the Vietnamese stock market typically fluctuate after Tet?

According to statistics from VietstockFinance, the trading week after the Lunar New Year holiday in the past 5 years has shown a predominantly "green" trend, with a particularly strong increase in 2021. Foreign investors have also shown enthusiasm with 3 consecutive years of net buying.

Many businesses pay cash dividends immediately after Tet

After the Lunar New Year in 2024, many companies listed on the stock market will distribute dividends to investors. The banking sector stands out with its generous cash dividend payment.

VNDirect: Real estate sector’s Q4/2023 profit up 132% excluding Vinhomes impact

Net profit increased over 30% YoY, driven by a strong rebound in business operations and the low base effect from the previous year.

Highest Net Profit from Listings

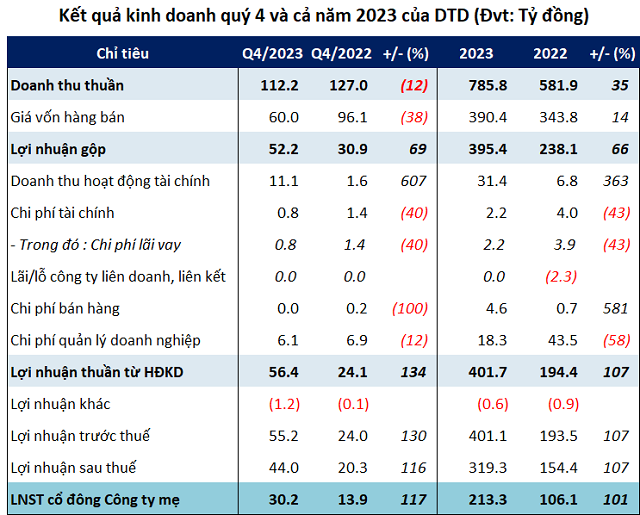

Closing out 2023, DTD achieved a net profit of over 213 billion VND, doubling the result from 2022. This also marks the highest annual net profit reported by the Company since its listing on the HNX in 2017.

Stock market: An efficient capital-raising channel

Despite several fluctuations, the Vietnamese stock market has managed to maintain stable growth. On the occasion of the Lunar New Year 2024, Chairwoman of the State Securities Commission Vu Thi Chan Phuong has given an interview to Thoi Bao Ngan Hang regarding operational and management solutions.

What factors will support the stock market’s resurgence in 2024?

The Ministry of Finance has mandated the State Securities Commission to proactively coordinate with relevant departments and units to expedite the upgrade of the stock market.

Leading real estate giants clean up bonds debt in 2023.

In 2023, several prominent real estate businesses have successfully managed their cash flow, actively repaying bond debts according to their pre-established plans.

