Noteworthy stocks at the opening of February 2nd

Vietstock's statistical data shows the recent top gainers and losers in the stock market.

Vietnamese Tet and Hanoi’s Festival Season 2024: Exciting Programs for Locals and Tourists

On the morning of February 2, 2024 (or the 23rd day of the Lunar New Year), various activities took place at the Hoang Thanh Thang Long Heritage Site: offering prayers at the Diên Kính Thiên Temple, releasing carp fish, and setting up a tall bamboo pole...to kick off the Year of the Rat Lunar New Year and the Spring Festivals of 2024...

[IR AWARDS] February 2024 Information Release Schedule Reminder

There are several noteworthy information disclosure events in the stock market in February, including the Fed's announcement of FOMC meeting results, the effective restructuring of VN30 portfolio, the announcement of portfolio restructuring by MSCI, the release of economic and social situation in February, and the expiration of VN30F2402 futures contract.

Ownership of Dragon Capital’s fund group at HSG exceeds 11%

Dragon Capital's fund group now holds over 11% stake in Hoa Sen Group (HOSE: HSG) as one of its member fund purchased 3 million HSG shares.

Currency exchange rate for the whole year 2024 might increase by 2-3%

The predicted decision from the Fed was expected to have minimal impact on Vietnam's economy, according to experts.

Viconship takes on the role of major shareholder in Hai An

On January 30th, Viconship acquired over 2.15 million shares of Hai An Transport and Stevedoring Joint Stock Company (HOSE: HAH), increasing its ownership from nearly 3.13 million shares (2.96% stake) to 5.28 million shares (5% stake) and officially becoming a major shareholder.

Technical analysis of the afternoon session on 02/02: Tug-of-war psychology emerges

The VN-Index narrowed its gains during the morning session as a candlestick pattern similar to a Doji appeared, indicating the investor's indecision.

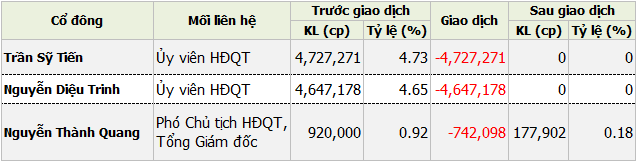

Vice Chairman and several AIC BOD members register to sell over 10 million shares

Mr. Nguyen Thanh Quang, Deputy Chairman and CEO of Aviation Insurance Corporation (UPCoM: AIC), along with two members of the Board of Directors, Mr. Tran Sy Tien and Ms. Nguyen Dieu Trinh, has registered to sell over 10 million AIC shares in order to recoup their investment capital.

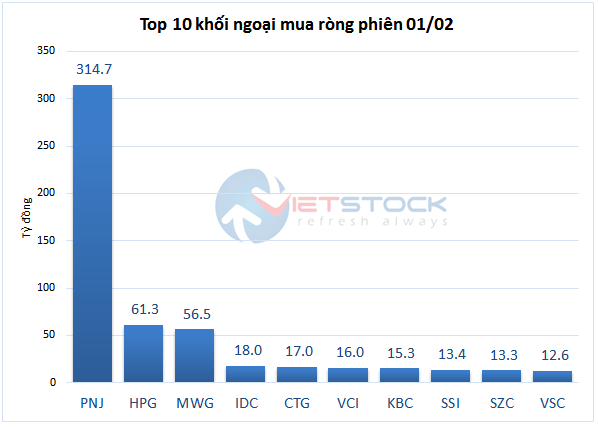

02/01 Sharknet: Institutional Investors Accumulating PNJ Shares Despite Strong Selling Pressure from Proprietary Traders

In the trading session on February 1st, both securities companies and foreign investors were net buyers, with net purchases of 87 billion VND and over 97 billion VND, respectively.

Bank Pulls Down Index, Stocks Suddenly Heat Up, Foreign Investors Also “Race”

The VN-Index experienced its steepest decline in 7 weeks, losing 9.09 points or -0.77% this morning. Bank stocks were the culprits behind the index's downfall, as 8 out of 10 stocks contributed to the biggest drop in the VN-Index. Among the 27 bank stocks, only 3 remained in the green, while many blue-chip stocks saw significant declines. Surprisingly, the securities group attracted money and foreign investors also actively bought...

![[IR AWARDS] February 2024 Information Release Schedule Reminder](https://xe.today/wp-content/uploads/2024/02/ir-awards--324x235.jpg)