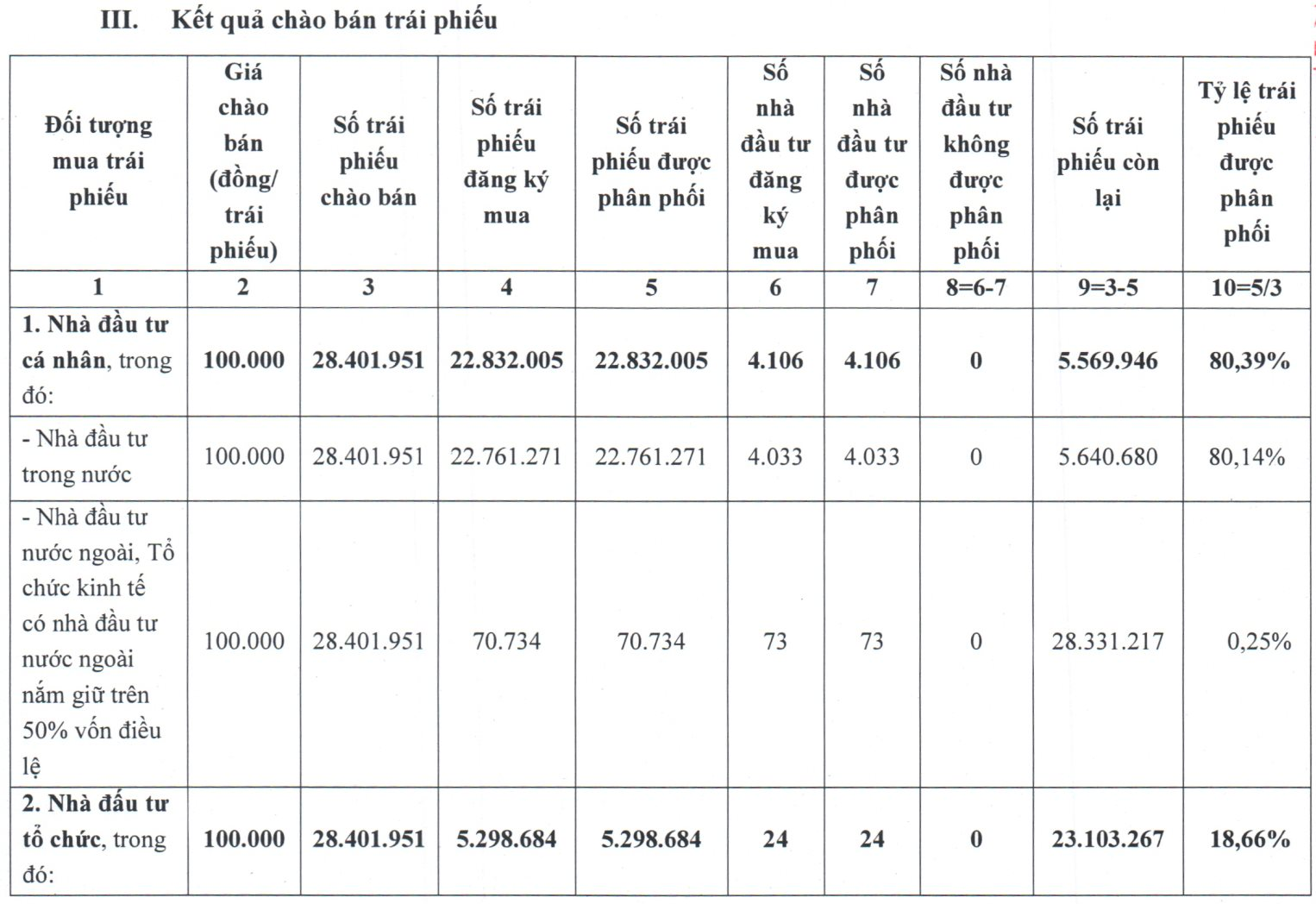

“Busy” Thủ Thiêm CII “shines” in the early year bond market: New issuance of...

Recently, CII has captured attention as the owner of a significant amount of land in Thu Thiem. This comes after news of the resumption of land auctions in the area.

Ford unveils stunning dream-like SUV model to replace EcoSport, with competitive technology against Hyundai...

The upgraded version of Ford Puma has just been launched in the European market, serving as a formidable rival to the Hyundai Kona and Honda HR-V.

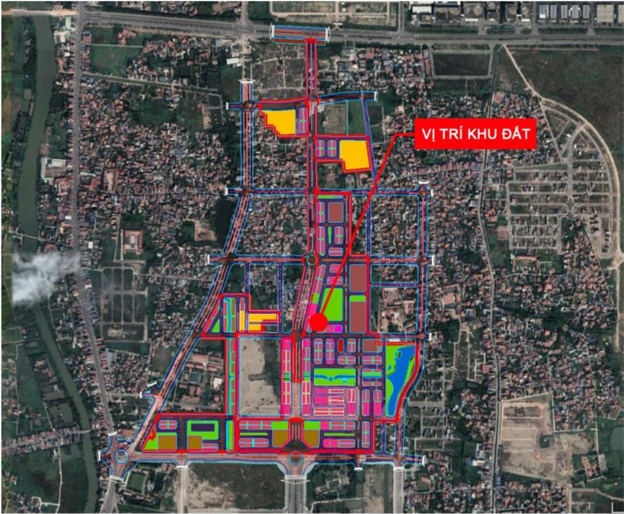

What does TCH’s project worth over 10 trillion VND in Thuy Nguyen district, Hai...

Hoang Huy Financial Services Investment Corporation's subsidiary (HOSE: TCH) has won a land plot of over 49 hectares in Hai Phong for a price of over 4.8 trillion VND, to develop a new urban area worth over 10.1 trillion VND.

- Advertisement -

Get in touch

Recent Posts

Most Popular

Ho Chi Minh City: Preserving the Minimum Parcelization Threshold for Residential and Agricultural Land...

The proposed replacement for Decision 60/2017 stipulates that all land plots, both before and after subdivision, must abut a transportation route approved by the relevant authorities.

“Coinbase Restores Functionality, But Withdrawals Remain Unavailable”

Coinbase, the world's second-largest cryptocurrency exchange by trading volume, suffered a major outage.

A New Major Shareholder Arrives, HAG Board Member Resigns After Three Decades of Dedication

The Hoang Anh Gia Lai Joint Stock Company (HAGL) has announced the resignation of Mr. Nguyen Chi Thang from their Board of Directors. Mr. Thang tendered his resignation on May 7th, citing personal reasons.

The Market Beat: The Prolonged Divergence Play

The market closed with the VN-Index down 3.94 points (-0.32%) to 1,244.7, while the HNX-Index climbed 1.1 points (0.47%) to 235.68. Bears dominated the market breadth with 396 declining stocks against 342 advancing ones. The large-cap stocks in the VN30-Index basket painted a similar picture, with 22 losers, 4 gainers, and 4 stocks closing flat.

Market Beat: VN-Index Surges Ahead

The market ended the session on a positive note, with the VN-Index climbing 1.68% to 1,241.58 and the HNX-Index gaining 1.78% to close at 232.29. The market breadth tilted in favor of bulls with 583 advancing stocks against 189 declining ones. The large-cap stocks in the VN30 basket painted a rosy picture, as evident from 28 gainers and merely 2 losers.